Ellen Brown is looking to expand Public Banking in the U.S., and has written three convincing books toward that end. Here the Third Option attempts to capture the gist of her main arguments.

By Robert Simmons

A National Public Bank is the best possible long term investment for individual citizens (retirement dividends, affordable basic needs), communities (infrastructure, small business investment), the nation (reduction of poverty, debt, homelessness, violence, incarceration, immigration), and the world (‘green’ infrastructure, circular materials economy, and creation of an inclusive ‘global’ community)

The Third Option

About Ellen Brown

Ellen Brown ‘the person’ is soft-spoken and unassuming in demeanor. Ellen Brown ‘the writer’ (with thirteen books and counting under her belt) – punches well above her weight class. Channelling her skills as a former attorney (civil litigation, quite appropriately), she relentlessly builds her case for public banking, one step at a time. Key witnesses, expert testimony, and mountains of irrefutable evidence compel readers to reach a unanimous verdict: public banking is the only vehicle capable of driving a more just and sustainable economy.

Her research on banking is extensive, and spans three volumes; it is a subject too large to summarize or even highlight. We offer merely a glimpse of what is contained within these works.

Much of the problem with the current system can be traced to the US Federal Reserve…The Fed might be independent of oversight by politicians, but it is not a neutral arbiter…during the Great Depression and coming out of it the Fed…was not independent but took its marching orders from the White House and the Treasury; and that decade…was the most successful in American economic history

Ellen Brown

Web Of Debt

In Web of Debt, Ellen Brown takes us down the yellow brick road of private sector economics, to seek out the great and powerful, who work the levers of society from behind the curtain. At the nexus between the financially powerful and our U.S. government (allegedly assigned to represent the people) sits the Federal Reserve. Arguably, no single entity wields more power and with less transparency than the ‘Fed’.

What is the FOMC?

The Federal Open Market Committee, or FOMC, is the Fed’s monetary policymaking body. It is responsible for formulation of a policy designed to promote stable prices and economic growth. Simply put, the FOMC manages the nation’s money supply.

Federal Reserve Education

The FOMC is a twelve-bank twelve-member committee comprised of 1) seven members from the Board of Governors of the Federal Reserve System (appointed by our President, approved by our Congress), 2) the president of the Federal Reserve Bank of New York, and 3) four other Reserve bank presidents (from the eleven remaining banks) who rotate in and out every year. They are obligated to submit a semi-annual Monetary Policy report to Congress, and not much else.

Because the Federal Reserve manages our money supply, it cannot help but work for (and with) the people who actually have money, and quite understandably ignores the people who don’t. When the Great Depression hit in 1929, the ‘Fed’ knew the stock market was going to crash; it told wealthy industrialists, foreign investors, and politicians of the impending crash, who all pulled out of the market leading up to that fateful day, meanwhile telling the American people ‘everything was going to be okay’. Next, it started selling off all its government-backed securities on the open market, collecting up the money it had created when it initially bought those ‘Treasury notes’. Interest rates rose, stock prices fell, people panicked, and came for their money.

Let’s take a moment to understand this process of ‘government-backed securities’, or ‘debt monetization’.

If the Fed buys bonds in the open market, it increases the money supply in the economy by swapping out bonds in exchange for cash to the general public. Conversely, if the Fed sells bonds, it decreases the money supply by removing cash from the economy in exchange for bonds…[this] also affects interest rates because if the Fed buys bonds, prices are pushed higher and interest rates decrease; if the Fed sells bonds, it pushes prices down and rates increase.

Investopedia

The Federal Reserve, being our ‘Central Bank’, applies a strategy of buying up our National Debt with money they create, thus inflating the money supply in our real economy. This is either called ‘monetizing the debt’ or ‘Quantitative Easing’, depending on whether the money is given to the government or to other banks, in order to loan it out to the public. When loaned out by the banks, our national debt is turned into personal debt, which is the usual way banks create new money to circulate within the real economy.

When more money is circulating around than is being naturally created through the real economy, it can cause ‘inflation’. At that point, the Fed attempts to sell off this purchased debt to whoever will buy it on the open market, in the form of ‘treasury’ notes, bills or bonds, thus removing money from the economy; this process shrinks the overall money supply, until inflation is again under control. Interests rates will rise, however, making homes harder to sell and harder to buy, and harder to ‘pay off’, if you decided to accept an ‘adjustable interest rate’ on your home mortgage. When the Fed raises interest rates, real Americans lose real property due to foreclosures.

In the world of ‘high finance’, small fluctuations at the top of the pile can crush the financial life out those down on the bottom.

