Nobel Prize-winning Economist / author / columnist Paul Krugman still believes Democracy and Capitalism can co-exist.

by Robert Simmons

Universal Healthcare or Bust

Paul’s Take

The U.S. healthcare system is wildly inefficient…We spend far more per person on health care than any other country…yet rank near the bottom among industrial countries in indicators from life expectancy to infant mortality… [Meanwhile] the system run by the Department of Veterans Affairs is not like the rest of American health care. It is, if you like, an island of socialized medicine…in a privatized sea…It’s a universal, integrated system. Because it covers all veterans, the system doesn’t need to employ legions of administrative staff to check patients’ coverage and demand payment from their insurance companies. Because it covers all aspects of medical care, it has been able to take the lead in electronic record-keeping and other innovations that reduce costs, ensure effective treatment, and help prevent medical errors.” Furthermore, the V.H.A. employs preventive medicine, “bargains hard with medical suppliers, and pays far less for drugs than most private insurers.

Of course, there was immediate backlash from the private sector about Paul’s favorable diagnosis of the V.H.A.; pressure was quickly put on a few ‘insiders’ to blow their whistles and their tops about it, claiming that—‘in fact’—V.H.A care was the ‘worst’ care imaginable.

“As you might guess, conservatives don’t like the observation that American health care performs worse than other countries’ systems…so whenever someone points out the obvious, there is a chorus of denial, of attempts to claim that America does, too, offer better care. It turns out, however, that such claims invariably end up relying on zombie arguments — that is, arguments that have been proved wrong, should be dead, but keep shambling along because they serve a political purpose…If you want a low-tax, low-benefit state, you want to claim that safety-net programs are harmful and unworkable. So a lot of effort goes into insisting that providing universal health coverage is impossible, even though every advanced country besides the U.S. somehow manages to achieve just that.”

When contrasting the V.H.A. system with Medicare, it “looks as if someone went down a checklist of things that the veterans’ system does right, and in each case did the opposite…the V.H.A. avoids dealing with insurance companies…[and] bargains effectively on drug prices; [Medicare drug legislation] forbids Medicare from doing the same.” As always, the private sector utilizes government not to help people, but only to help itself. The current cries from the right that we are being ‘socialized’ is a tradition that goes back a hundred years or more, but it did not stop Medicare or Social Security from happening anyway, because it was ‘the right thing to do’; someday, people will fashion a world based on this premise—just not in our lifetimes, it appears.

Paul has generally been supportive of Obamacare, but fears it is vulnerable, because it “is a hybrid public-private system rather than a simple government insurance program; it has a number of moving parts, and it’s not too hard to throw sand in its gears…The insurance industry would not take kindly to being eliminated, and has a lot of clout,” but Paul feels that if Republicans “don’t kill Obamacare soon, the next step will probably be an enhanced program that lets Americans of all ages buy into Medicare.” This ‘hybrid’ A.C.A. model has two other notable features: in order to keep overall premiums down for everyone, the A.C.A. needs to get young healthy people to sign up for insurance coverage; if only people with pre-existing conditions signed up, premiums would be driven up substantially. Also, the system was organized into fifty state-level programs, each encouraged to set up their own health insurance marketplaces, with the federal government A) setting the overall rules, and B) ready to help finance anyone who needed it. Most ‘red’ states held out; 12 states still refuse to take free government money to help their own citizens. Conservative states are likely holding out to be able to point to higher premiums, that are caused by, well, conservative states holding out. Making the A.C.A. a state-level program proved to be a smart move, protecting participating states from the private sector’s attempts to sabotage it for everyone.

Third Option Goal: Design the Highest Quality, Most Affordable, Universal Healthcare Possible

In reality, there is nothing wrong with ‘private sector’ healthcare. Its main goal is to make a profit for itself, and in this category it is currently ranked number one in the world; $4.1 trillion in revenue was collected in 2020—a number which could climb to as much as $6.2 trillion by 2028. Everybody wants to feel better, and maximize their quality of life; this is the foundation on which consumerism was built: to financially ‘capitalize’ on American’s universal demand for life, liberty, and happiness. A positive externality has also been the negative externality of poor health outcomes in a society built on relative inequality, which has inadvertently made healthcare costs the perfect measure of America’s ‘Gross Domestic Unhappiness’.

There is a good argument that the private sector has a ‘conflict of interest’ when offering services like private prisons or private healthcare. U.S. healthcare currently kills 250,000 Americans every year from medical errors alone (which is more than the Vietnam War killed in 20 years of actually trying to kill Americans). Maximizing profits means being overworked, understaffed, no one sharing information or best practices, no one pushing hard enough for preventive health measures, big pharma quashing research and stretching out patent protection, and every little component along the way—from infrastructure to patient billing—providing private sector healthcare with a chance to jack the price up even further. Even Charitable foundations have become investment firms seeking a ‘return on donation,’ versus any actual investment in human life. It is time to file a ‘do not resuscitate’ order on this American Sickness, then mercifully pull the plug on all of it.

Ultimately, Universal Healthcare makes the most sense; not only is it ‘the right thing to do,’ “here, doing the right thing is also cost-efficient. Universal health care would save thousands of American lives each year, while actually saving money.” (Paul Krugman). The Third Option also contends that if Universal Healthcare changed its goal from G.D.P. to G.N.H., private sector healthcare wouldn’t even wait until we fired it, it would voluntarily quit first.

