Calling All Economists: a union of concerned social scientists is not enough anymore; time to form a New Economic Justice League. Tryouts start today.

By Robert Simmons

We all know the story. The Earth and its people are under siege; a dark parasitic force has taken over the planet. It has attached itself to every one of us. It feeds when we feed – the more we consume, the larger it grows – and now it has grown beyond the power of any government to control. We need someone who can save us; in fact, we need several ‘someones’.

There is only one problem: Economics bought the intellectual property rights to heroes a long time ago. Now we have to slap down ten bucks just to watch imaginary ones up on a movie screen.

Table of Contents[Hide][Show]

- THE OLD SCHOOL

- THOMAS PAINE on Property Rights

- HENRY GEORGE on Georgism

- MORE VOICES OF REASON

- RICHARD THALER on Making Economics More Human

- Third Option Addendum

- PAUL KRUGMAN on Universal Healthcare

- AMARTYA SEN on Positive Freedom

- ELIZABETH ANDERSON on Democratic Equality

- THE THIRD OPTION on Step Two: Our Submission for a New Working Unified Theory of Economics

No one is allowed to fight for each other anymore. Even war heroes fight for Economics, no matter what our government marketing department says. Perhaps heroes never existed. Maybe it’s just been Economic propaganda all along, to keep the simmering masses from boiling over, or reinforce our ‘learned helplessness’. Perhaps it’s too late for humans to defeat Economics – the slow drip of Consumerism has already euthanize our collective souls.

If ever there was a time for heroes to emerge, though, this would be it. Someone to step out front and lead. Someone with a very particular set of skills – in this case, ‘economic’ skills. Unfortunately, the only economists who have any real ‘say’ right now are the ones who say just what Economics wants them to say. This, of course, makes them valuable only as an Economic ‘commodity’, bankrupt of any heroic value.

To have real value to humanity, ironically, means one cannot be bought by Economics. Unfortunately, money is the kryptonite that ultimately weakens even the best and the brightest among us. Can those who have sworn allegiance to Economics somehow join together to replace it?

We can only hope – and help prepare the way. The Third Option has put together a small but promising list of Economists who could still turn out to be our working-class heroes.

BRANKO MILANOVIC on Inequality and Family

Taking care of the elderly, of children, cooking and delivery of food, shopping, chores, dog walking and the like used to be done within households. This expansion of capitalism potentially opens up questions about the role, and even survival, of the family…we can expect, in the long term, an increase in single-member households, and in numbers of people who have never partnered or married.

Branko Milanović

Branko Milanović concedes that Capitalism is doing quite well for Itself – whether this is a good thing for people should be the more relevant question, but Capitalists are never going to ask that question, and unfortunately, those on the butt-end of the Capitalist joke have been shamed into silent acquiescence; this leaves economists like Milanović to ask these kinds of questions.

Like a prairie on fire in a high wind, Capitalism has spread, consuming everything around it in order to create MORE of Itself. This tribute to human virulence is affectionately referred to as “Economic Growth’, apparently as a way to encourage it. While World War C rages on, “the expansion of capitalism to areas traditionally not considered apt for commercialization…is in collision with strongly held beliefs. Unless it is controlled and its field of action reduced to what is used to be, it will continue this conquest of as-yet-un-commercialized spheres.”

Capitalism’s latest growth spurt is called the ‘Gig Economy’, where the wealthy, wishing more ‘me’ time, are ‘outsourcing’ what the average 20th century middle class family would refer to as their ‘lives’. Kids, Parents, Cooking, Cleaning, Shopping, Driving, Work – all these have become jobs for anyone willing to take the ‘gig’.

The financially desperate get crucial side-money (as their first two jobs are not quite enough to pay the ‘rent’), meanwhile the financially stable have no obligation to pay benefits or offer any job security. Without anyone even batting an eye, we are now one degree of separation from voluntary slavery.

In economic terms, the ‘rent-seekers’ are paying too little to the laborers in the field to make the ‘rent’ payment, so the ‘field laborer’ now has to double as the ‘house laborer’, too. The one degree of separation is the money, which is handed to the laborer, who then gives it right back to the wealthier rent-seeker. Money creates the very thin veil of our collective ignorance. As is his practice, Milanović states facts, and leaves it to others to draw conclusions. He tosses us this fact: “already in Nordic countries, between 30% and 40% of households are one person only,” attempting to alert us that family dissolution has already begun, and even though Scandinavian countries are more generous than the United States in providing welfare to single parents, nevertheless the findings of Kyrre Breivik and Dan A. Olweus (the Scandinavian Journal of Psychology, March 2006) show that throwing economic money at the problem has done nothing to assuage the negative outcomes of single family parenting.

To understand this issue, one would need a degree in economics, sociology, psychology, and history. All of these, by the way, are ‘social sciences’, but would only join forces if a ‘Capitalist’ paid them to do so. Without multi-discipline education, we cannot serve the needs of people – we can only serve Capitalism.

With commodification comes compartmentalization, euphemistically referred to as ‘specializing’, which means that you are a dedicated ‘tool’, good for only one thing – to earn a wage paid for by someone with the cold hard cash. Psychologically, people also compartmentalize their thinking, in order to avoid the ‘cognitive dissonance’ they feel from ‘knowing too much’. The average citizen has no ‘agency’ to change their situation, so to avoid poor mental health, tries to NOT think about it. Drugs, alcohol and cigarettes also help cognitive dissonance, while scoring more Economic Growth for Capitalism.

Milanović, always a voice of reason in otherwise emotionally-charged conversations, is strong on one point: Capitalism is not going to go out with a whimper. Without intervention, it will finish its intended purpose – to consume us, the planet, or Itself – and we need to decide if this is what we want, or not. And we need to decide soon.

Important Takeaways

- Milanović favors the redistribution of wealth, but also admits that the ‘tax and transfer’ system will likely never be allowed to reach early 20th century levels again (over 70% tax rate for the top earners). Instead, offering equal education, housing, and other ‘endowments’ up front could allow the concept of ‘capitalism’ to remain intact, without the inherent suffering of subservience followed by back end compensatory ‘handouts’.

- Although each country has its own divergent history, economics and politics, they all share an equal ability to generate Inequality. This speaks to some inherent human factor underlying the economics, which causes people to oppress others, no matter which way the cards are dealt.

THOMAS PIKETTY on Ideology and Redistribution

For far too long economists have sought to define themselves in terms of their supposedly scientific methods. In fact, those methods rely on an immoderate use of mathematical models, which are frequently no more than an excuse for occupying the terrain and masking the vacuity of the content.

Thomas Piketty

French Economist Thomas Piketty is trying his best to start a revolution, and his timing, really, could not be better. There are only two ingredients necessary to cook up a good revolution: a massive amount of inequality / oppression, and enough people to give a crap about that. The first ingredient is always present, and Piketty has a worldwide database and his latest book – Capital and Ideology – to prove it. The second ingredient is always much more difficult to round up.