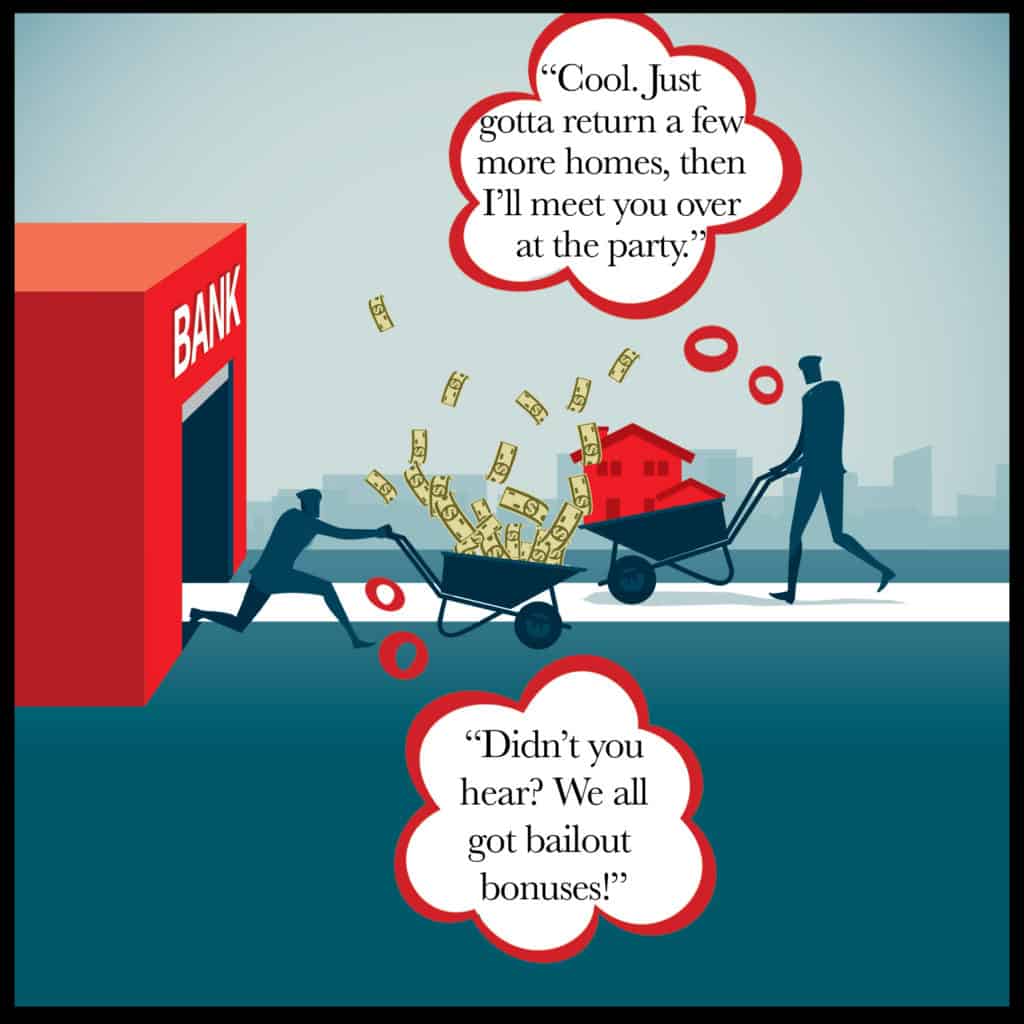

Besides the Fed choosing profits over people during the Great Depression, it once again proved where its loyalties lie in the 2007-2008 financial crisis; an estimated 10 million homes were lost in the 2006 – 2014 ‘debt cleansing’, while ‘too big to fail’ AIG (American International Group Inc) received a $150 Billion bail-out.

According to Brown, the ‘Fed’ also hikes up interest rates when it comes time to ‘rollover’ our national debt payments. Private investors (foreign or domestic) are not interested in scoring low interest rates on government securities, so it falls to the ‘Fed’ to raise rates in order to offer a more attractive product; every time it does this, there is a corresponding spike in home foreclosures. Banks foreclosed on 3.6 million homes in 1990, for instance, when the ‘rent came due’ that year.

The truth is that homeowners are the ‘collateral damage’ in this “Ponzi-like” scheme, where “new loans must always be issued to create the money to pay the interest on the previous loans” (This from the Public Banking Institute). When our government goes over-budget, we procure the extra money needed to ‘pay the bills’ by selling treasury securities to investors. These typically mature in 20 or 30 years, and pay out interest every six months. The American taxpayer covers the interest payments (about 8% of our taxes goes to this each year), but when the full amount finally comes due, we simply sell this debt off again, to someone else. Make no mistake, this debt is real. We made it real, when we allowed someone else to pick up the tab for our government going over-budget (which it has done for the past twenty years). Now we have to pay it back, unless the United States decides to declare bankruptcy at some point, and just give Minnesota to the Japanese (we owe them $1.25 Trillion) , Hawaii to the Chinese (we owe them $1.1 Trillion), and so forth, until we are ‘all square’ with our creditors.