The Third Option Universal Healthcare would cost around $1 trillion a year, mostly because that is what healthcare really costs, minus greed and waste; it “is one-fourth the price because it applies ‘economies of scale’, removes ‘profit-seeking’ (and redundant ‘middlemen’), procures all its infrastructure, equipment and supplies ‘at cost’, and ‘nudges’ our residents to be more accountable for their own well-being.” The price should only go down in time, because A) the system is heavily invested in issues of mental health, which often precipitate self-destructive behaviors, B) it places taxes on (proven) unhealthy products and services, that would hopefully ‘nudge’ people toward more moderation, and B) most of the cost estimates used in deriving the total were taken from private sector projections, which are usually overblown. (For more on Third Option Universal Healthcare, go here.)

Securing Social Security

Paul’s Take

Since the politics of privatization depend on convincing the public that there is a Social Security crisis, the privatizers have done their best to invent one…America does face a real crisis—but it’s in health care, not Social Security…Medicare, though often lumped in with Social Security, is a different program facing different problems, [namely] the rising cost of medical care…

Those who seek to privatize government programs (schools, social security, prisons, transportation, the military, et al) constantly utilize “scare tactics and fuzzy math;” one such tactic involves lumping the expanding financial cost of Medicare in with the more modest shortfall in Social Security revenue, to make the overall numbers appear more intimidating. Social Security’s only real issue “is a matter of demography”, as Paul puts it; “as the population ages, the number of retirees will rise faster than the number of workers. As a result, benefit costs will rise by about 2 percent of G.D.P. over the next thirty years, and require additional revenues equal to…the revenue lost each year because of [Republican] tax cuts…to people with incomes over $500,000 a year.”

Third Option Goal: Utilize a ‘Dig Once’ Policy to Secure Social Security

While Social Security is completely stable by itself (because it’s a “pay-as-you-go system”), there are some issues surrounding Social Security that need to be addressed when attempting to fashion the best version of retirement security for our citizens.

The Social Security Trust Fund

“As you know, the Social Security System is teetering on the edge of bankruptcy…Unless we in government are willing to act, [impending disaster] will soon hang over the welfare of millions of our citizens.” Letter from Ronald Reagan to Congressional leaders, 1981

Ronald Reagan tried his best to cut benefits to the poor and the elderly. “He proposed to cut Social Security benefits for all new retirees. That was slapped down. He turned to a plan to slash benefits for three million people, 90,000 of them women over 90. That blew up in his face, too. Finally, Ronald Reagan sought to shave the increases for the 36 million beneficiaries already receiving benefit checks. This idea proved so unpopular that the president gave it up before he even announced it.”

In the end, he successfully managed to raise the payroll tax instead, at the recommendation of Fed Chairman Alan Greenspan, and the result was a $2.9 trillion surplus, earmarked for baby boomers when their retirement number came up. Along the way, unfortunately, the government could not help but appropriate it without telling us, to pay for ‘other things’ that it does not feel compelled to disclose. According to the Treasury, “if there were no trust funds, the Treasury would still borrow just as much, all of it from other investors.”

When the Treasury borrows money, it offers bonds, bills, notes or securities in exchange; most of the amount is reflected in our National Debt, currently at $29.8 trillion, for which We the Taxpayer are forced to currently remit $422 billion in interest-only payments annually. Some of our ‘investors’ are China, Japan, England, Ireland, but as it turns out, We the Taxpayer are the biggest investors—through our Social Security Trust Fund—although the Treasury doesn’t see this as ‘national debt’ apparently. A tax is just a tax—on ‘payroll’ or ‘income’—to utilize as they see fit, but a debt is apparently not really a debt when we borrow it from ourselves, and therefore not worth mentioning to anyone.

To recap: the American people are taxed (on payroll); the money is then borrowed, making Social Security “$80 billion in interest payments in 2019 alone,” but where did the Treasury get the $80 billion to pay us back, let alone the principal on that $80 billion? Best answer: from their usual source, We the American Taxpayer.

Once our ‘trust’ fund money was appropriated, in order to get our savings back, we had to reach into our pockets a second time, with even further taxation. If this is incorrect, we would be eager to hear how our Social Security money did make it back into our trust fund, with interest; perhaps private individuals borrowed it, making our U.S. treasury a kind of National Public Bank; if so, it would certainly be more legal, as National Banks are Supreme-Court certified, thanks to former Treasury Secretary Alexander Hamilton.

Currently, payroll tax—because it has a ‘cap’ on it ($142,800 as of 2021)—unequally taxes (and therefore unequally benefits) the most wealthy. For example, some entrepreneur who makes $142,800 a year would give $17,707 –or 12.4% —to Social Security, while an independent investor who makes $1.48 million a year would also give $17,707, or 1.24% of their earnings). In a sane and educated world, everyone would correctly reason that in a closed environment, the emergence of poor and rich people are likely not mutually exclusive events. Additionally, they would note that when citizens are considered more valuable as consumers than as laborers, chances are they will be going into debt; here in bizarro world, though, we prefer to call it ‘economic growth;’ for marketing purposes.

By the way, Reagan was wrong: it is Capitalism itself which is constantly teetering on the edge of bankruptcy; to cover up this fact, it dumps all its losses into a pile known as our National Debt. The large chunk of money collected from working people’s paychecks—in order to fund Social Security—does not become ‘debt’ until Reaganites and their ilk secretly appropriate it from our savings account. Amazingly, the conservatives then have the audacity to tell us that our savings account is in trouble, so that we might consider ‘privatizing’ Social Security, which simply means we would willingly hand all our money over to them, rather than forcing them to appropriate it from us. The financial sector has a ‘history’ of being frivolous with its own money; it is difficult to imagine it would be more responsible if it gambled with House Money. If it did lose all our money, however, government could simply tax us in order to recoup our losses (plus bonuses all around for Wall Street investors, for doing the best they could), which is basically no different than we are currently doing. The fact that the Treasury has taken money out of our wallets and chose not to readily disclosed this fact does seem to prove, unfortunately, that no branch of government is immune to the ravages of ‘creeping capitalism.’

