Whether it swings right or left, U.S. Government has long since relinquished “Command” of our Economy to a Market system, of which tax incentives are inevitable.

By Robert Simmons

Sometimes a deal with the devil is better than no deal at all.

Lawrence Hill, Someone Knows My Name

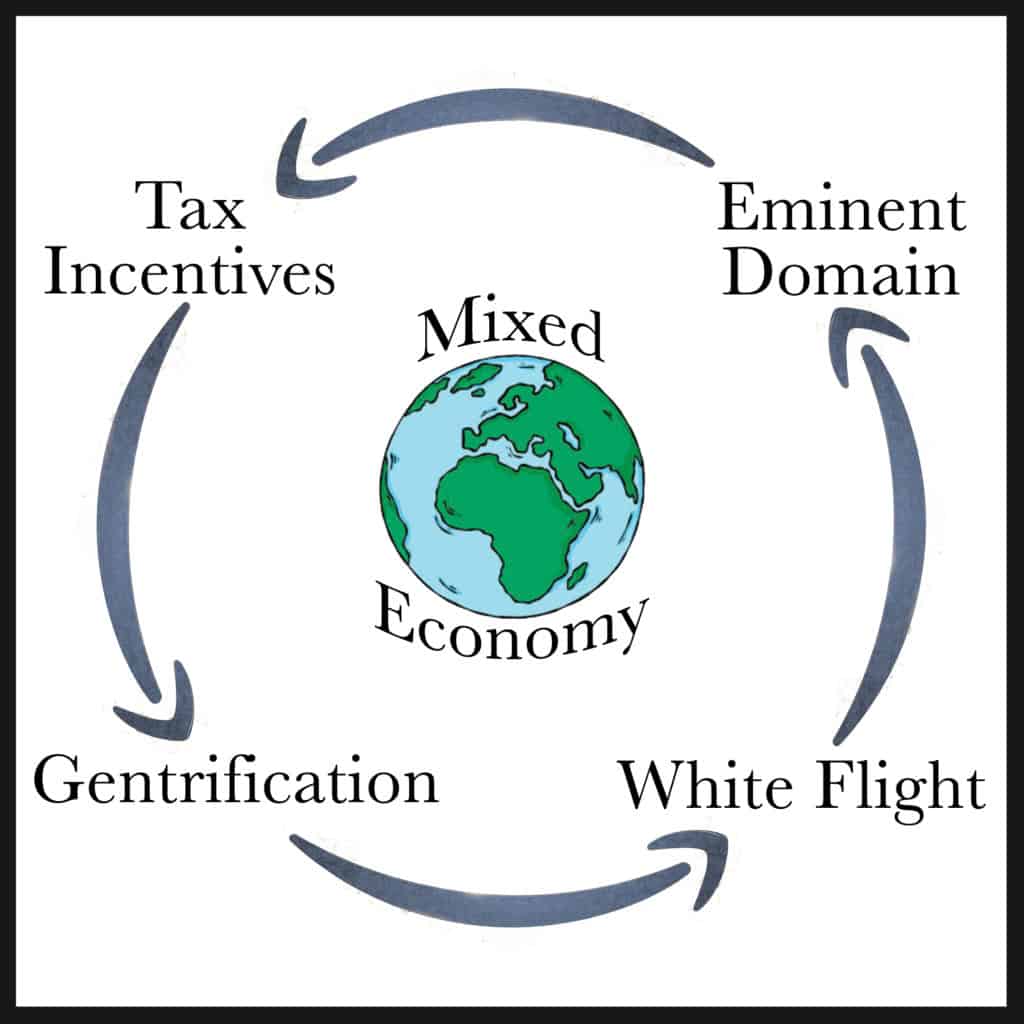

Tax incentives are a natural externality of a Mixed economic system; that is to say, where a Market-based system meets up with a Command or government-run system. Whether U.S. government swings Conservative or Liberal makes no difference; our government has long-since relinquished “command” of the economy to the Market system, apparently to see how far Economic Growth can take us.