Piketty believes this is due to the ideological rhetoric that accompanies most economic disparity, in order to create enough plausible deniability to defer retaliatory action. “The wealth will trickle down”. “The rich will give it back through philanthropy”. “Property is liberty”. “The poor are undeserving”. “Once you start redistributing wealth, you won’t know where to stop”. “Communism failed”. “The money will go to black people.” (These examples come from Piketty himself, in an interview with Simon Kuper of Wired Magazine). No doubt, this rhetoric does help ‘nudge’ the timid further into complacency, but there are many factors at work that have genetically predisposed us toward this complacency; lifetimes of Oppression have surely domesticated the masses; talk of paternalism and ‘learned helplessness’ are unfair and euphemistic at best; to call us subservient house pets is even kind. Oppressors need mules and other draft animals. We all have grown blinders in order to pull this economic load straight to market.

Emotionally, people need to feel they have personal ‘agency’ (knowledge and means) in order to make change; Piketty says the economic community “pretends to have developed a science that is so scientific, nobody else can understand [it]”. This seeming complexity does cause the average person to concede control to those elite ivy league types, who are then weened on the same steady diet of inegalitarian economics that got them into those schools; for anyone who worries that inequality might eventually recede, rest assured, inequality is ‘in the bank’.

Capitalism is the blunt tool of an inegalitarian society; no one could argue that it does not make a most excellent hammer, for anyone lucky enough to get their hands on It. Thanks to a cult-like following of ideologues and their minions, hammering on other people is all perfectly legal, and with the same reasoning people gamble in Vegas or buy lottery tickets, the big sales pitch is that you, too, can hammer on the rest of us, once the hammer gets in your hands.

People need to feel empowered, motivated, and hopeful that some path to change exists. Without these, we can only spend our days venting / complaining about inequality, with no real feeling of agency to affect change. One naysayer is a dissident, two makes it a conspiracy. 48.2% constitutes a minority. If anyone ever breaks 50%, no worries, we have ‘filibusters’ and ‘supermajorities’ standing by.

Meanwhile, Piketty’s research confirms what we already know: when we tax the rich less, top earners engage in more rent-seeking than investment; in other words, they do not make the tide rise for the rest of us, they just buy themselves bigger and bigger yachts. Who could blame them, really. Shame on us, not them. We are equally complicit in the deception, through our complacency.

Piketty’s first book, Capital in the Twenty-first Century, summed it all up in a simple equation.

r>g

“When the rate of return on capital exceeds the rate of growth of output and income…capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based.” – Thomas Piketty, Capital in the Twenty-First Century

For those holding the hammer, the rate of return on their wealth [r] is around 4 to 5%. Economic Growth [g] rarely if ever keeps up with that percentage. While the economy lags behind, and the wealthy accumulate more, this excess money can grab an even larger rate of return, widening the gap still further.

Too much energy has been and still is being wasted on pure theoretical speculation without a clear specification of the economic facts one is trying to explain or the social and political problems one is trying to resolve…Social scientists, like all intellectuals and all citizens, ought to participate in public debate…They must make choices and take stands in regard to specific institutions and policies.

Thomas Piketty, Capital in the Twenty-First Century

Piketty is part of a new generation of economists – a true social scientist, not just a paid hammer salesman. At the turn of the 20th century, people were all political economists, with knowledge of economic history, human geography, even psychology. As Capitalism divided and conquered each and every one capable of standing up to it, economics became what Piketty now refers to as merely a “sub-discipline”; it has been stripped down so far as to become useless, except as propaganda for Economic Growth, Consumerism, Free Markets, Big Business, Globalism, Wall Street – the big pigs always eat first at the Capitalist feed trough. Every so often a large War comes around, then everyone eats. As Paul Krugman notes, “The Second World War was the largest economic stimulus package in history.”

Thomas Piketty’s Wishlist

- A Global Progressive Tax on Capital: a tax on real assets (land, natural resources, houses, factories, etc.) starting at 1 percent (on a million dollars) and capping at 10 percent (on anything over a billion dollars).

- Equality in Education. Currently, “Parents income has become an almost perfect predictor of university access…not only because of the high cost of attending the most prestigious private universities…but also because admissions decisions clearly depend in significant ways on the parents’ financial capacity to make donations to the universities.”

- An even better retirement plan. “One of the most important reforms the twenty-first-century social state needs to make is to establish a unified retirement scheme based on individual accounts with equal rights for everyone, no matter how complex one’s career path.”

- A capital transfer (aka an “inheritance for all”). With a progressive tax on wealth, finance a “capital transfer to every young adult at the age of 25.” The equivalent of $134,000 per person is “about the level of medium wealth today in France or in the U.S.”

- A wealth tax of 90 percent on any assets over $1 billion.

Other Important Takeaways

- In the Depression of 1929, we let businesses and banks fail. In 2008 we did not. We used the central banks as the ‘lender of last resort’ and “saved insolvency of smaller banks.” Piketty thinks of the central banks as the “only ‘public’ institution capable of averting a total collapse of the economy and society in an emergency”. Ironically, central banks are actually not public – at least not yet.

- Socialism is seen as the ‘command’ arm of the economy, attempting to keep Capitalism from tripping over its own dick. Within our current ‘mixed’ system, the tax and transfer method is the sole tool available for redistributing financial inequality – Piketty admits social tax and transfer systems have gotten too complex, but still cannot seem to envision a system where taxation would not exceed two-thirds of national income; in a new model of economics, we will clearly need to do more with less (taxation).

- Piketty leaves the door open for new forms of economics. “There is no single variety of capitalism or organization of production in the developed world today: we live in a mixed economy…this will continue to be true in the future, no doubt more than ever: new forms of organization and ownership remain to be invented…it is perfectly possible to imagine that new decentralized and participatory forms of organization will be developed, along with innovative types of governance, so that a much larger public sector than exists today can be operated efficiently…the fact that a service is publicly financed does not mean that it is produced by people directly employed by the state or other public entities.” – Thomas Piketty

- Piketty has no qualms about taking the wealth away from Jeff Bezos, Mark Zuckerberg, or any other ‘oligarch’. Like The Third Option, Piketty points out that both men “benefited from public infrastructure, public education, decades of computer science and the invention of the internet.”

- “Educational Justice” as a term meaning to spend the “same amount on each person’s education.”

If we are to regain control of capitalism, we must bet everything on democracy.

Thomas Piketty

ROBERT REICH on Countervailing Power

Few ideas have more profoundly poisoned the minds of people than the notions of a ‘free market’ existing somewhere in the universe, into which government ‘intrudes’…a market – any market – requires that government make and enforce the rules of the game…government doesn’t ‘intrude’ on the ‘free market’. It creates the market…without them there is no market.