The Third Option, to be honest, is actually inspired by this chicanery. From now on, we suggest simply borrowing ALL the money from ourselves, then pay ourselves back with interest, and 65 years later, divvy it all back up again in retirement dividends (but still call it ‘Social Security’, if people would feel more ‘secure’ calling it that). Currently, the National Debt interest payment is on course to cost us $910 billion a year by 2031. We will, of course, be forced to raise taxes on the low- and middle-class worker, per our usual strategy, in order to afford this 100%+ increase. A plan is already on the table to raise the payroll tax from its current 12.4% to 14.4%, then up to as much as 18.4% in the future. Before this happens, however The Third Option urges Americans to bring back a National Public Bank, which would replace the Federal Reserve, and get control of our money from the U.S. Treasury, which, as Paul points out, has been infiltrated with partisan agendas for quite some time, and can no longer be trusted as an objective entity.

While we are at it, let’s employ a ‘dig once’ policy, meaning we would only dig once into the pockets of the American people. Instead of taxing ourselves from 22% to 37% (or higher) on income, then another 14%+ on ‘payroll’, The Third Option would simply charge all stakeholders a 10% ‘fee’ on revenue each year, ‘invest it’ into the National Bank, pay for all our essential needs –food, shelter, healthcare, education, transportation, energy, communication, water / sewer—and through our combined efforts—in every community—provide these essential needs services to each other, meanwhile creating a more sustainable form of retirement revenue in the process. In this way, even our National Debt could be turned into retirement credit.

This move would also create a ‘livable’ wage—not by raising wages, but by lowering the cost of essential needs. We will never be able to control the private sector’s penchant for overcharging us on essential needs, because their built-in excuse—the concept of ‘demand’—drives their price-fixing agenda. The private sector’s addiction to capital cannot help but create bubbles that burst at fairly regular intervals. The wealthiest know this, which is why they have spent lots of money buying politicians and lobbyists, in order to protect themselves, through various legislation designed to ‘spread out the risk’ onto the rest of us. It is time for the rest of us to also share in some of the rewards.

The Lessons of Economic Geography

Paul’s Take:

Major urban centers have always been magnets for economic growth. They offer large markets, ready availability of specialized suppliers, large pools of workers with specialized skills, and the invisible exchange of information that comes from face-to-face contact.

NY Times

Paul’s ‘New Economic Geography’, which helped earn him the Nobel prize in 2008, got people thinking about how cities or other geographic areas came to arrange themselves, in order to be more economically viable. Agglomeration, or people and things ‘clumping together,’ has made for patterns both good (see above quote) and bad (like housing bubbles and other issues of ‘economic rent’). Paul introduced the new economic geography “to attract the attention of mainstream economists” which had “decided long ago that devising abstract models” was somehow more “useful” to their profession. Paul’s belief was that the Keynesian model of economics began this era of “model-oriented thought,” which then diverged from ‘institutional’ approaches (like geography) that considered ‘real’ spaces where real economies were going on. Economists felt that abstract models were more helpful to Capitalism (or perhaps Capitalism paid more for them), and thus real-world pragmatism was slowly usurped by cold hard math.

Paul’s ‘core-periphery’ model hearkens back to our earlier industrial economy, when manufacturing set up shop where the demand was greater, while a stable agricultural presence established itself around the periphery, to supply manufacturing with essential raw materials. In other words, these two regions could be seen to work together, as a unit. For a while, an ‘equilibrium’ was established between the two.

“First, the concentration of several firms in a single location offers a pooled market for workers with industry-specific skills, ensuring both a lower probability of unemployment and a lower probability of labor shortage. Second, localized industries can support the production of non-tradable specialized inputs. Third, informational spillovers can give clustered firms a better production function than isolated producers.” The benefits of agglomeration create ‘economies of scale,’ which offer “increasing returns.”

Paul himself sometimes wonders if his ‘core-periphery’ model has become obsolete, when in fact, with a little social science engineering, it could beome the model that will finally unite America.

Third Option Goal: Apply Economic Geography to Maximize Economic Efficiency

We can’t help rural America without understanding that the role it used to play in our nation is being undermined by powerful economic forces that nobody knows how to stop.

NY Times

In a purely profit-seeking model, “things clump together; the periphery cannot hold.” With the help of economic geography, however, a people-centered model could be designed that proves more efficient and effective than a profit-centered approach, as well as more inclusive, fair, and sustainable.

Utilizing Paul’s ‘new’ economic geography, researchers (like Professor Alex Anas, for example) found that as cities increase in size, economic geography dictates that a kind of de-agglomeration would begin to occur; smaller entities would form that “become completely specialized mini-factory towns producing a single variety that is traded to all the other cities.” Thus, the human pattern of increasing efficiency and effectiveness leads toward specialization of economically viable functions. Much like specific organs in the human body specialize in functions necessary for the health of the whole person, so would whole cities of people do better to apply the basic biology of “self-contained and self-maintaining” cells which combined, would constitute a healthy living organism.