Of course it really isn’t going to take us anywhere, because there is nowhere to go. Call it Market Economics or Command Economics, ultimately it is all a subset of Earth’s Eco-system, and thus is forced to revolve in a closed loop (although Market Economics operates more like a centrifuge, separating the “cream” out more and more with each pass). The convenient part about going in circles is that we can step on at any point and witness the entire journey. For the purposes of this article, we will step on at the point where Tax Incentives appear.

Why do cities offer tax incentives to businesses?

The main purpose of tax incentives for businesses is to draw economic development to an area (in the form of new jobs, new businesses, or financial investment). To facilitate this, state and local governments offer financial lures in the form of tax breaks and subsidies.

What is an example of a tax incentive?

Tax incentives to businesses can come in the form of tax credits (an amount of money businesses are allowed to deduct from any income tax they owe), or from property tax abatement (reducing or even eliminating the amount of property tax a business needs to pay when locating to a new area).

Timothy Bartik, of the W.E. Upjohn Institute for Employment Research, has spent a considerable amount of time attempting to dissect economic development incentive programs. Here is his take:

“Incentives don’t pay for themselves, as a rule. When you bring in jobs, you also bring in people…The added public-service costs eat up at least 90 percent of any increased revenue…If incentives don’t pay for themselves…you have to increase taxes, or you have to cut public spending. Increased taxes reduce residents’ incomes. They don’t have as much to spend, and that’s going to decrease jobs in the area. If you cut public spending, that may directly lead to laying off public workers – which directly reduces jobs…”

Nevertheless, local governments continue to use taxpayer money to attract economic development to their area. To better understand why this is so, it is instructive to look at a specific example, and there is no better example available than Amazon.com, Inc.

The Prodigal Son Returns

Fortune Magazine: “Overall, Amazon has received nearly $3 billion in subsidies from state and local governments. There are surely other handouts in the works. Officials justify these monetary favors as necessary for bringing jobs and investment to a local area.”

In one such deal, Amazon received $741 million in tax breaks for 36 facilities built in the Chicago area; $100 million for 15 warehouses built in predominantly white communities, and $640 Million in taxpayer incentives for 21 other facilities built in predominantly non-white communities. It cost six times more to get Amazon into these poorer communities because the property tax rates there are five times higher (Park Forest, for example, has a 35.7% property tax rate, while Burr Ridge has a rate of 7.1%).

.

Ironically, poor people are taxed more because they have no money. In Market Economics, only people with money to spend are capable of drawing businesses to an area. In turn, those businesses bring in taxable revenue; without them, government is forced to squeeze higher taxes from local homeowners in order to provide them with basic services. Amazon, injected into these communities, would give them a decided boost, but Amazon is a business, not a charity, and would not locate there unless It not only had financial incentive to do so, but some other logistical reasons as well.

“The only way you can create a path to revitalize the Southland is to leverage the unique attributes you have. One of them is location next to infrastructure.” – Reggie Greenwood, Executive Director, Chicago Southland Economic Development Corporation

Greenwood is referring to the “maze” of highways (I-57, I-80, and I-294) and cross-country rail lines that form a triangle around the community of Markham, where Amazon chose to build; obviously, a shipping business like Amazon logistically needs easy access to transportation infrastructure.

In order to clear this space for Amazon, developers had to buy up more than half the land, driving out 35 occupied residences; but communities like this are no stranger to the governmental use of Eminent Domain.

If we look further back in the history of this area, we would see that another big business was in town not so long ago: South Works Steel was Its name. When it left, it took the whole area down with it. Those who were stubborn stayed behind, in the homes where they were born, and where their parents eventually died; homes long-since paid off, that represented a sense of certainty for these stubborn types; a feeling that becomes even more prevalent after having been stripped of everything else. The land got cheaper. No banks would invest where opportunity did not exist. Meanwhile, the people who skipped town had sprawled out into outlying communities that now needed roads to connect them.