Robert Reich, Saving Capitalism

Economics was never meant to be a religion – or even a science – simply a management tool for allocating our natural resources. Yet here we are, attributing some bizarre cult-like anthropomorphism to the ‘Free Market’, then bowing down in worship before It. Humans have a history of deifying anything they cannot understand – including themselves. In their defense, one cannot blame humans for being stumped by unregulated economics, so we will attempt to simplify it for a moment. The Free Market is akin to a giant Human Circus. The P.T. Barnum’s of the world run the Circus and get the biggest cut. The Barkers and Con Artists get paid depending on how successful they are at relieving the ‘Suckers’ of all their hard-earned cash. Suckers are born every minute, and thus represent the largest cross section of the population. ‘Liberty’ is the ‘con’ – one has the ‘liberty’ to spend their cash any way they wish. Obviously, the con artists would prefer that no one regulate their little shell games, magic elixirs, fried Twinkie’s, and fantastical freak shows, but unfortunately, government has a sworn mission statement – slash – social contract to ‘insure’, ‘promote’ and provide’ us Suckers with some measure of equal opportunity and happiness. The con artists cry ‘Liberty’ in order to confuse the Suckers and keep the Circus running without regulation; regulation would help the Suckers, except that we are Suckers, so by definition we do not even understand our own human nature, let alone why regulations exist.

Robert Reich is one of the good guys. He is rooting for us Suckers, and his economic vision is 20/20. He can see that within this rigged system, “those at the bottom are the first to be fired, last to be hired, and most likely to bear the brunt of declining wages and benefits.” He also has run the numbers, and it is telling him that “43 percent of children born into poverty in the United States will remain in poverty for their entire lives.”

In this Darwinian version of resource allocation, it has become a steep and slippery slope in order to make it to the top of the economic summit. Robert Reich is an economic Sherpa, but even he does not believe that those on the bottom are capable of making this climb.

As income and wealth have concentrated at the top, political power has moved there as well. Money and power are inextricably linked. And with power has come influence over the market mechanism. The invisible hand of the marketplace is connected to a wealthy and muscular arm.

Robert Reich, Saving Capitalism

Reich is also a realist, and can see that a box of band-aid fixes could never cure the cancer of Economic Growth. His recommendation: The bottom 90 percent will need to join forces to form a “new Countervailing Power”; a majority who all share one commonality – we are all mysteriously short of cash. This new ‘Countervailing Power’, as a voting block devoid of political affiliations, will need to overturn the many rules that have been changed to favor the top one percent.

Political Economist Peter Barnes, another economist ‘good guy’, attests to the fact that almost all interest, dividends, capital gains and inheritances – which account for one third of income received by Americans – goes to the top one percent. In his book, With Liberty and Dividends for All, he identifies some of the ‘commons’ – resources to which all people have an equal claim, like air or water – and how these can be leveraged to give people ‘shareholder dividends’, which he calls “co-owned wealth”. Currently, the wealthy make much of their fortunes off of ‘rent-seeking’, which takes resources like property (both physical and intellectual), money (in the form of loans), and public infrastructure, and without improving them, charge the rest of us a fee to use them. Barnes rightfully suggests that we collectively ‘rent seek’ on ourselves first, and then split the profits. We will include his Wishlist below along with Reich’s.

Reich, utilizing some history and a straight-edge ruler, has plotted a course from our past through our present, and the direction is pointing toward a fairly scary future: one that contains less jobs, no middle class, and advanced technology that no one will be able to afford. Our economic mission, therefore, becomes how to allocate income so people will be able to purchase the products others create; otherwise, the economy will effectively be kaput.

Robert Reich’s Wishlist

- End corporate welfare – “including subsidies to Big Oil, Big Agribusiness, Big Pharma, Wall Street, and the Export-Import Bank”

- Establish a third major party, to organize a “new countervailing power” against the hostile takeover of the one percent.

- Once in power, the new ‘countervailing power’ should:

- Reform campaign finance and “get big money out of politics.”

- ‘Amend the Constitution to declare that Congress may regulate campaign spending”

- Shorten lengths of patents and copyright protection and ban any attempt at “pay-for-delay” agreements to extend patents because of “cosmetic changes in products or processes.”

- Use antitrust laws to break up the cable monopoly, the monopoly on the “genetic traits of our food chain”, and the financial monopoly: we can no longer allow any Wall Street bank to hold more than 5 percent of the nation’s banking assets.

- Raise minimum wage to “half the median wage.” (Equivalent to around $32,000 a year, or $15.38 an hour).

- Change Educational funding – it can no longer be based on local property taxes, which are skewed.

- Regulate corporations so they pay more to their workers or be taxed accordingly.

- Provide some sort of ‘share’ of the overall economy to every citizen, through a ‘land tax’, or maybe a small dividend from all intellectual property generated – to more widely share overall gains.

Peter Barnes Wishlist

- Through taxing common resources, create a pool of ‘co-owned wealth’ that can be turned into ‘dividends for all’. Examples:

- We cannot charge for air, but we could charge people for polluting it: slap a Carbon Tax on Industry, Transportation et al, and easily pick up a ‘clean’ $200 Billion per year.

- The financial infrastructure of Wall Street and Investment Banking is the source of much ‘legal’ profiteering and do so practically free of charge. A small financial transaction ‘user fee’ on trading stocks, bonds, and derivatives could net us another $350 billion per year. Meanwhile, banks are creating new money at a rate of $244 Billion a year; coupled with the Federal Reserves ‘quantitative easing’, this raises financial services to over $320 Billion per year.

- Intellectual Property Rights (IPRs), in the form of patents, copyrights, and trademarks, are raking in big bucks for the corporations that claim them. Like all property, without the backing of the federal government (that’s We the People), these agreements wouldn’t mean a thing. We the People can set up our own ‘protection racket’, and charge a fee to maintain these valuable IPRs, and collect up to $320 Billion per year for it.

- Radio, television, cell phones and data transmission: those airwaves are public property, but private broadcasting and telecommunications are gouging us to use it anyway. An airwave ‘usage fee’ is in order, to the tune of $418 Billion, plus another $84 Billion for those “spectrum intensive industries”.

- Private-sector pillaging of our public lands would likely piss all of us off, if we bothered to pay any attention to it. Timber, minerals, soil, livestock grazing, water – from now on, the private sector should pay us to extract public resources.

- Our publicly-funded freeways, Internet, stadiums, national parks: there are many common areas that are being utilized by private sector business; ‘we the taxpayer’ foot the bill, then pay businesses for products that come by way of this infrastructure. Watch out Amazon, Facebook, and others, we are coming for our rent money.

JOSEPH STIGLITZ on Shared Prosperity

Creating shared prosperity is not just a matter of redistribution – redistributing after-market income through taxes and transfers – though that is very important. We must also increase wages, well-being, and ultimately economic and political power for the majority of Americans…to fight inequality at the source.