Economics, as it unfolds naturally (‘first nature’) or through the human desire to maximize what nature provides (‘second nature’), is healthy; the profit-seeking model of Capitalism, however, is cancerous to the health of the whole, and it has allowed the slow atrophy and economic death of the entire midsection of our country.

The Third Option has devised an economic ‘theory of everything’ that digs down beneath the core and the periphery, to the basic building blocks of all economics: 1) people and 2) their current geography. Utilizing a ‘unified theory’, ‘core-periphery’ cells (or communities) of people could organize within the most densely packed cities as well as the most sparsely populated rural regions. What makes this model economically superior is that all these cells feed the whole; they are not isolated. Through a National Public Bank that loans money equally to every community, groups of people can maximize the geography around them, exercise their right to life, liberty, and happiness, which in turn would feed the entire body politic, and reward every stakeholder for simply being themselves. In this way, economic geography becomes valuable in creating a more affordable life, not just more affordable products.

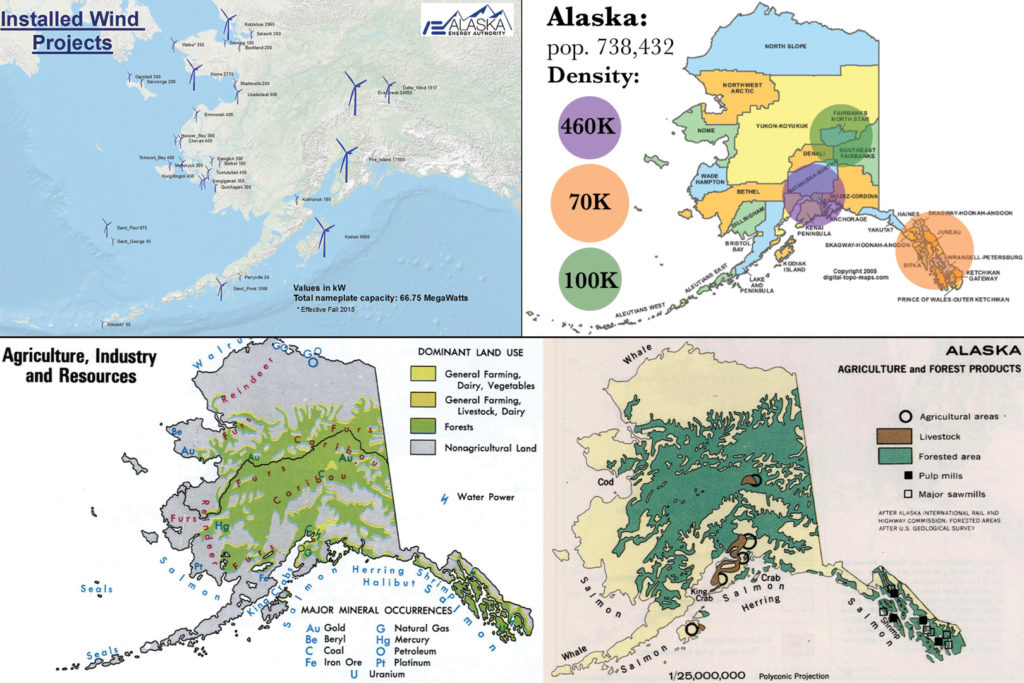

America is a country of population extremes. New York City has 13 congressional districts alone; Entire states like Alaska, Delaware, Montana, North Dakota, South Dakota, Vermont, and Wyoming have only one. On average, a congressional district comprises a population of 710,000 people; The Third Option prefers to provide essential needs coverage to ‘communities’ of approximately 100,000 people. New York’s 13th congressional district is the smallest geographical area, while Alaska is clearly the most expansive.

The population of Alaska is 738,432, so The Third Option plan would hope to divide Alaska into seven communities of roughly 100,000 people. Nearly a half million of Alaskan residents reside in the south central part of the state, in the Anchorage, Matanuska-Susitna and Kenai Peninsula Boroughs.

The rules of Economic Geography place natural resource extraction where nature dictates, while people either huddle around products and services or products and services huddle around them; in either case, economy of motion (the supply chain from resource to manufacture to distribution) needs to be as efficient and effective as possible.

In the same manner, The Third Option would also utilize the efficiency of economic geography in its education system. For instance, high schools would be repurposed to offer associate degrees in essential needs fields relating to healthcare, education, communication, transportation, agriculture, energy, water / waste management, and construction / engineering. To deliver instruction most efficiently and effectively, per what economic geography dictates, each discipline would need to be separated out and housed within its own school campus.

A typical population of 100,000 people has no more than 1,500 students in any one grade. Currently, the average high school holds 850 (some a daunting two-to-three thousand), but there is already a movement toward reducing high school populations down to a more manageable 400-student range (or 100 students per grade). This would appear to require building 15 different high schools in any single community; per the essential needs listed above, plus degree offerings in social science and other liberal arts fields, 10 to 12 schools would seem to be enough in most cases. In their final two years, students would travel to the school (within their community) where their degree specialty is offered; who is to say whether internships or even entire job markets might begin to spring up around these schools, in the spirit of economic geography.

In general, The Third Option would utilize Human Geography to address several concerns:

- Where to place regenerative versus vertical farming,

- Where to place transportation routes and hubs, from hyperloops, high speed and heavy rail, to electric air and ground transit,

- Where to position our international Global Schools, to best serve the essential needs of populations who are isolated and underserved,

- How to build communities that reflect both local geography and culture (past and present),

- How to maximize green energy output by tracking heat, light, wind, and wave power capacity,

- Where to place health and education services to facilitate public access by all,

- Who (and where) to regulate environmentally, in order to minimize damage from hazardous waste, pollution, etc., and

- How to best facilitate international relations, through tracking migration, poverty, hunger, climate, agriculture, transit, language, culture, and more.