Highways and rails criss-cross Markham because, well, the land was cheaper, and economically speaking, no one important was living there anymore. When people are made to feel unimportant, they often become civilly disobedient, partly because they feel disrespected, partly because they start disrespecting themselves. People need validation; they need to feel included. In the cold hard math of Economics, this is considered a flaw, and not factored into the equation. Crime goes up, housing prices go down, retail businesses leave…unemployment ensues, followed by property tax hikes, followed by welfare, followed by government handing out tax incentives to whoever will take them; rinse and repeat.

Ironically, when people hang on too tightly to the past, the Future comes rolling in, and kicks them out anyway. It buys up their house, and tears it down. Nowadays, they call it Gentrification, a form of Progress replete with new jobs, that attract new people, who fill new houses, and bring new hope. The final irony, in case you missed it, is that being poor leads to a bunch of highways running through your backyard, which in turn brings a corporation that doesn’t really need poor people’s money at all, they just need the infrastructure. Poor areas become the perfect place for chemical plants, oil refineries, toxic waste dumps (Superfund sites) et al, and governments, desperate to have their neighborhoods be “economically” successful, bring the devil right to the people’s door, all because of this belief that the Economics of Greed can somehow diminish all human suffering, when in fact (irony #4), it does the opposite.

The lesson for us is that, in this world of Economics, people are not the constant, they are the variable. The times they really aren’t a-changing. We are still a nomadic species, who must go wherever we can in order to survive. Even now, Certainty is a moving target, and we have to move with it.

Throughout human history, trouble always arises when those among us are allowed to gain excessive power over the rest. The fact that our current Economics in no way attempts to solve this problem is a tribute to our absolute stupidity. Witness our stupidity made manifest in the case of Amazon.com, Inc.

Amazon: A Cautionary Tale

Tyler Cowen, touted by Forbes as “one of today’s most influential economists”, defends Amazon in this way:

“Amazon pays plenty in terms of payroll taxes and also state and local taxes. Nor should you forget the taxes paid by Amazon’s employees on their wages. Not only is that direct revenue to various levels of government, but the incidence of those taxes falls somewhat on Amazon, which now must pay higher wages to offset the tax burden faced by their employees.”

Let’s break down Tyler’s statement for a moment.