Joseph Stiglitz, Re-Writing the Rules of the American Economy

Joseph Stiglitz is attempting to do what no economist has done before: be proactive. Most economists arrive after the fire, with their little publicly-funded money hose; Stiglitz at least believes in fire prevention. Shared prosperity would definitely promote the ‘general welfare’ much better than constantly putting out fires with conciliatory tax and transfer schemes. Unfortunately, ‘sharing the wealth’ is a long-term type of strategy, and financial ‘short-termism’ seems to be the only thing currently trending. The new buzzkill-word of the pyromaniacs is ‘shareholder value’, and it’s all the corporate rage.

For the record, Joseph Stiglitz is not a fan of ‘shareholder value’. He sees it as a ploy meant to serve only top management. “The shareholder revolution transformed corporations into sources of cash for financiers.” Short-term thinking has unfortunately become the new long-term strategy: “rising executive pay, increasing payouts to stockholders, frequent corporate restructuring, massive mergers, and reduced capital investment” has a youthful ‘live like there’s no tomorrow’ vibe to it, but the road does not go on forever, and the party always has to end. As Stiglitz reports, “In the four quarters before the September 2008 financial collapse, corporations spent on average 107 percent of profits buying their own shares and paying dividends.”

Good news for Capitalists, though: the government is going to pay for the party, plus cover the cost for all the stuff you broke as well. A timely tip for wealthy parents: teaching your kids that actions have consequences may feel a little oppressive for them, but will wind up being a lot less oppressive for the rest of us.

Unregulated financial markets lead toward “systematic predatory lending, fraud, and discrimination, aimed at taking advantage of lower-income borrowers.” Stiglitz feels that unless markets are made truly competitive, firms will continue raising prices without consequence. “Markets don’t exist in a ‘vacuum’; it is governments that structure markets and sets the rules and regulation under which they operate,” and until government embraces their intended role, taxpayers will have to keep footing the bill for fancy rich kid parties to which (sadly) none of us ever get invited.

Joseph Stiglitz’ Wishlist

- Apply taxation to Negative Externalities. Example: within the financial sector, tax short-term trading to discourage it, tax dividends for long-term holdings of stock, and tax rent-seeking activities to disincentivize them.

- Make all markets competitive to keep prices fair. Example: allow U.S. to shop outside America for their healthcare drugs – to “buy American” only creates a monopoly effect and allows our own people to gouge us. The veteran’s health care program is allowed to shop around for its prescription drugs; this is one of the reasons why the cost of military healthcare is more reasonable.

- “Provide affordable and quality public education, health care, childcare, financial services, and retirement security” (aka ‘fire-proof’ the house a little). Examples:

- Legislate paid family leave, Subsidize childcare, and provide across-the-board access to reproductive health services for all women. Invest in children through Early Childhood Home Visiting Programs and Pre-K, for example.

- Provide banking services (through post offices) so no one has to utilize check-cashing services or predatory short-term ‘payday’ loans.

- Create ‘universal healthcare’.

- Create a public option for housing “Rather than trying to nudge the private mortgage system with federal backstops, subsidies, and implicit bailout guarantees, lawmakers should create an explicitly public mechanism in the housing market.”

- Boost social security: government could ‘match funds for lowest rung of contributors.

- Allow a path to citizenship for immigrants.

- Base student loan repayment on a percentage of future income.

- Reform criminal justice (if only to lessen the amount incarcerated).

- Raise minimum wage and raise income threshold for mandatory overtime (when people are paid a ‘salary’, they are not allowed overtime; they are often forced to work well over 40 hours a week. The current threshold is $684 a week to be a ‘salaried’ employee, or $35,568 a year.

- Tax all forms of income at the same rate (income tax, capital gains, and dividends); tax short term capital gains even more and eliminate ‘stepping up’ someone’s base of wealth at death, designed to allow transfer of wealth to heirs, with no capital gains to be paid. Do the same for corporate profit globally, so corporations can stay here or go abroad, but there is no tax break incentive either way.

- Eliminate welfare for the rich (Big Oil, Big Agribusiness, Big Pharma, plus perks like non-competitive bidding for federal land natural resources, and ‘sole’ source contracting of military equipment (see Halliburton contract).

- Re-do national infrastructure to create jobs and use a Public Infrastructure Bank to finance it.

- Eliminate offshore banking.

- Allow no tax deductions on second and third homes, etc.

- Rein in the Federal Reserve, which is skewed toward larger financial interests and not to the mass of people.

- Bar imports of products that use child or prison labor, or wood procured from endangered forests, etc.

Other Important Takeaways

- Incentives could also be devised to encourage long-term loyalty, not just short-term profit-seeking.

- Securing Intellectual Property Rights (IPRs), through patents, is a way of limiting competition; within the healthcare industry, for instance, corporations have even been able to extend these patents in order to monopolize the market on innovations. Thus, IPRs do not improve innovation. (BTW innovation that is profit-driven is usually harmful; innovation based on human need happens without financial incentives, usually through the ‘command’ economy – aka government.)

- Trade agreements have also been used to extend patents, “making it more difficult for generic medicines to enter the market”.

- “There is no evidence that a lower tax rate for the wealthy has encouraged investment or growth.”

THE OLD SCHOOL

Human Existence is a one-way street because of Time; this is why all things eventually evolve, (or accumulate). Human knowledge is no exception. Our contemporary Economic Justice League owes much of their thinking to the intellectual groundwork laid by those who came before. Because early economics came coupled with politics, history, human geography and psychology attached, it allowed earlier economists to see the world with greater depth – though unfortunately with what Piketty calls “very thin data”. Their ideas, nevertheless, are worthy of mention.

KARL POLANYI on Land, Labor, and Money

Karl Polanyi argues that creating a fully-regulating market economy requires that human beings and the natural environment be turned into pure commodities, which assures the destruction of both.

Joseph Stiglitz, foreword to The Great Transformation by Karl Polanyi

Karl Polanyi basically referred to the dream of a true Free Market society as ‘a Utopian fiction’. Because it subordinates people into being commodities, and commodities continually get consumed in the Free Market model, people would eventually be forced to resist their own consumption in order to escape extinction. Similarly, they would resist the extinction of the planet for the same reason. The Free Market is an invention of Oppressors. As humans evolve, and (very) slowly realize that oppression sucks, Oppressors have been forced to make concessions. The arc of Oppression is long, but it bends toward unions, democracy, cooperatives, and the like. Oppressors are greedy bastards, though, and like cockroaches, never die – they just wait in the shadows until the light of human vigilance dims, even momentarily. Currently, each of us is given a small taste of the ‘Oppressor Version’ of happiness, in exchange for our commodification. As Pablo Freire and others have come to see, “The oppressed, instead of striving for liberation, tend themselves to become oppressors…[they] want at any cost to resemble the oppressors.”

As professor Robert Kuttner at the American Prospect points out, “The mainstream of [economics] has largely stopped teaching the history of economic ideas. Nor do most economists today study the relationship of economics to politics and social history.”