The Manic Depression of Capitalist Economics

Paul’s take:

Events after 2008 spectacularly confirmed the predictions of the depression-economics framework. Massive budget deficits didn’t drive up interest rates, money-printing on an enormous scale wasn’t inflationary, and governments that tried to be prudent by cutting spending suffered much worse slumps as a result.

Arguing With Zombies

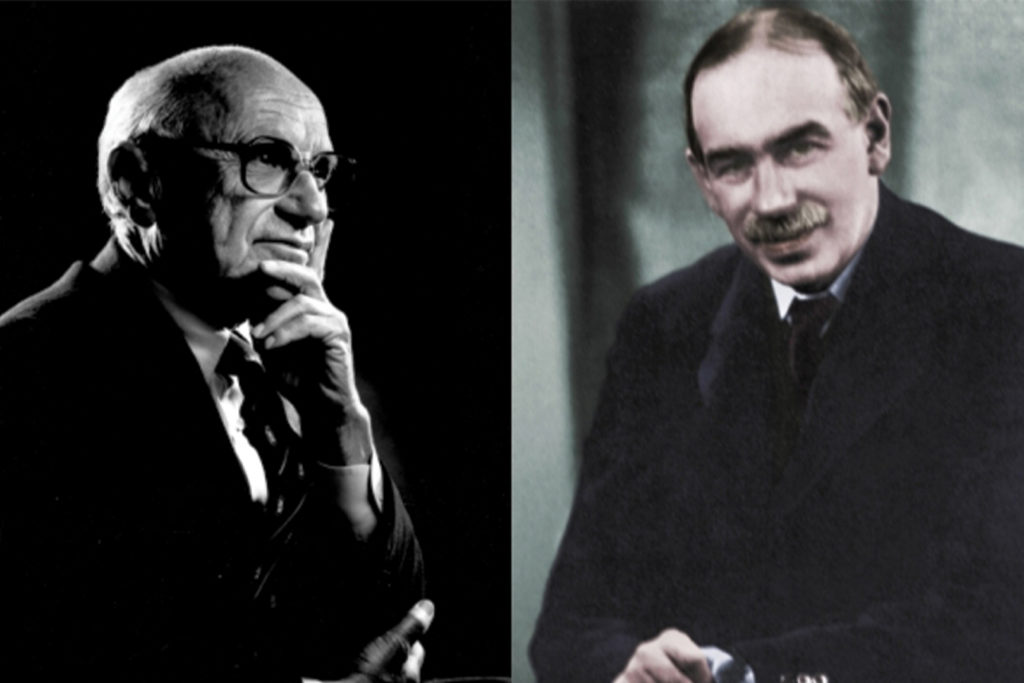

In the beginning, we had an economic Depression. Many began to think Capitalism was a failed system, but John Maynard Keynes stepped into to save Capitalism, by providing government support for it. Though no one ever dare mention it, Capitalism—without government to prop it up—is an unsustainable model. Even so, once Keynes died (1946), ‘conservatives’ began chipping away at his model. According to Paul, “Once you accepted a government role in fighting recessions, you might adopt a more expansive view of government in general,” and so the wealthy began to champion any form of economics that made them rich and kept them rich. Enter Milton Friedman—the darling of the ‘one-percent solution’—and the ‘voodoo economics’ crew on the supply-side of the equation, willing to slash taxes for the wealthy, so they may (or may not) trickle them down to the tired poor huddled masses.

The Road Goes on Forever, and the Party Never Ends

Keynes preached that ‘economic downturns’ are a product of inadequate demand. He reasoned that government should provide this demand, even if it increased overall debt, because the private sector would not risk it in times of economic instability.

Friedman and the Monetarists did not want government involved; ‘give money to the banks’ and allow the economy to cure itself. Once banks had more money, people would come and borrow it, and the economy would get moving again. Supply side economists chimed in with their ‘take’: ‘let the wealthy keep their money’, by cutting their tax rate, and they would use this extra money supply to start taking risks again, and the economy would get moving again.

Everyone believed they had the economy on a string, and that string was wrapped around their finger. The economy, in truth, dangled quite precariously at times, though it never hit rock bottom like in the 1930s. “The collapse of more than 1,000 savings and loan institutions in the late 1980s” was seen as “the major cause of the economic recession of the 1990s.” Technology stocks took a huge dive in late 2001, but by then, even ‘New Keynesians’ had fallen in love with the fantasy of “rational individuals and perfect markets…there was no room in the prevailing models for such things as bubbles and banking-system collapse.”

Financial Crashes: Driving While Under the Influence

Indeed, home buyers generally do carefully compare prices—that is, they compare the price of their potential purchase with the prices of other houses. But this says nothing about whether the overall price of houses is justified. It’s ketchup economics, again: because a two-quart bottle of ketchup costs twice as much as a one-quart bottle, finance theorists declare that the price of ketchup must be right. In short, the belief in efficient financial markets blinded many if not most economists to the emergence of the biggest financial bubble in history. And efficient-market theory also played a significant role in inflating that bubble in the first place.