THIRD OPTION SOLUTION

If we had a National Public Bank as our Central Bank (instead of the Federal Reserve), every time we went over budget, we would simply borrow the money from ourselves, and pay ourselves back with interest each year.

As an example: we just went $3.13 trillion over budget in 2020. If we borrowed that from a National Public Bank, the payments would cost $179.3 billion a year (for both principle and interest), and in 2050 we would end up with $5.38 Trillion in the Bank (meaning that our ‘investment’ would pay out ‘dividends’ of $16,300 to every American citizen). In our current scenario, we must make ‘interest only’ payments of $522.8 billion each year on ‘all federal government debt outstanding’ (which includes treasury notes and bonds, plus ‘special purpose securities’), meanwhile A) paying back nothing on the principle, and B) never seeing a dime of this ‘interest-only’ money come back to us.

Monument Voted Most Likely to Offend: 1) Andrew Jackson

Although U.S. President Woodrow Wilson was actually the one who signed the Federal Reserve Act into law, he still knew that “we have…one of the most completely controlled governments in the civilized world – no longer a government by…a vote of the majority, but a government by the opinion and duress of a small group of dominant men.”. Later, Franklin D. Roosevelt acquiesced that “a financial element in the large centers has owned the government since the days of Andrew Jackson, [and his] fight with the Bank of the United States.”