Polanyi represents a rarity as he expanded his expertise across several academic disciplines in order to speak outside the ‘box’ market-based economics had fashioned for itself – a self-absorbed realm that forbade self-criticism. Although a professor at Columbia University, he ultimately had to leave America for Canada, because his wife had communist ties, which by association allegedly made his politics and economic ideas dangerous to our sensitive American ears. Of course, the only people who fear the truth are those living a lie.

Kuttner also points out how Polanyi, who sided with democracy, has ultimately beat out the free-market liberals who actually contended that “popular democracy was a danger to capitalism”. The capitalist economists have had no problem getting political, predicting democratic intrusion in the free market would lead to some eventual form of totalitarianism, which it has not done once; meanwhile, those countries who embraced free market excesses have ruined several democracies. In every case, free market economics won out because it was “more useful to the ruling class.”

As the economic historian Karl Polanyi recognized, those who argue for ‘less government’ are really arguing for a different government – often one that favors them or their patrons.

Robert Reich

Polanyi did not believe ethics should be separated from economics, which it surely must be in order to run things through a market economy. Polanyi also believed that some things were not meant to be bought and sold. Labor is simply human activity, and land is subdivided nature, and because money has to be regulated in order to control inflation and deflation, it is a “fictitious commodity” as well. The objectification of people and nature in order to fit into a market system is amoral at best. Because these ‘fictitious commodities’ of land, human labor and money are not really under the control of the market, government must ‘regulate’ them. Education, welfare (unemployment of all kinds), and property management become a ‘thing’. Immigration flows become a ‘thing’. Fluctuations in farming output and pricing becomes a ‘thing’. The “dream’ that the economy can run outside the confines of the state is unrealizable; this is why Polanyi reasons that only within the context of the nation-state can market economics exist.

Polanyi’s hope was that democracy would be established prior to economics in the ‘third world’, and economics be allowed to unfold within this more human-centered paradigm. In reality, globalism came knocking first, and got a foot in the door before democracy had a chance to enter.

Every American should take a moment to dig into our sordid past, and they will find too many instances where our own government thwarted Democracy within nearly every third-world country, in order that We the People could nab their resources before they could secure rightful ownership of them; in this oppressive way, we used Democracy as a Trojan horse to let Globalism through their gates. Democracy is supposed to be about an ‘even playing field’. Capitalism does not want an even playing field. According to Polanyi, Capitalism (and Globalism) wouldn’t be able to survive on an even playing field.

Important Takeaways

- Because Free Market Economics can only be held up by a nation-state (government) in order to function, yet purports the exact opposite, the entire system is thus built on a lie.

- Free market economics is opposed to democracy, because it interferes with the domination of a privileged few; anyone who says different is either ignorant of this fact, or a liar.

- Human labor, money, and land are not meant to be commodified, and this is why government must regulate them, or else the free market would collapse.

- There is no way to navigate toward a better version of society without people beginning to embrace ‘interdisciplinary’ research, study, and philosophy. As New Scientist points out, “The challenges we face are not solvable by people remaining in their single discipline silos”.

- All Economies are ‘embedded’ within their respective societies, intertwined with social relations and institutions; this is vital, “so that the market does not destroy other aspects of human life”.

Many economists are disciples of Karl Polanyi, especially those who support the injection of humanism into the soulless vacuity that is economics. Economic Sociology is an early attempt to join clearly interlocking disciplines in order to answer relevant questions about why people and free market economics do not mix. Mark Granovetter utilized Polanyi’s theory of ‘embedded-ness’ in his 1985 work “Economic Action and Social Structure: The Problem of Embeddedness“, which attempts to bring economics back to its roots in the social sciences, where it has drifted away, toward some utilitarian fiction about an irrational self-interested ‘Homo Economicus’. Granovetter has also published a book called Society and Economy (2017) that is required reading for our next generation of economic super heroes.

THOMAS PAINE on Property Rights

The most affluent and the most miserable of the human race are to be found in the countries that are called civilized.

Thomas Paine, Agrarian Justice

At America’s beginning – when “the insolence of oppression” was “too long established”, and the rights of man were “a new study in this world”, educated men like Thomas Paine knew that there was a difference between the property men created (whether physically or intellectually), and the ‘natural property’ that was already here when we arrived. Paine conceded that equality could not be gained in what men created for themselves, but certainly could be found among the ‘common ground’ of earth and all its resources.

Paine imagined that the Native American had already established a balanced or ‘median’ form of existence, and in our attempt to install ‘civilization’, we had introduced the wretchedness of poverty in order for a few of us to live above this median, in relative wealth. Civilization has always been about making the many suffer for the good of a few, and to this end, the fair-minded among us have sought to ease some of this suffering through redistribution.

Once people turned the resources of the Earth into products – ‘improvement’ of the land – people had a right to it under ‘individual property’, but the natural property utilized in this process was in fact ‘common property’. Paine reasoned that private property was a human contrivance, necessary at the time, in order to maintain agriculture, but a mistake was made when individuals believed they needed to control or hoard the natural property in order to secure the individual, or ‘acquired’ property. His solution was that a tax on this appropriated land would be a form of compensation, or “just indemnity”, for what was usurped from “the commons”.

HENRY GEORGE on Georgism

No person, I think, ever saw a herd of buffalo, of which a few were fat and the great majority lean…Man is the only animal whose desires increase as they are fed; the only animal that is never satisfied.

Henry George

Before politics got a divorce from economics in the early twentieth century, there was Henry George. A political economist who subliminally channeled Thomas Paine, George believed people should own the value of what they produce, but whatever rested on or underneath the land should belong equally to all members of a society. His most popular work, Progress and Poverty, introduced a land value tax as a way to balance the gap between progress and poverty. To that end, George felt that natural resources should be under public ownership; this goes to the idea that basic (or survival) needs are the property of the ‘commons.’

Poverty is the openmouthed relentless hell which yawns beneath civilized society.

Henry George

The man who gives me employment, which I must have or [otherwise] suffer – that man is my master; let me call him what I will.

Henry George

The equal right of all men to the use of land is as clear as their equal right to breathe the air – it is a right proclaimed by the fact of their existence.

Henry George

MORE VOICES OF REASON

SIR PAUL COLLIER on Inclusivity and ‘Reciprocal Obligations’

States that link ethical purpose to good ideas have achieved miracles.

Sir Paul Collier, The Future of Capitalism

Paul Collier blames our current political divide on issues of belonging and esteem, as well as a lopsided system of higher education. With wealth, the opportunity for higher education is more available, and through this, higher-skilled jobs. Predictably, those with higher-skilled jobs naturally begin to draw more self-esteem from their economic success, and less and less from collective ‘national pride’. Those with less means (leading to less education and inevitably, less skilled jobs) are more likely to unify around a sense of pride in their country, even to the point of deriving their ‘sense of identity’ from it. Belongingness is so essential to human nature, we will scarcely leave our tribes for fear of isolation, shunning, shaming, and the potential loss of esteem. In this way, our current divide can be seen as yet another negative externality of the wealth inequality caused by our economic system. Collier is way ahead of all of us. While we are trying to see land, money and labor as ‘commons’, Sir Paul is already seeing that ‘human rights’, like property rights, do not really exist, either.