NY Times

Confidence was high, and apparently, so were many home buyers, who attempted to purchase a house with no money, and bankers, who let them do it, and Wall Street brokers, who bundled all those high-risk investments in with less risky ones, in order to peddle the whole thing off to whoever was high enough to trust Wall Street brokers. But more than anyone else, economists were high enough to trust that the Fed could solve any economic problem, simply by running its only play: lowering interest rates to stimulate spending, per Milton Friedman’s monetarist revelation. Unfortunately, not even a zero percent interest rate was “low enough to end this recession. And the Fed can’t push rates below zero, since at near-zero rates investors simply hoard cash rather than lending it out.” This is what constitutes a ‘liquidity trap,’ when money is better held onto and not invested, for there is nothing to be gained.

My spending is your income and your spending is my income. If we both slash spending, both of our incomes fall…Government purchases…put unemployed resources to work. Government borrowing…puts idle funds to work. As a result, [an economic downturn] is a time when the government should be spending more, not less. If we ignore this insight and cut government spending instead, the economy will shrink and unemployment will rise. In fact, even private spending will shrink, because of falling incomes.

Arguing With Zombies

Paul believes austerity measures are a proven nonstarter in times of stagnation. Still, the private sector seems perfectly okay with pushing austerity measures on poor people in times of economic struggle (see IMF). Even with occasional scare tactics about the National Debt, “Republicans never actually cared about debt; they just pretended to be deficit hawks as a way to hamstring President Barack Obama’s agenda. And many centrists have turned out to have a double standard, reserving passionate concern about debt for times when Democrats hold power.” The reality has always been that government needs to help kickstart the economy in times of economic downturns, until the private sector “is willing to spend enough to produce full employment.”

“When almost everyone in the world is trying to spend less than their income, the result is a vicious contraction—because my spending is your income, and your spending is my income. What you need to limit the damage is for somebody to be willing to spend more than their income.” As the negative externalities of Capitalism continue to pile up, it is no surprise that government spending has increasingly represented a much bigger share of the economy than at the time of the Great Depression.

“Standard estimates suggest that a dollar of public spending raises G.D.P. by around $1.50.” Laundering money through the Fed or cutting taxes for businesses or the wealthy have never achieved these kinds of numbers. This “is probably the biggest reason the Great Recession didn’t turn into a full replay of the Great Depression. Moreover, budget deficits weren’t causing any visible economic problems. Interest rates remained low, suggesting both that investors weren’t worried about debt and that government borrowing wasn’t “crowding out” private investment.”

In Paul’s view, the only bad debt is the kind we owe to other people (or institutions). Currently around $7.5 trillion of our National Debt is owned by foreign countries, for instance. This kind of debt needs to stop. Meanwhile, a new theory has emerged that basically believes that debt is meaningless and thus encourages it to maintain growth.

“Modern Monetary Theory (MMT) is an economic theory that suggests that the government could simply create more money without consequence as it’s the issuer of the currency, according to the Federal Reserve Bank of Richmond. As part of this theory, the thinking is that government deficits and national debt don’t matter nearly as much as we think they do.”

Paul sees this as a regurgitation of Abba Lerner’s “functional finance” doctrine (circa 1943). “[Lerner’s] argument was that countries that (a) rely on fiat money they control and (b) don’t borrow in someone else’s currency don’t face any debt constraints, because they can always print money to service their debt. What they face, instead, is an inflation constraint: too much fiscal stimulus will cause an overheating economy. So their budget policies should be entirely focused on getting the level of aggregate demand right: the budget deficit should be big.”

Paul feels this model dismisses debt, and he feels that debt does matter, especially once it gets big. We are nearing a National debt two times our annual G.D.P.; when it gets three times the amount, the interest payments on it would cost Americans a lot in spending cuts or tax increases to service that debt. He does not feel we can just ignore the debt, and the interest rates on it. Investors in our debt, who eventually want their money back, are likely not big supporters of MMT, either.

Third Option Goal: Build an Economy that Won’t Break ‘Down’

Investment can and should be debt-financed.

Arguing With Zombies

Paul believes really big spending plans should involve investment in something, not just a tax cut for the wealthy. He sees three broad categories of government financial expenditure: Investment (infrastructure and research), enhanced benefits (like childcare or Medicaid insurance), and major system overhaul (like healthcare).

The Third Option plan does all three at the same time, with each paying for the other, so the cost is negligible. Paul feels that if the money can be loaned out cheaply, and the return on investment is big, then do it. He also believes that ‘benefit enhancements’, like Medicare or Social Security, are “harder to justify borrowing for,’ so are usually funded by taxing somebody. When the liberals tax the wealthy, it always raises cries of ‘Socialism,’ but in the current system, there is no alternative but taxation; as discussed earlier, it is likely that raising the payroll tax or health care premiums is how benefit enhancements would find the funding.

The Third Option’s National Public Bank would supply the Debt; through paying off this Debt, all Americans would prosper. The road would go on forever as long as the effort never ended; only the era of ‘money for nothing’ would end, before profit-seekers figured out how to eliminate wages from their income statements, and ‘my non-spending becomes your non-income.’