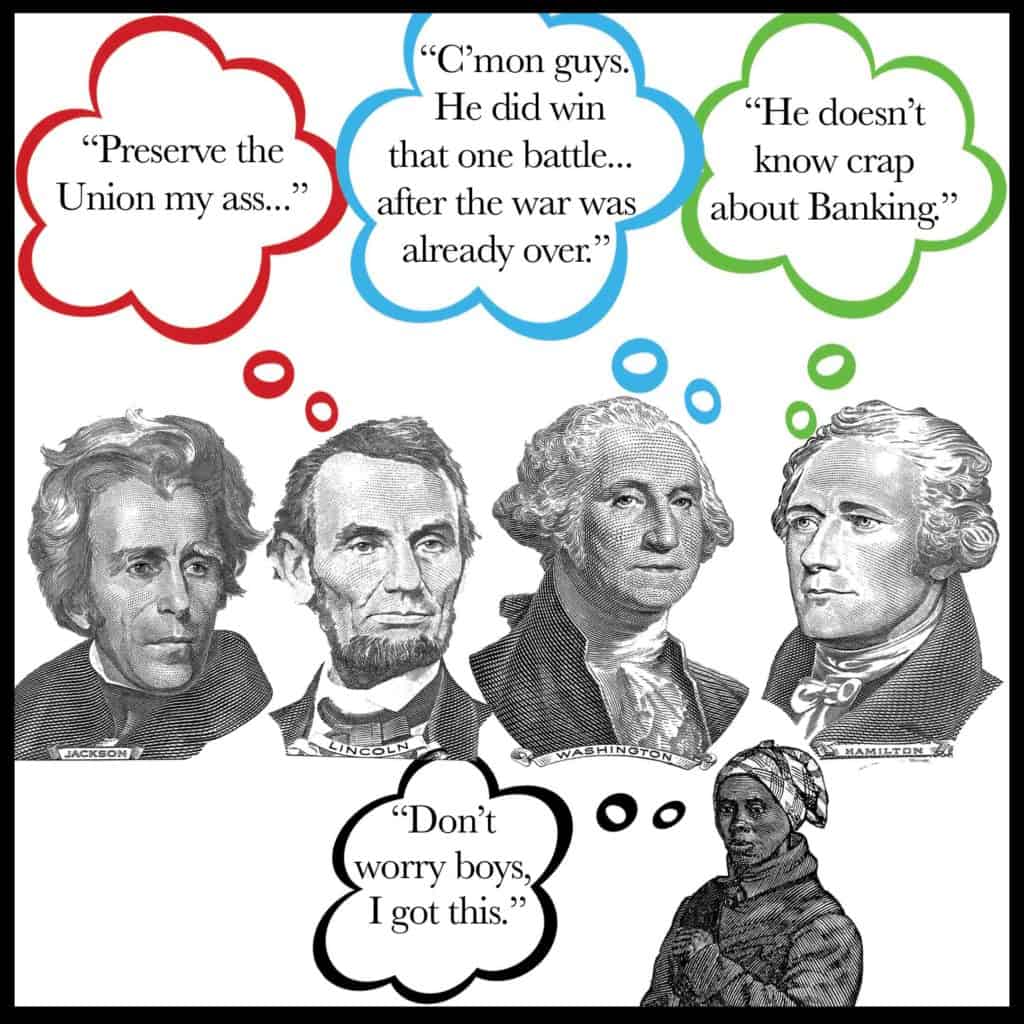

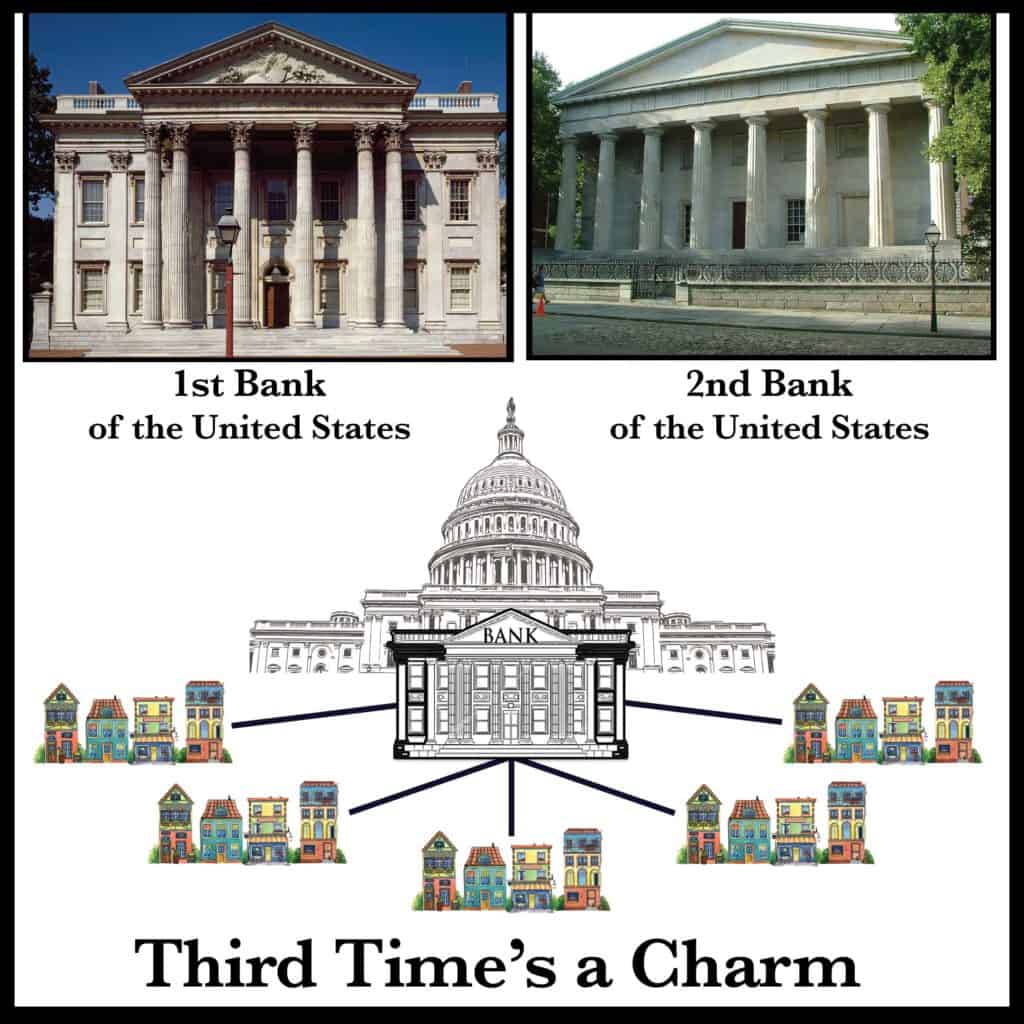

It was Andrew Jackson who wiped our National Public Bank off the map in 1832, after it had served the country well for 40 years (two 20-year stints). Why did he do it?

Andrew Jackson has to be at the top when ranking the most truly oppressive tyrants ever to wield power in the United States; he paved the road toward many of the troubles we now face. As Dylan Matthews of Vox recalls, “Andrew Jackson was an executioner, a slaver, an ethnic cleanser, and an economic illiterate.” He ordered the removal of the Indians from the South in order to expand the overall slave plantation business model – basically a Tyrant two-for-one. This, of course, put him at odds with civilized people, who sought to deprive him of his liberty to own slaves and exterminate all people of color (actually he exterminated several of his own people as well, so was not just your run-of-the-mill racist tyrant, but a true Tyrant’s tyrant).