Tyler: “Amazon pays plenty in terms of payroll taxes”…

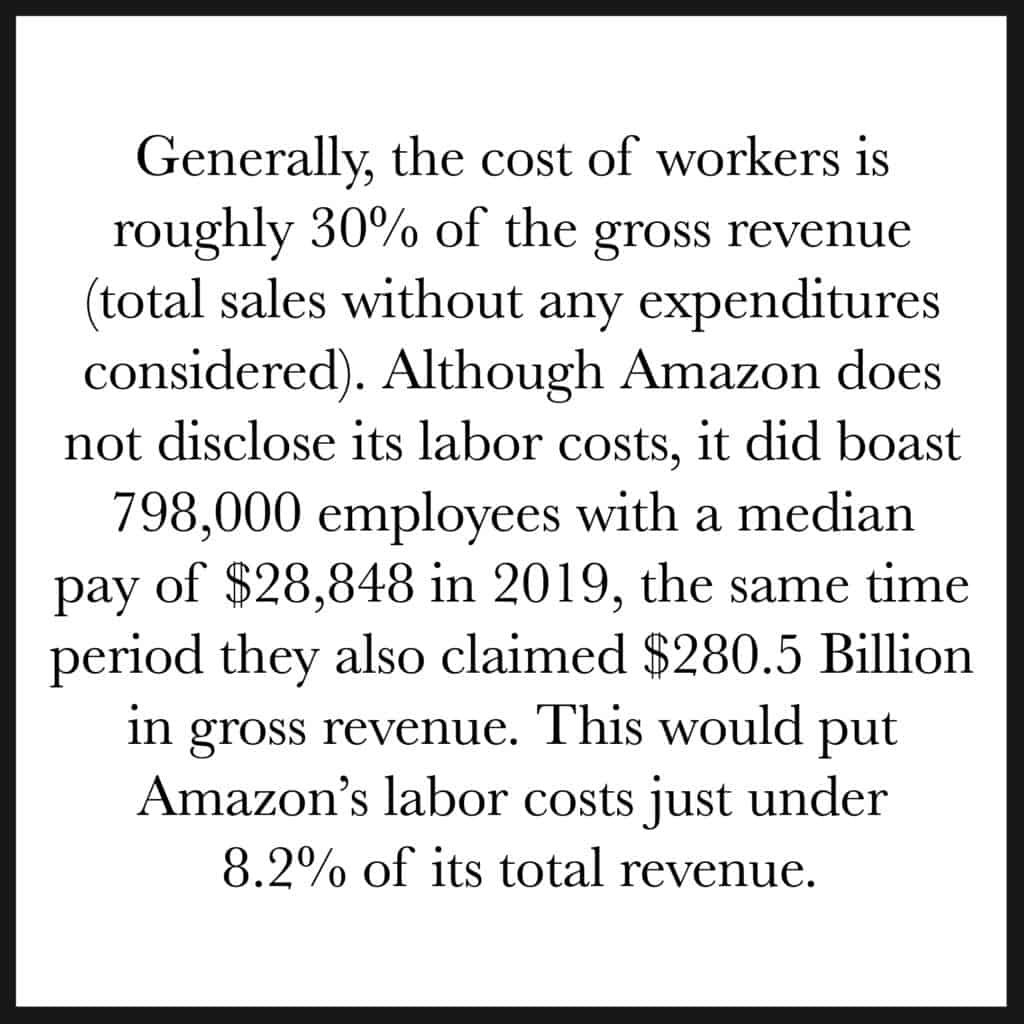

Payroll taxes are what finances Social Security (6.2% of wages for both employee and employer), and Medicare (1.45% for both as well); we all know this, of course, because everyone pays into them equally, whether you are an owner or a worker (16 million self-employed Americans are forced to pay the entire tab). When Amazon pays an employee $15 an hour (as it has done since November, 2018), the employee only receives $13.85 an hour, and Amazon must pay $16.15. Tyler is possibly trying to apply Economies of Scale to the units of labor; in other words, the larger Amazon’s stable of people, the less It should have to pay for them.

Tyler: “…and [Amazon] also [pays plenty of] state and local taxes…”

Good Jobs First (GJF): “State and local governments gave Amazon.com subsidies totaling more than $3.7 billion as it grew to become one of the world’s largest companies, according to an update released today by Good Jobs First, the national watchdog group on corporate tax breaks…the $3.7 billion going to Amazon likely understates total subsidies going to the company, because companies have become more sophisticated in hiding the true total amounts.”

Tyler: “…nor should you forget the taxes paid by Amazon’s employees on their wages…”

Here Tyler is offering a Trickle Down Theory of tax assessment: When the wealthy are not taxed, taxes will naturally trickle down to those least financially able to afford them. From 2016 to 2019, every single person Amazon employed paid more in federal taxes than Amazon did. In 2017, they actually received a refund of $137 Million.

Tyler: “…the incidence of those taxes falls somewhat on Amazon, which now must pay higher wages to offset the tax burden faced by their employees.”

Tech Crunch: “Amazon in November [2018] raised its own minimum wage to $15 per hour in response to the ongoing criticism around pay disparity and poor working conditions.” Jeff Bezos: “…that is not what drove the decision…We did it because it seemed like the right thing to do.” In that same year, analysis from the National Low Income Housing Coalition determined that “nationally, someone would need to make $17.90 an hour to rent a one-bedroom apartment or $22.10 an hour to cover a two-bedroom home.” One can only speculate, but I believe Tyler was trying to say that Amazon would prefer to pay their employees less, but then who would pay for Amazon’s taxes?

In reality, Amazon pays no federal taxes because of three major deductions the company utilizes: Property, Plant, & Equipment (PPE) expenditures, investment in Research & Development, and Employee Stock Compensation. We already discussed earlier how PPE expenditures makes Amazon eligible for tax credits, as It usurps real estate in exchange for local job creation. Amazon’s PPE expenditure is currently around $60 Billion (So It somehow is allowed the tax credits and the full deduction).