Saving Economics, the Profession

Paul’s Take

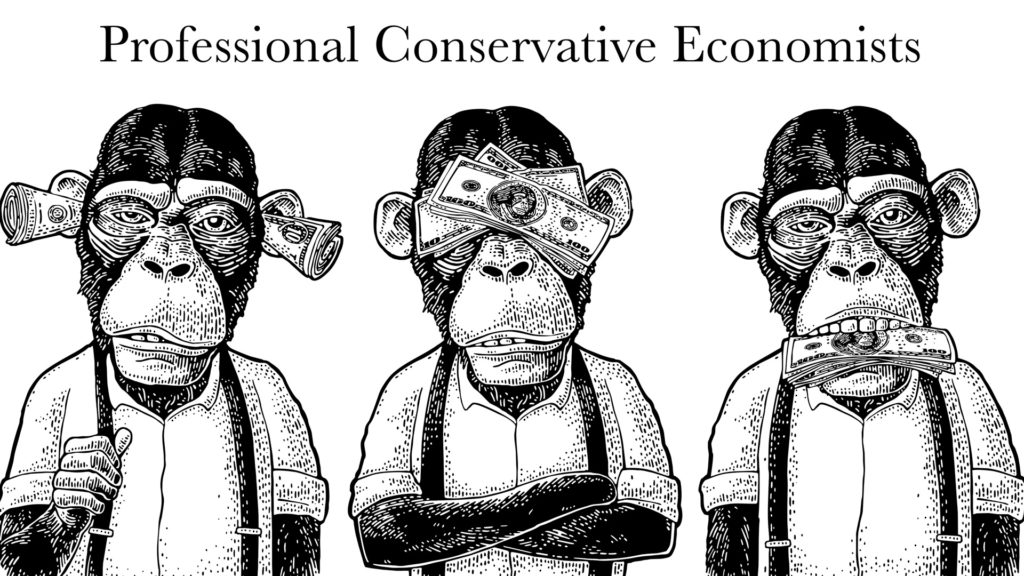

There are three kinds of economist in modern America: liberal professional economists, conservative professional economists and professional conservative economists…Professional conservative economists are…people who even center-right professionals consider charlatans and cranks; they make a living by pretending to do actual economics—often incompetently—but are actually just propagandists. And no, there isn’t really a corresponding category on the other side, in part because the billionaires who finance such propaganda are much more likely to be on the right than on the left.

Paul (who is certainly ‘liberal-leaning’) has been known to also question the motives of his conservative-leaning peers on occasion: “Some of it is clearly ambition on the part of conservative economists still hoping for high-profile appointments. Some of it, I suspect, may be just the desire to stay on the inside with powerful people.”

“The truth is that the vast majority of real-world economics disputes are about easy questions—questions for which there is a clearly right answer, but one that powerful interests don’t want to accept.” In order to address these disputes, Paul feels it is not enough to “continue acting as if we were having a good-faith debate: to lay out the evidence, explain why it means one view is right and the other is wrong, and stop there,” as many of his colleagues have resigned to do. Academia is littered with various attempts to lay down these good-faith arguments, but none of it will be used to alter our current trajectory. Paul’s belief is that economics has to ‘get political’ in order to get things done, but in reality, politics itself is not designed to ‘get things done.’ It is a dead end; there is no outlet for good ideas to go through this political roadblock. If we want to get anywhere, we have to go around it. We have to go ‘off-road.’

Third Option Goal: Offer Economists a Real Job

Economics, as a science, is akin to dermatology; it only offers cosmetic fixes, which generally involve either cutting something off, or prescribing one of three ointments, to keep the problem at bay. In truth, neither the ‘Tax Cuts’ ointment, the ‘Helicopter Money’ ointment, nor the ‘Government Spending’ ointment has eliminated any of the negative externalities that routinely blemish the surface of our economy; that’s because each one is actually a symptom of a much deeper chronic (but manageable) condition inherent to our particular economic system. Unfortunately, economists are currently not ‘licensed’ to perform a procedure of this magnitude, although they clearly are the most qualified to do so; ever since Capitalism reached ‘religious status’, unfortunately, those in Control have opted for more of a ‘Christian Science’ approach to economic healing, based mostly on prayer, in order to realign all our souls with the inevitable Truth of a Perfect Free Market.

In reality, economics is not a science, because it is not natural, meaning it is not naturally occurring; economics is a human-made system –a virtual world—that has been laid on top of the real world, in order to make things feel more Certain for people. Once we realize that the fundamental goal of economics is to create Certainty for people, a more productive discussion could begin, starting with the obvious first question: is our current version of economics the best ‘virtual world’ we could possibly fashion, in order to facilitate ‘Certainty’?

Democracy is another human-made concept that necessarily arose because those in Control of the ‘economics’ decided to fashion a system that would only make things more Certain for themselves, always at the expense of everyone else. Democracy adds the concepts of Inclusivity and Fairness to the initial goal of Certainty; sadly, Democracy still hasn’t quite found its place yet, even 250 years later.

Consumerism—the perfect word to describe our economic agenda—is beginning to have an effect on our host; the natural tendency of life is to go viral—to “be fruitful and multiply’—until it either oversteps its boundaries or adapts a more sustainable course of action. Thus, we must also add Sustainability to the mission statement of any future economic blueprint.

We have all been trained to navigate within this manmade economic box, and therefore can only think ‘inside the box.’ Paul himself has wondered “how much has our nation’s future been damaged by the magnetic pull of quick personal wealth, which for years has drawn many of our best and brightest young people into investment banking, at the expense of science, public service, and just about everything else?” The problem is that we have all been altered by the systems we create, because living organisms are hard-wired to adapt to whatever environment they are forced to navigate, per their will to survive. We cannot build a new box while we are stuck inside the old one. We need someone to think ‘outside the box,’ in order to fashion a better version of reality.

Economics as an Applied Science?

Physical Science has got Engineering, to apply its knowledge toward practical solutions for people. Biological Science has got Medicine, in order to do the same. Then we have Social Science, which serves no practical purpose, because its main application, economics, has chosen to serve ‘capital’ instead of people. Physicist Freeman Dyson claims “there are no prima donnas in engineering,” which may eliminate economists from being our social science ‘engineers’ by the sheer size of their egos.