He has cleverly started a campaign to rephrase rights as ‘reciprocal obligations’, or mutual commitments we are bound to confer upon each other (if we hope to also procure them for ourselves). Let us reason this a step further, and we will get to the crux of all that matters: for better or worse, richer or poorer, we are inexorably tied to each other for all Time. Our economics can make us ‘interdependent’ individuals, but we will never be completely ‘independent’ of each other. The sooner we realize this – and confer the gifts we desire onto all those around us (until every citizen of the earth is included) – the sooner our self-induced suffering will end.

Paul Collier’s Wishlist

- In a nod to Henry George, impose a National tax on Landlords of densely populated urban land, to retain some of the gains of ‘agglomeration’ (rent-seeking by bumping up housing costs), that mostly accrue to landlords. All the gains from agglomeration are generated by interactions between masses of people, and so are a collective achievement that should benefit everyone. (Economists call it a ‘public good’.) Landlords did nothing to affect this agglomeration, yet reap all the rewards from increased production within cities.

- Meanwhile, impose a local tax on areas that are more affluent, as they are taking more of this income than others. Then redistribute it to the people of these urban areas.

- Repair lower-income cities through local ‘development banks’, to spur jobs, and grow communities.

- Provide high-quality technical vocational education and training (TVET) inserted into the curriculum of major universities; the training must be linked to a future job in some specific firm. Make sure the training is thorough enough to encompass all the broader skills necessary to become useful to a firm.

- Create some universal way to secure retirement for everyone, regardless of how much they were able to contribute themselves.

RICHARD THALER on Making Economics More Human

The Reflective System (our rational mind) can be nicer as well as smarter than our Automatic System (non-thinking intuitive mind). Sometimes it’s even smart to be nice. We think that Humans would be better off if they gave a boost to what Abraham Lincoln called “the better angels of our nature.

Richard Thaler, Nudge

In his book Nudge – a collaboration with Cass Sunstein – Richard Thaler advocates for a new movement he humorously labels ‘Libertarian Paternalism’, where ‘choice architects’ (in charge of design) present options to consumers in such a way that it might ‘nudge’ them toward greater health, wealth, or happiness. As it turns out, whether you think about presentation or not, you are nudging people subconsciously in some direction, so in this new age of using one’s ‘noggin’, we all might as well decide that ‘yes’, we would like our kids to eat an occasional carrot, and ‘no’, we prefer men not pee all over the floor, because they care not where they aim.

Of course, it is difficult to partake in this kind of humanistic economics when trying to sell someone artificial food or a handgun; the only hope is that future ‘behavioral economics’ will not be about manipulating our behavior toward poor-but-profitable choices, but instead will attempt to ‘nudge’ us toward choices that are healthy for people and planet. Baby steps, apparently, are what humans are doomed to take toward whatever Destiny awaits us; we can only hope that the door to extinction doesn’t hit us where the good Lord split us, because we ‘nudge’ along just a little too slowly.

Third Option Addendum

People only appear to have limited rationality and a lack of self-control; this is brought on by the overall feeling that we do not have control of our lives (‘agency’), or our destiny (‘hope’). Feelings of isolation (of being seen as ‘less than’ by those immediately around us) conflict with our need to belong and erode our self-esteem. At this point, we are bound to make poor choices for ourselves, because we feel we deserve them (shame). We are, in essence, punishing ourselves, after first being habitually punished by society. In order to care about losing something, people first have to feel they have something to lose. If we truly want people to be happy and healthy, we need to supply them with a little mental health and happiness first, so they have something of actual value to protect.

PAUL KRUGMAN on Universal Healthcare

The U.S. healthcare system is wildly inefficient. Americans tend to believe that we have the best health care system in the world…But it isn’t true. We spend far more per person on health care than any other country – 75 percent more than Canada or France – yet rank near the bottom among industrial countries in indicators from life expectancy to infant mortality.

Paul Krugman

Because the hierarchical structure of an aristocracy is a forced arrangement, an ‘Army’ becomes absolutely necessary to keep it in place. This is why, throughout history, the loyalty of military personnel, through various ‘spoils’ or perks, becomes the aristocracy’s top priority. This is why, even today, the U.S. military receives a complete ‘basic needs’ package, which includes affordable food, housing, education, employment, transportation – and healthcare.

The secret of its success is the fact that it’s a universal, integrated system. Because it covers all veterans, the system doesn’t need to employ legions of administrative staff to check patients’ coverage and demand payment from their insurance companies. Because it covers all aspect of medical care, it has been able to take the lead in electronic record-keeping and other innovations that reduce costs, ensure effective treatment, and help prevent medical errors.” Furthermore, the V.H.A. employs preventive medicine, “bargains hard with medical suppliers, and pays far less for drugs than most private insurers.

Krugman sees granting Universal Healthcare as an ‘open and shut’ case. “The only things standing in the way of universal health care are the fear-mongering and influence-buying of interest groups. If we can’t overcome those forces here, there’s not much hope for America’s future.”

DAVID HARVEY on Use Value versus Exchange Value

The question of what kind of city we want to be cannot be divorced from the question of what kind of people we want to be, what kinds of social relations we seek, what relations to nature we cherish, what style of life we desire, what aesthetic values we hold.

David Harvey, Rebel Cities

David Harvey believes that free market economics is rife with contradictions, some of them foundational. One such foundational contradiction is that Money, originally a fictitious measure of value, in order to ‘exchange’ various goods in the marketplace, now has its own ‘use value’, meaning it has become a commodity, like any product in the market, to be bought and sold. The fact that most of us think this is ‘normal’ speaks to how much we have normalized our own commodification.

As Harvey points out, in Seventeen Contradictions and the End of Capitalism, the emergence of “speculative fictitious capital” has ‘underpinned the immense increases in social inequality and the distribution of wealth and power such that an emerging oligarchy – the infamous…(0.1 percent) – now effectively controls all the levers of global wealth and power.” Money has become a ‘resource’ in and of itself, and because it is a figment of our own imagination, it has conveniently been deemed an infinite resource by those at the top, much to the unimaginable suffering of those real people on the bottom of the economic pile.

Harvey, like Karl Marx, does not choose to believe that humans are genetically greedy, but for at least one percent of us, the evidence is overwhelmingly stacked against that assertion. Money, once merely a measure – like weight or length – in order to facilitate a fair exchange of goods, has literally taken on a life of its own, and disturbingly, Harvey does not see a positive end in sight.

Capitalism will never fall on its own. It will have to be pushed. The accumulation of capital will never cease. It will have to be stopped. The capitalist class will never willingly surrender its power. It will have to be dispossessed…it will obviously take a strong political movement and a lot of individual commitment to undertake such a task.