Those civilized people also wanted public education, science, national parks, and to have a National Bank, in order to rebuild the nation’s infrastructure and fuel economic development – so of course Andrew Jackson had to be against all of that as well. When the National Bank charter came up for renewal a third time, in 1832, (unfortunately falling within his time in office), he vetoed it out of existence. For now.

Proprietary Trading

Proprietary Trading is how investment banking does most of its business nowadays, betting their own money instead of their clients’ money on stocks, bonds, options, commodities, etc., in essence, offering financial services to themselves, “so as to make all the profit”. According to Bloomberg, “Now, virtually all banks are making huge bets with their own assets on many more fronts, and using vast sums of borrowed money to jack up the risk even more.”

This, of course, was yet another reason for the financial collapse of 2007-2008, as our own government chose to save investment banks over U.S. homeowners. Ironically, it was really the fault of commercial banks, who made these risky home loans because they had the financial backing of the investment banks, who in turn thought they had reduced the risk by packaging all these ‘subprime’ loans into Collateralized Debt Obligations (CDOs), which are financial products designed to spread out the risk of mortgage-backed securities. They were so confident with CDOs, they even placed a financial ‘side bet’ with other traders (in a derivative credit default swap) that these CDOs were bullet-proof; the smartest guys in the room, allegedly.

Where was the Fed in all this? Apparently fearing potential inflation from high oil prices, it ran the only defensive play it knows, and blitzed its own people with high interest rates throughout 2007. Millions of homeowners were forced to punt on these already questionable loans, which nudged this whole house of cards right where it was most vulnerable.

In the end, though, the financial sector made out okay; only the American people got hurt, which is how this system was designed; another successful failure.

“It is dispiriting, of course, that we are still learning about the billions provided to various financial firms during the [2007-08 financial] crisis…But that’s the way our world works. Billions are secretly showered on troubled financial institutions to stave off disaster. Individuals get little or no help.” Gretchen Morgenson, who in her The New York Times piece cited that “the nation’s six largest banks – JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley – borrowed almost half a trillion dollars from the Federal Reserve” during the ‘peak periods’ of this crisis.

“The Wall Street model of banking has made the economy serve the needs of high finance rather than the reverse, with taxpayers propping up the banks rather than the banks supporting the economy. Regulation won’t fix this systemic dysfunction.” – Ellen Brown

Public Banking Solution: From Austerity to Posterity

In the Public Banking Solution, Brown wastes no time in addressing the “systemic dysfunction” in our financial system: as gains get “privatized”, and losses are “socialized” (meaning government absorbs them in the form of National Debt or taxpayer subsidies), banks become empowered to engage in riskier and riskier behavior, knowing they are “too big to fail” and “too big to regulate”. Behold the “casino economy” of Wall Street – a high-wire circus act of derivatives and hedge funds – and We the People hold our giant safety net under them, to absorb any risk, should they fall (as they did most recently in 2008).

Brown would like to see the people, who provide all the labor, and incur all the risk, finally reap some of the benefits; if we were to “socialize” the gains, as well as the losses, issues like poverty and unemployment would surely dissipate.

The private sector might know what they are doing; then again, they might not. With the National Debt at $27 Trillion and climbing, they clearly think that debt (like age) is just a number; still, most people will croak before they reach 100, so the burning question becomes: what amount of debt can America incur before it goes six feet under? Currently, states also have accumulated $1.5 Trillion in debt; 40 of them have no way to pay it back. American’s personal debt stands at $14 Trillion.

Banks turn debt into credit. As Brown points out, banks are allowed to create money “out of thin air”, as long as they responsibly manage the risk that it might not be paid back. Through the magic of “double-entry booking”, invented by Italian bankers in Medieval times, new money gets handed out to, for example, a prospective home owner; meanwhile, an equal amount of debt is tallied in the debit column for the bank. Now there is a credit for the buyer, and a debit for the bank, which the buyer must repay (with interest). If all goes well, the buyer will wind up owning their home “free and clear”, and the bank will get all their money back plus interest, except that the “principle” money did not exist before the creation of the loan; when it gets paid back it has, in effect, grown the overall money supply.

Brown thoroughly lays out the history of Public Banking, which started with the Sumerians and Babylonians, and is currently employed in countries like Brazil, Russia, India, China, Canada, Germany, Japan, Australia, New Zealand, and Switzerland.

America’s first Bank of the United States was a Public Bank as well, founded by the first Secretary of the Treasury, Alexander Hamilton, and it helped stabilize the country after the American Revolution left us in debt. Private banking soon overran our country, but public banking was always brought back whenever the country was in need (as private banking was only designed to enrich itself). A Second Bank of the United States was brought back to fund western expansion. Lincoln used public money to stabilize our nation during Civil War. Franklin Roosevelt brought it back, in the form of the Reconstruction Finance Company (RFC), to move us out of the Great Depression. The RFC funded the New Deal, rebuilt the country’s infrastructure, and even funded World War II.