We cannot blame economists for their egos, unfortunately; they, too, are the victims of their environment, and Capitalist Economics is built entirely on ego; it only utilizes science as an asset toward Control or financial gain. The truth still remains, however: our current economics is flawed; it must be fixed, preferably sooner than too late, and if social science doesn’t quickly create a ‘niche’—from which to make itself useful—it could be placed on permanent sabbatical by those in Control. It needs to exercise its best and only option, and ‘engineer’ Americans a better economic model, from which others can ‘get political.’

Every one of us holds a piece of the puzzle that contributes to this ‘big picture’ of a more Certain, Inclusive, Fair, and Sustainable society. If we left anyone out, there would be something wrong with that picture, and why would we want to exist every day in some self-imposed mediocrity? The Third Option only wishes to establish an open space where all these pieces can be assembled. Either Social Science creates its own ‘engineering’ division, and simply utilizes the ‘economics’ piece in its Unified Theory, or Economics creates its own Applied Science space to assemble the other social science pieces into an Economic Theory of Everything. In The Third Option view, the current system represents ‘Capitalism’s version of Democracy’, where liberty, freedom, equality, et al, have taken on a financial meaning. We advocate for creating ‘Democracy’s version of Capitalism,’ to ensure that economics is finally people-centered, and like Democracy, becomes a more ‘bottom-up’ approach, versus the current ‘top-down’ approach.

The Multiplier Effect

Paul’s Take

As [Arindrajit Dube] says, there’s considerable evidence that “workers at low-wage jobs [have] historically underestimated how bad their jobs are.” When something — like, say, a deadly pandemic — forces them out of their rut, they realize what they’ve been putting up with. And because they can learn from the experience of other workers, there may be a “quits multiplier” in which the decision of some workers to quit ends up inducing other workers to follow suit…[this] dovetails with one of the main discoveries of behavioral economics — namely, that people have a strong status quo bias. That is, they tend to keep doing what they were doing even when there might be much better alternatives. Famously, workers are far more likely to enroll in retirement plans when they have to check a box to opt out than when they have to check a box to opt in. Checking that box costs nothing, yet many people will fail to take advantage of a good deal unless enrollment is automatic.

NY TImes

This ‘multiplier’ effect is further evidence of the exponential force created when people ‘agglomerate’ rather than remain in isolation, although this force can either be utilized toward constructive or destructive ends. Ultimately, those seen as leaders are simply the ones who do need help in making their choice, and by doing so, empower others to do the thing they always wanted to do, but never felt they had the ‘power’ to do alone; again, sometimes this ‘empowerment’ manifests itself into doing something helpful, and sometimes not so much.

One person gets a divorce, a few others ‘follow suit’. One person quits a dead-end job, others become ‘empowered’ to do that same. One president denounces an election, others decide to storm the capitol. One never knows how others will be ‘empowered,’ but The Third Option believes that among social scientists—an alleged ‘reasoning’ (if not reasonable) group of people—if one economist speaks out for a more democratic version of economics, others would be empowered to take a look at it, also.

Sir Paul Collier talked about this effect in relation to protest, where there needs to be someone willing to throw that first rock, and when they do, there is always a second group of people teetering on that same edge, who just need a little push; they will in turn empower a third group, and so on until suddenly an Arab Spring emerges, or various Occupy Movements, Independence Movements, or other violent and non-violent protests. Until now, these waves have been suppressed, so the wave that would finally drown Oppression would have to be one hell of a wave.

Third Option Goal: Assert Power Over Our Desire to Control

Power is something generated from a single source, and this Power flows outward, and facilitates or ‘empowers’ others. Oppression is an attempt to Control that which holds Power, to serve some ‘uncontrollable’ desire. Liberty is about choice, and within an environment where Oppression is free to exist, one might choose either to Power or Control power. Democracy is an environment where one is free to exercise Power, but only exercise Control over oneself, and not others, per their Liberty to do the same. The only way to defeat Oppression is to embrace the weapon we have so far failed to wield effectively: Democracy. It is the weapon that will ultimately destroy Oppression, but it is, unfortunately, too heavy to lift unless we lift it together. Like the myth, it is wedged in a block of dense stone representing our impenetrable Ignorance.

Challenging Oppression has traditionally been a risky business, but social science has little to lose; it is already being dismantled precisely because it challenges this authority, through revealing inconvenient truths and investigating every casualty and causality.

While we remain complacent, economics continues to do its work: consume the most profitable parts of each one of us and discard the rest. Look what it has done to social science: ‘Behavioral’ economics, ‘Political’ economy, economic ‘Law; economics ultimately appropriates, assimilates, subordinates or annihilates whatever is in its path. We are born to ‘maximize our economic purpose,’ and if found palatable enough, consumed into the ‘collective;’ resistance is futile.

The whole of social science might as well ‘double down’ at this point, before it is completely consumed, and winds up no better than the media, selling capitalist propaganda in order to pay the ever-increasing rent. At this point, it’s ‘Democracy, love it or leave it’; if we abandon it, the capitalists will surely crucify it— alongside ‘Freedom’, ‘Liberty’, ‘Justice’ and ‘Equality’—and hang them all up on the front of a cheaply mass-produced t-shirt.

Or…the best and brightest of social science could take up the mantle for a science-based form of economics that the American people can either choose (if they can still remember how) or fail to choose (if it is already too late for them). If anyone in social science is willing to fashion us a big enough rock, The Third Option would be more than happy to throw it.

Michael Sandel

Michael Sandel