David Harvey, The Enigma of Capital

If Money had a ‘shelf life’, similar to the products it helps us procure, the ‘need for greed’ hoarding of capital could be potentially eradicated and replaced with a ‘use it or lose it’ philosophy. Whether this would solve all our problems – or just create new ones – is unclear. One thing is certain: people will always produce things of utility – like shelter, food, transportation, communication, healthcare, education, and energy sources – even without Money in the equation. It is naive to think, however, that the discontinuation of Money would somehow eliminate the Oppression that always seems to circle and hover so zealously nearby. Economies are inevitable, as is Oppression; that the two always meet up is also apparently inevitable. What a bitch, though.

David Harvey’s Wishlist

- Create a means of exchange that allows for the circulation of goods and services, but limits or excludes the capacity of private individuals to accumulate money as a form of social power.

- Land and Knowledge need to be managed and protected as our most important ‘commons’, not to be hoarded.

- Social (external) control by private persons should be seen as a pathological deviancy, and barred by economic and social means, as well as generally frowned upon within the general population.

- Communities have the facility to assess and communicate their needs to each other, which can furnish the basis for all logistical decisions (see communication infrastructure theory).

- New technologies should lighten the work load, and allow more time for activities, while diminishing our ecological footprint.

- People should help to police their own communities.

- Every one is entitled to “education, health care, housing, food security, basic goods and open access to transportation, to ensure the material basis for freedom from want and for freedom of action and movement”.

- Production needs to pay more attention to protection of ecosystems, recycling of nutrients, and general regard for maintaining the beauty of nature.

JAMES HECKMAN on Education

The accident of birth is a principle source of inequality in America today. American society is dividing into skilled and unskilled, and the roots of this division lie in early childhood experiences. Kids born into disadvantaged environment are at much greater risk of being unskilled, having low lifetime earnings, and facing a range of personal and social troubles, including poor health, teen pregnancy, and crime. While we celebrate equality of opportunity, we live in a society in which birth is becoming fate.

James J. Heckman, Giving Kids A Fair Chance

In his book Giving Kids a Fair Chance, James Heckman applies his economic number-crunching chops toward solving the ‘human equation’, and the numbers point to a growing polarization in American society based on educational skill level.

Digging further, Heckman sees that the non-cognitive factors of physical, mental, and socio-emotional health are what drive human self-confidence, motivation, attentiveness, and perseverance.

Peeling back the next layer, Heckman learns that early socio-emotional skill development “depends on the family environment…but family environment in the United States has deteriorated over the past 40 years.” This leads him to the obvious conclusion: public policy needs to focus its attention on early childhood interventions – not later ones, and certainly not after they have already entered the school-to-prison pipeline.

“The effects of adverse childhood experiences (ACE) – abuse and neglect, as well as domestic violence – correlate with poor adult health, high medical care costs, increased depression and suicide rates, alcoholism, drug use, poor job performance and social function, disability, and impaired performance of subsequent generations.” Regardless of who does the research, the conclusion is the same: “severely neglected young children often have persisting cognitive, socio-emotional, and health problems.” – James Heckman

Heckman’s conclusion is that ‘pre-distribution’ beats out ‘re-distribution’, meaning that giving kids something positive up front increases social mobility and inclusivity much more than handing them a welfare check at some point in time, once the damage has already been done.

We can better ‘promote the general welfare’ by mitigating the unfair disadvantages that come from unfavorable early conditions.

James Heckman

Important Takeaways

- Cognitive ability and non-cognitive skills (mental emotional health) go hand in hand – they rise and fall together; emotional health leads to increased effort toward cognitive ability. This places emotional health over cognitive skill development. Without the early emotional foundation, skill development will not proceed. We must bet the farm on this.

- “Roughly 65 percent of blacks and Hispanics now leave school without a high school diploma.” This fact gets covered up by excluding incarcerated kids from the head count, meanwhile including any GED diplomas they might earn while incarcerate.

- Further: “GEDs’ earning power is similar to that of non-GED dropouts in the U.S. labor market. Including the GEDs in official graduation rates thus conceals major problems in American society…the GED does not reduce recidivism…when we take the GEDs out of the graduating group …the result is that the high school dropout rate has increased.”

AMARTYA SEN on Positive Freedom

In-egalitarianism asserted the justice or necessity of basing social order on a hierarchy of human beings, ranked according to intrinsic worth. Inequality referred not so much to distributions of goods as to relations between superior and inferior persons. Those of superior rank were thought entitled to inflict violence on inferiors, to exclude or segregate them from social life, to treat them with contempt, to force them to obey, work without reciprocation, and abandon their own cultures. These are what Iris Young has identified as the faces of oppression: marginalization, status hierarchy, domination, exploitation, and cultural imperialism. Such unequal social relations generate, and were thought to justify, inequalities in the distribution of freedoms, resources, and welfare. This is the core of inegalitarian ideologies of racism, sexism, nationalism, caste, class and eugenics.