Meanwhile, Amazon leads all businesses in Research & Development investment – $35.93 Billion in 2019. Amazon allegedly spent this money on projects like developing Alexa, cloud-based services, and cashier-less services (Amazon Go); ideas that would only enrich Amazon. It is unclear how this R&D would create any jobs; it would more likely eliminate them.

In a collaborative study of Amazon by Finland, Austria, and Japan, “a number of questions were raised about Its R&D model, such as, is it really R&D?…Much has remained veiled inside the black box of Its unique model.” The group concluded that “The accounting principles of R&D in the digital economy should be reviewed.”

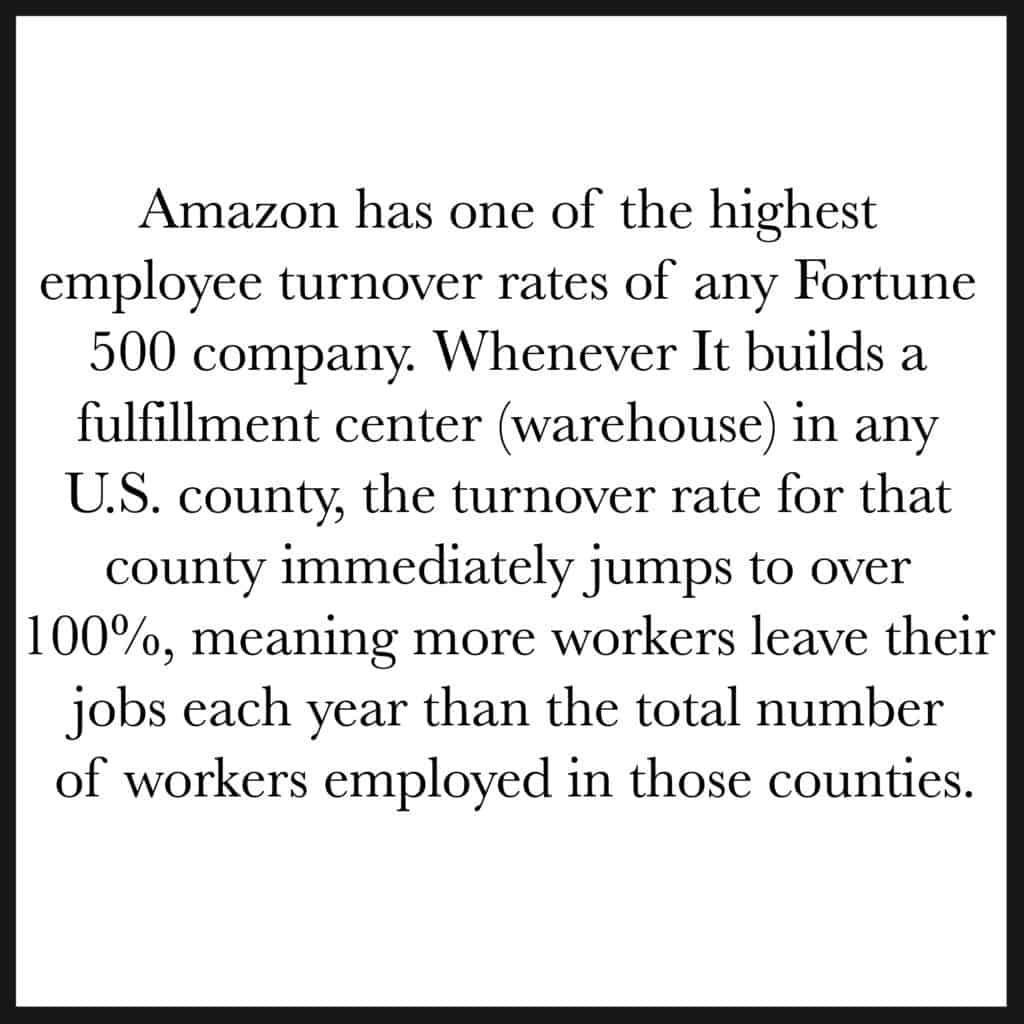

A move to stock-based compensation (versus cash compensation) for its employees is the third driver of Amazon’s tax breaks. For Amazon, these restricted stock units (RSUs), given each year to their million employees, allow tax deductions on the ever-increasing value of the stock; meanwhile, the individual shares only pay out if the employee can make it through two years of continuous service. At that point, after tax penalties for realizing the gains, compensation is basically equivalent to a $0.44 an hour increase in pay over the two year period of continuous service. This stock-based compensation loophole in the income tax code is made for Amazon; the genius of this tax evasion strategy is that Amazon makes no outlay of cash, yet gets millions in deduction for it. With Its “burn and churn” business model (half its employees never make it through the year), Amazon manages to avoid making good on the majority of Its stock “promises”, while still receiving all the deductions (at zero cost to Itself).

While empowering Amazon to succeed, many other businesses are failing; Amazon consumes them. With no restrictions on It, Amazon, through Economics, has begun to quietly take over control of the planet. It is buying up the submerged intercontinental internet cable from here to Asia (Google is attempting to get control of the internet in a similar fashion). It has also bought a fleet of 100,000 electric trucks to facilitate all Its own deliveries (these trucks have autonomous capability, so won’t need drivers at some point). Once they get A.I. robotics to move the packages off the shelves and onto the trucks (using Alexa), they will control all phases of this Economy of Things, and do so without creating wealth for anyone else: no jobs, no income tax, no property tax. It will, in effect, win this Game of Economics we seem so insistent on playing. What comes next is the final subject of this article.

“The question to address is not why Amazon pays no taxes, but under what tax structure could we be better off?” – Stephanie Denning, Forbes Magazine