This RFC is a curious story, as it is arguably the most important public financial institution that America never heard of; this is because books about it have been removed from print, and the media rarely mentions it.

Brown believes that because most media is tied to banking interests, any talk of the RFC and public banking has been made taboo. One thing is certain: the RFC single-handedly pulled America from the ditch of a Great Depression and shot them to the top of the world, by tapping into the potential of its people to work together, and not merely for some private interest.

Brown’s hope is that Banks in America will go back to being owned by the people, through their government. In this way, when we extend credit to government public works, private home ownership, or student loans, the debt we create can be turned into profits for us later, when we pay it back.

The Third Option also wishes to rebuild our current crumbling infrastructure by using what Brown describes as “self-liquidating loans”, which simply means that when infrastructure is built, the loans are automatically paid back through income derived from the infrastructure itself, like tolls on bridges or fees on electricity. This was the method used in many RFC loans, which helped stimulate employment while providing necessary infrastructure. In order to wind up with even more shareholder dividends, the Third Option proposes to make the loans out of ‘real money’ – our federal income taxes – so that we’d eventually get all of that back as well, while further dissipating wealth disparity (those who succeed more each year will also invest more each year; all of it would be used to grow our future together).

The fact is, Public banking has been a success every time it has been tried. The Bank of North Dakota (BND), the only U.S. Public Bank that remained in operation these past 100 years, has kept the state of North Dakota debt-free throughout its operation, and even operated at a profit during the whole of the 2007-2008 financial crisis.

All theories and conjecture aside, people create the world around them to extract the most benefit they can derive, and in our current system of private ownership, a handful of people have been allowed control of the money supply, in order to extract benefit from everyone who, by their nature, also seek to maximize benefit. Should a system be designed so the many are forced to go through the few in order to extract a sliver of life, liberty, and happiness for themselves? Or should the system be designed to amplify our collective desire to improve the human condition?

People are the building blocks of Societies, and as people seek to improve their condition, they slowly eliminate what doesn’t work, and keep what does. The only reason societies fail to do this is because some form of Oppression stands in its way, usurping power over the many, and bending society to serve only its selfish and narrow interests.

Brown highlights how publicly owned banks have always benefited the societies who utilize them. Sometimes, in the course of human events, it becomes necessary to dissolve certain banks which have connected us in inherently oppressive ways. We at the Third Option and the Forebrain Underground support Ellen Brown’s efforts.

We have a $21 trillion debt that cannot possibly be repaid. The government just keeps rolling it over and paying the interest to banks and bondholders, feeding the “financialized” economy in which money makes money without producing new goods and services. The financialized economy has become a parasite feeding off the real economy [while] driving producers and workers further and further into debt.

Ellen Brown, Banking on the People

Banking on the People: Democratizing Money in the Digital Age

In Banking on the People, Brown continues to hammer home her main message: that banks create the new money in our economy when they make loans. She also continues to reiterate her concerns about the Federal Reserve, and the ‘casino economy’ of Wall Street investment banking. Here we will try to explain a little about the “repo” and derivatives markets, and how they connect to the real economy of goods and services, through the commercial banking industry.

Derivatives

Former derivatives broker Brett Scott, author of The Heretic’s Guide to Global Finance, offers this analogy about derivatives: if you go to the race track and bet on a horse that you do not own, you are entering into a “horse-racing derivative”, and ‘speculating’ on the future outcome of this race. If you actually own one of the horses, but bet against it anyway, you are ‘hedging’ your bet – you basically would win something either way (or perhaps more correctly, you wouldn’t lose out completely, no matter what happened). In this way, derivatives are basically gambling on the outcome of real events, where one can choose to take on risk (to speculate), hoping to win, or to protect against risk (to hedge), in order not to lose too much. If you were a baseball player (like Pete Rose, for example), derivative ‘hedging’ would get you banned for life; in the world of Wall Street, however, it is just another day at the office. Ironically, you’d even be seen as more ‘ethical’ than the ‘speculative’ crowd. (For the definition of ethical, go here.)

The Repo Market

The ‘repo’ (repurchase agreements) market is like a pawn shop for debt: hand over your debt and get cash for it. In commercial banking, money is created through debt, as banks put a deficit on their balance sheet in order to hand out large sums of cash to home buyers, who slowly pay this deficit back (with interest) until the deficit is wiped clean from the bank’s accounting books. Because of ‘capital requirements’ imposed on commercial banks (in order to keep them from over-extending themselves), these banks are typically quite stable.

However, with a repo market around, commercial banks can sell their debt off, wipe it from their books, and be free to make even more loans. The problem is that ‘loan risk’ is not actually averted, only passed onto someone else – the repo market – which has little to no regulation.

Perhaps this is because they are so crucial to the success of every one involved in the high-stakes casino economy; whatever the reason, they are extended ‘immunity’ should any deals go south.

Then-Fed chairman Alan Greenspan somehow believed removing the risk from commercial banks and passing it on up to investment banks, then de-regulating them, so they had no risk either, would somehow protect the American people, meaning that:

A) he is a complete idiot, or B) we are all complete idiots, or C) the Fed (along with its pursuit of Economic Growth) is not really in the business of protecting people at all. Most likely it’s D) all of the above.

The Clinton administration and Congress decided that…the derivatives market should be largely unregulated. This position was codified in the Commodities Futures Modernization Act of 2000 and the Gramm-Leach-Bliley Act, also known as the Financial Services Modernization Act of 1999. For depository banks to bet in the derivatives casino, that portion of the Glass-Steagall Act separating depository banking from investment banking had to be repealed, and this was achieved through the Gramm-Leach-Bliley Act.

Ellen Brown, Banking on the People

Hedge funds have cash and want to make some interest off of it; the government has debt that it needs to sell off. The commercial banks only deal in debt, and need to somehow convert it into more lending money. To investors, debt and money are clearly two sides of the same coin, and while the rest of us in the real economy attempt to tread with our heads just above this money-debt liquidity, those investment bankers surf right over top of it. Derivative ‘speculators’ choose to sit on the beach and watch it all with some high-priced binoculars. When the wave comes crashing down – and it always does – only those actually in the water – the American people – get ‘worked’.

In the time leading up to the recent financial crisis, commercial banks (feeling unburdened of risk) loaned money to home buyers with no credit and no money to put down. The loans were passed onto the repo market and packaged up with (or hidden inside) less risky-looking investments, and sold off. Meanwhile, many in the derivatives market started betting whether these ‘credit default swaps’ were going to hold up or fail; as we all know, they failed, and pretty much like betting on whether someone is going to die or not (which, by the way, Wall Street also does), when the housing market croaked, investors actually made money off of this. The final nail in the coffin, so to speak, was that Congress grants repo and derivative markets ‘safe harbor’, meaning that when the wave crashes, and insolvency or bankruptcy is declared, repo and derivatives are first in line to get paid back, as ‘secured creditors’. Is it really gambling when there is nothing to lose?

“Repos and derivatives are where the big money is today…it is considered the main financing tool of the shadow banking system and a key player in the modern financial scheme…Repos are one-day or short-term deals, continually rolled over or renewed until the money is repaid. They are really a form of securitized loan; but legally, ownership transfers to the lender, who can…sell it quickly and get his money back without getting tied up in bankruptcy if the borrower defaults.” – Ellen Brown, Banking on the People

In the hierarchy of our existence, the smaller fish gets eaten by the bigger fish, that gets eaten by people, who get eaten by the bank, that gets swallowed up by the biggest predator of all – the investment bankers, who feed in the waters of the ‘repo’ and ‘derivatives’ market. So the question becomes ‘how could We the People evolve our thinking, in order to reach the top of this now-financial food chain, where our own species preys on itself?’

It is assumed that…nobody labors unless somebody else, owning capital, somehow…induces him to labor…Labor is prior to and independent of capital. Capital is only the fruit of labor, and could never have existed if labor had not first existed.

Abraham Lincoln, First Annual Address to Congress, December 3, 1861

The Third Option

Politicians, who have always depended on the kindness of (wealthy) strangers, are paid to tell you that a Public Bank is run by ‘the government’, and they wouldn’t be lying. Public Banks are owned by the citizens of a particular jurisdiction, and those citizens usually organize themselves through the instrument of ‘government’ – either locally, state-wide, or even as an entire nation. In fact, because of our U.S. Constitution, most people would pretty much insist on it. The irony is that people do not trust government because it gets infiltrated (then sabotaged) by the very same people who are telling you not to trust government (or “If I were you, I wouldn’t trust any government who would have me as a member”).

Yes, it is true: Private investors bought seats in Congress and in the judicial system, filled them with people who represent their interests, who further gerrymandered voting districts, and changed campaign finance laws, so that money is speech – speech is still free, but unfortunately money is not free, so now only people with the money are free in this country.

IF there was a mechanism by which government could disperse the money power more fairly, so that no one entity could ever hold a position of power

over another, then most of us would likely choose to trust ourselves with the money supply, through government, over the current arrangement, where a handful of private investors (looking to profit off the rest of us) have taken control of it.