Economics, From The People’s Perspective

Economics, like history, is a tale told from the point of view of the Winners. Democracy was intended to tie the fates of people together; Economics, the way it is currently practiced, has the opposite effect. When it comes to wealth inequality and all the externalities it brings, the buck has got to stop somewhere, but in the system we have, the buck, of course, never stops. If Democracy has even the slightest chance to exist within the moral vacuum of Economics, then we, the peddlers of Democracy, need to do everything in our power to give it oxygen.

Timothy Bartik, our tax incentive expert, did feel there was hope for economics to do the right thing, as long as it is “structured to incentivize the desired result.”

In order to incentivize the desired result, we must hold this one truth to be self-evident: that government is the only thing powerful enough, through the force of our collective will, to step out in front of Economics and lead it where it needs to go. But to do this, We the People need to reform our Government, because right now, it is wholly incapable of leading us anywhere. In its analogous role as parent, Government has, in effect, sold all its sons and daughters into a life of prostitution, in order that we each send a little home to Mommy and Daddy, in the form of government taxation. It doesn’t much feel like love, really.

- The United States is a sovereign nation, meaning it derives its power from a centralized government.

- The centralized government of the United States is collectively owned by We the People, who are a subset of people who call themselves Americans.

- Americans therefore collectively own the United States of America, through their government.

If anyone owns America, Americans do, but what does it get us? Another year older and deeper in debt. Americans need to take ownership of America, but to what, exactly, we are entitled?

The United States is foremost a large piece of property. The government exercises its Eminent Domain over this property from time to time (as is its sovereign right), proving that a government ownership agreement is already in place. It also taxes Americans for the property they individually own, and if taxation is thought of as “Rent”, it again proves that a government ownership agreement is also already in place (if we start thinking of taxation as rent, by the way, we would finally have a better argument for taxation).

The United States is more than just a piece of property, however. We must also include the infrastructural “improvements” that Americans have built, and collectively use, in order to make human existence sustainable. The best way to visualize all this shared infrastructure, that facilitates crucial human services, is to think of it as different “Platforms”.

Government is a Platform. Economics is a Platform. Property, Agriculture, Transportation, Healthcare, Energy, Communication (and the Internet), Banking, the Water/Sewer System, Housing, Education – even People are a Platform, when they are inter-connectedly used for some purpose, whether it be as laborers, or as consumers. Without people as consumers or laborers, there is no Market Economics or Commerce. Why are we always so quick to discount people in an equation made of and by and for people?

Amazon utilizes five different Platforms:

- the “Market”, which is really people, in the form of consumers and laborers

- the Market “Place”, where the exchange of goods is allowed to occur

- the Communication platform (here, the Internet), where the new (digital) Marketplace resides

- the Money Platform, where government legitimizes all financial transactions that occur

- the Transportation platform (where products are physically delivered)

What makes Amazon unique is that It does not own, neither does It pay rent toward, any of the Platforms It uses on the way to amassing $280 Billion a year in revenue.

Look at Transportation, for example. The average American citizen is only capable of driving one car at a time. Generally, this car weighs 3,000 to 5,000 pounds. Amazon is going to have 100,000 vehicles on the roads, and they weigh from 10,000 to 80,000 lbs. (they currently have 20,000 of the 80,000-pound variety on the road). Vehicle Weight causes exponential damage to the roads, meaning that a 10,000 lb. truck, though only twice the weight of a citizen’s car, causes 20 times the damage. The 80,000 lb. trailer causes 9,600 times the damage. If each citizen paid $1 for road repair, Amazon would need to pay $2 million (100,000 vehicles X 20, which represents the damage caused by 10,000 pound vehicles, only;. if figuring in those 20,000 large Amazon trailers, the cost would jump another $192 Million.)

Currently, vehicle registration only pays for 12.7% of road maintenance fees; the rest is through federal and state income taxes, and taxes on gas. Because Amazon is going completely “electric”, minus any vehicle registration costs, It will contribute exactly $0 toward fixing the roads on which their entire business relies. Amazon is clever; if we charged It for the use of the roads, It would probably switch to using drones. This is why the People need to also claim Eminent Domain over the U.S. airspace and waterways (and can we somehow stop Elon Musk from littering the sky with low flying orbital satellites? Who is in charge around here?)