Rules do not stop people who want what they want. The establishment of money as Power was a positive first step toward dispersing Power (so every one could own some). To fulfill our Constitutional mandate to secure the Liberty (or individual Power) of each citizen, we allow people access to larger sums of money than they could ever accumulate on their own – through banks. The third step should be to make sure all money creation and dispersement goes through the same bank; this will tie all our fates together, so that wherever each person’s Liberty takes them, all would benefit, rather than anyone having to suffer for it, as we do now.

With a National Public Bank

With a National Public Bank We Could…

- Power (in the form of money, and all that goes along with it), would be broken into 3300 different pieces, with every community of 100,000 people getting the same amount of financial power. A local bank branch will give communities a chance for civic engagement, when making larger infrastructure decisions, while individuals would have the protection of government when they come in to borrow for their own purposes.

- Money would have an anchor again. Before, it was the ‘gold standard’; now it would be based on ‘Effort’. Money would be created purely through our effort, not through economic ‘rent’, or the making of money off of having money. Inflation would be forever erased within this new paradigm. Current talk of receiving a ‘Universal Basic Income’, or getting ‘free money’ for simply existing, is born out of this oppressive ‘money for nothing’ paradigm, which needs to be finally eradicated, and replaced with the much more sustainable paradigm of Effort, where ‘Dividends’ become the well-earned measure of our overall contribution as a society.

- Debt is now turned into Credit for every one, and the more we spend, the more we make. This is important, because projects like Green Energy may cost more than using petroleum products, for example, but because spending more money only yields more money for every one in the end, decisions can be made because they are the ‘best thing to do’ and not the ‘cheapest thing to do’. In other words, we CAN maximize profit and quality at the same time in this new paradigm.

- We could all become ‘Venture Capitalists’. Venture Capital is a “type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential.” The place for largest growth is where the most wealth disparity currently exists; as ‘investors’ in every community, we would all benefit when each community prospers. Meanwhile, we are in effect diversifying our risk, by tying all ‘investments’ together under one bank. In the Third Option plan, our local banks would also come with business advisors included, to ensure small businesses make prudent decisions, to grow every one’s investment. With ‘every one on the same team’, the old paradigm of attempting to bring down the others around us, in order to ‘win’, would no longer be logical.

In the end, we must make the public bank national, then tie it into local and state-owned branches, otherwise we risk increasing wealth disparity, not curbing it. The state bank worked for North Dakota because no private investors wanted to go into a sparsely populated rural area – the same will not be true in urban centers. With a National Public Bank as the umbrella, to cover the entire money supply, rural and urban centers alike would all have access to money equally; there is no other way to guarantee this, and we have 250 years of history to prove that argument. We appreciate that activists have no choice at this time but to build momentum for Public Banking at the grassroots level (as the federal rules have been manipulated to block the return of a National Public Bank), but all the various Public Banking Alliances need to eventually speak with one voice on this matter, and declare that the ultimate goal is to give control of the money supply over to every one equally, as a National Bank ‘shareholder’. We can no longer allow individual Liberty to be a condition of ethnicity, geography or socioeconomic status.

In her three books on Public Banking, Ellen Brown cites numerous reasons why private banking is a poor choice for promoting Democracy, and cites numerous reasons why public banking is a much better choice; the best reason to create a National Public bank, though, is simply because it’s the right thing to do. In each person’s life there will come a moment of clarity, when all pretense will be muted, and the opportunity is offered for some far far better thing to be done. We have the whole rest of our lives to be petty and flawed, make selfish choices, and pass the buck for these choices onto our posterity, but right now there is a far far better thing that needs to be done first. For too many generations, Oppression has been passed on down the line. We are the ones – here right now – who are currently forced to shoulder the weight of it. Will we do the right thing, or continue to kick this can down the road, to the next generation?

Book Reviews

The Web of Debt – Ellen Brown

Ellen Brown attempts to show how our continued servitude is accomplished, through private control of the money system; as a few are able to profit from the labor, taxation, consumerism, and ensuing debt of the many, the only way out is for citizens to re-take control of the money supply.

Public Banking Solution: From Austerity to Posterity – Ellen Brown

Ellen Brown outlines the way out of national and personal debt, through a system of public banking that turns debt into credit; when banks are once again ‘publicly-owned’, money can flow within a closed circular economy, rather than being constantly syphoned off by private interests.

Banking on the People: Democratizing Money in the Digital Age – Ellen Brown

Ellen Brown questions whether Democracy is being served when a handful of elites hold all the financial leverage in the world, making money from money, while the real economy labors in order to fund this inequitable arrangement.

Veronica Garza on How Education Can Level Systemic Inequity

Veronica Garza on How Education Can Level Systemic Inequity