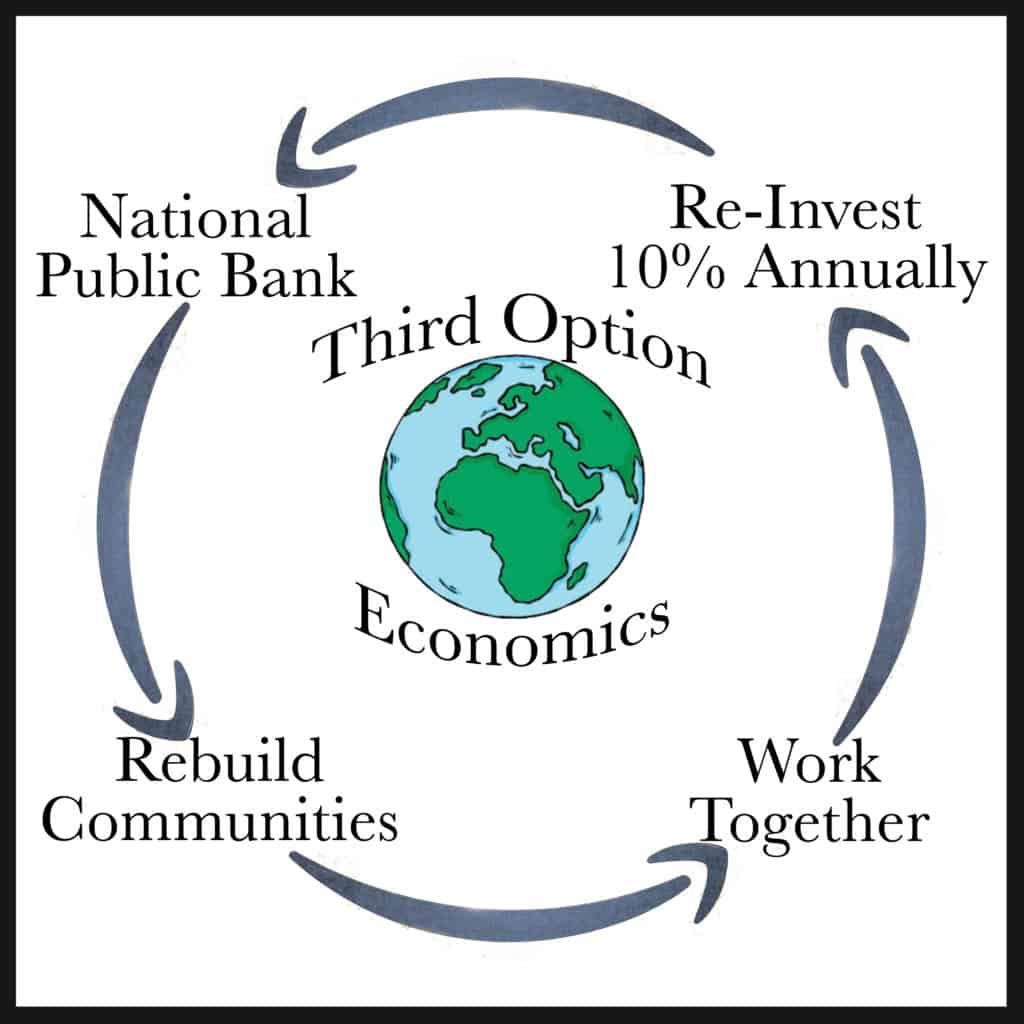

Step 1: The Third Option proposes a Land Value Tax of 1% on all property, which would net the People $200 Billion a year, or a dividend of $606.06 a year for every U.S. citizen. This would limit states to only charging for structures that sit on individual property, and not the land value, which will lessen property taxes overall. The Third Option also has a plan to entirely pay for public education, so the need for state and local property taxation would become less necessary.

Step 2: A proposed Third Option income tax: 10% on all gross revenue, every bit of it invested in a National Public Bank located within the U.S. Treasury, in order for the People to rebuild, and therefore own, all Platforms built on U.S. soil. For our current discussion, let us only talk about the new Transportation and Communication Grids.

It may cost as much as $2.8 Trillion to pay for a new Transportation Grid throughout the United States, and the mortgage payment on this loan, $160 Billion a year, would be the equivalent of 5 cents a mile on the 3.2 trillion miles Americans drive each year on U.S. roads, or the equivalent of $703.30 for each of the

227.5 million registered drivers currently in our country. Using this metric, Amazon would owe the government $70.33 Million for Its share of Transportation Grid Usage.

The Communication Grid bill would likely be under $5 a month for every citizen, so Amazon’s share of that would be negligible. It may get local governments to pay Its share of the Land Value Tax, but It would not be able to escape the 10% Income “Investment” Tax, which only has one allowable deduction: all money given to employees, in the form of wages. Thus, the People’s National Bank would receive $28 Billion of Amazon’s $280 Billion in gross revenue, regardless of how much It pays to Its employees (whatever It pays to employees becomes their tax obligation instead). This “income” tax is the price of doing business. The people of the U.S. represent a large clientele of which all the businesses of the U.S. are allowed access.

The Income tax goes into the National Bank and becomes loans to build Platforms that We the People would now own. When the people utilize these platforms, there is a usage fee, which goes toward paying back the original loans; these accumulate as “shareholder dividends”, creating a nice sustainable loop (The $2.8 Trillion Transportation Loan, for instance, would yield $4.8 Trillion in 30 years, or $14,545 for every U.S. citizen). Meanwhile, all businesses can grow as big as they like – in fact, we would encourage it – because it gives all of us more investment money, and ultimately, a larger government dividend. In this way, Americans are more tied together in this cycle of labor and consumption.

For more on how we can reach Economic Democracy, while still retaining the best parts of Economics, visit the Third Option website.

The Fourth Level of Mastery

The Fourth Level of Mastery