Amartya Sen, Commodities and Capabilities

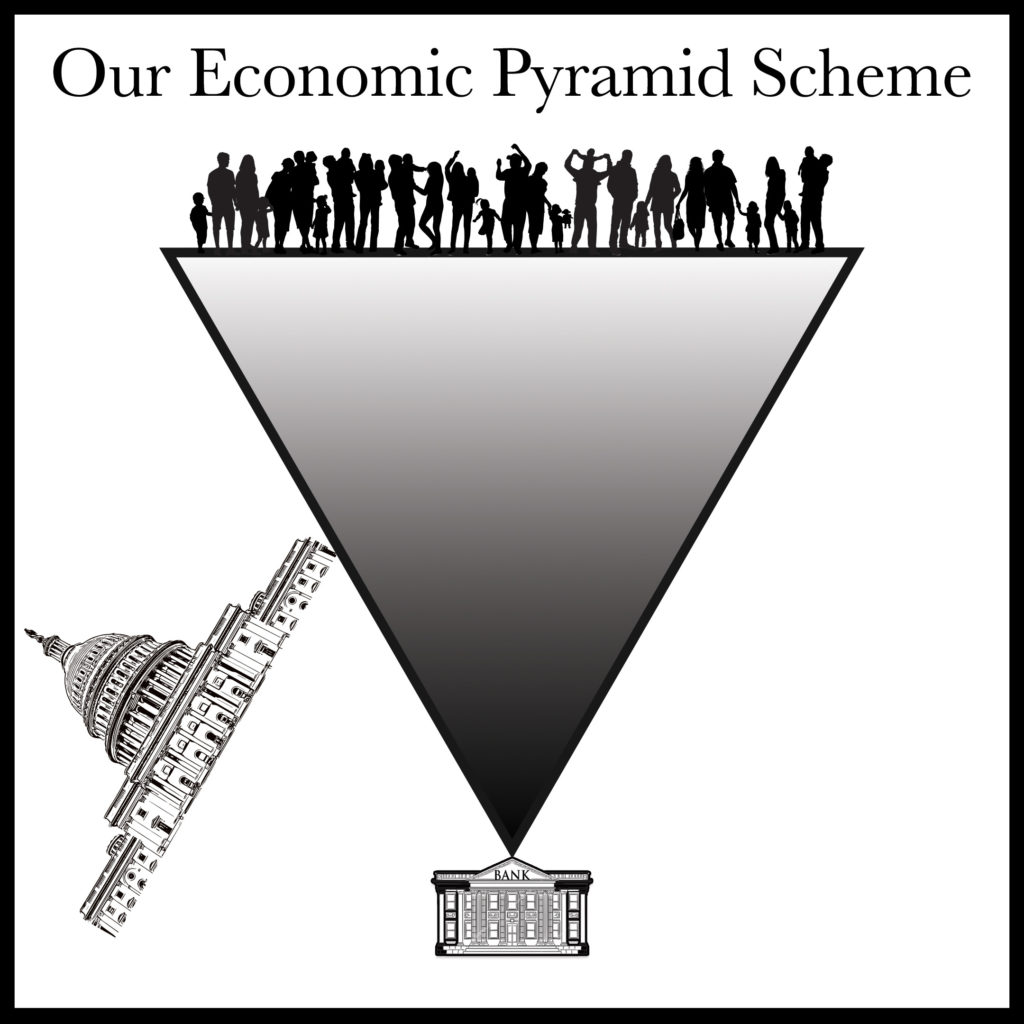

Systems, such as Government or Economics, have a physical structure to them, not unlike a building. As with any foundation or framework, the structural integrity can never truly be known until extreme conditions are present. When Bengal Province suffered millions of preventable deaths during a time of food scarcity in 1943, Amartya Kumar Sen (only 9 years old at the time) became moved to understand how his country’s Economic infrastructure failed its people so badly. What he found proved to be the flaw in all western Economic Theory.

Economics, as a system, is upside down, and this is why it is unstable. Like a pyramid balancing on its tip, the elite few become the structure’s foundation, with the masses hovering precariously above. One might argue that the mass of people are the foundation, but if this were the case, we as a society would be more concerned with maintaining the structural integrity of this foundation (e.g. ensuring the mass of people are happy, well-fed, educated, and healthy), in order that the overall structure holds together. Of course, the opposite is true. When the structure collapses, as it does anytime there is the least bit of a nudge (housing bubbles, viruses, droughts, natural disasters, et al), the elite (along with their banks and all their investments) are the ones who ‘land on their feet’. These are the ones who are considered most worth protecting. We do not call our system LowerClassism, we call it Capitalism. Not only are the privileged few secured a sound base, they are sheltered in such a way that none of the masses will land on them when the whole thing collapses, as it has done far too often.

In Commodities and Capabilities, Sen begins to build a more upright foundation for ‘egalitarian’ economics, starting with a new definition of freedom: positive freedom – the antithesis of the freedom that drives ‘inegalitarian’ economics.Life, he reasons, is made up of a constant array of “beings and doings” – for instance, one might ‘be’ starving and choose to ‘do’ some eating. The building blocks of ‘being and doings’ combine to form various human ‘Capabilities’, which are the challenges we individually choose to undertake within our lifetimes (Abraham Maslow, in defining various levels of human motivation, would likely place ‘capabilities’ under our desire for ‘growth’). From this we can derive a new definition of ‘agency‘, which refers to our ability to freely pursue what we value: the ‘functionings’ and ‘capabilities’ that constitute true (or ‘positive’) freedom of choice.

Inegalitarian economics focuses only on negative freedom, believing freedom could be adequately resolved by mere ‘non-interference’. In other words, inegalitarian economics would assert that all of us are ‘free to eat’, while feeling no obligation to ensure we had the ‘means’ available to eat. From the point-of-view of Economics, one may starve to death and still be ‘free’. Sen does not agree.

Understand, in all the cases of starvation occurring in India, food was actually present and available – it just wasn’t ‘made available’ to those in most need of it. In America, we have a strong government presence in place, always ready as a backstop, to cover for our economic structure, which is completely devoid of accountability. Without government propping up our economics, we too would feel the complete instability economics provides. Witness the recent loss of 600,000 Americans during the Covid pandemic. While we may chastise government for this particular failure, Americans know that government did a hell of a lot during this time period. What always seems to get a pass is how badly economics performed. Our economics – minus constant government intervention – is somewhere between completely unreliable and useless as an actual foundation for human existence. The elite happily hold the means for themselves not to starve, but why, in God’s creation, would we allow them to hold the means for the rest of us not to starve?

Long ago, oppressive types usurped authority over the many, and fashioned government and economics to serve only their interests. This bias is still in place, woven into government and economics, genetics and tradition, and it will take a concerted effort to dislodge it, and finally tip this system over onto its rightful foundation. Redefining freedom in a more positive way, as well as redefining justice as ‘fairness’, are steps toward a theory of Economics that is no longer at odds with Democracy. To achieve true Economic Democracy, a new way of thinking is needed – perhaps we should call it Democratic Equality.

ELIZABETH ANDERSON on Democratic Equality

Recent egalitarian writing has come to be dominated by the view that the fundamental aim of equality is to compensate people for underserved bad luck…[but] the proper negative aim of egalitarian justice is not to eliminate the impact of brute luck from human affairs, but to end oppression, which by definition is socially imposed. Its proper positive aim is not to ensure that everyone gets what they morally deserve, but to create a community in which people stand in relations of equality to others.

Elizabeth Anderson, ‘What is the Point of Equality‘

Finding the current economics “ethically barren”, Elizabeth Anderson set about re-connecting it to its social science roots. Step two has been to apply this interdisciplinary comprehension toward a democratic theory of justice and equality.

Anderson sees “Democratic equality” as “the construction of a community of equals.” It is a “relational theory of equality; it views equality as a social relationship.” To use Paul Collier’s term, Anderson feels two people are equal when they mutually confer ‘reciprocal obligations’ upon each other. What galls her (and should worry her) is how the hostage-terrorist syndrome of oppression has turned egalitarians into the oppressors they despise; by seeking equality through the redistribution of goods, they have inadvertently acquiesced to their own commodification. They have presupposed a hierarchy of lucky and unlucky people, when in truth people only feel unlucky once you point it out to them through a demeaning exercise in ‘distributive justice’.

“Luck egalitarians thus view the welfare state as a giant insurance company that insures its citizens against all forms of bad brute luck. Taxes for redistributive purposes are the moral equivalent of insurance premiums against bad luck. Welfare payments compensate people against losses traceable to bad brute luck, just like insurance policies do.”

Anderson comes down hard on so-called ‘distributive justice’, which basically claims that the ‘lucky’ need to “transfer some or all of their gains due to luck [onto] the unlucky”. They misuse the philosophy of John Rawls in order to make this claim. Acceptance, Belonging, Intimacy – these are the commodities people actually seek from others. They cannot be purchased, or even stolen – they must be given freely. Economics cannot deliver these products, and in fact, often keeps us from these exchanges through the isolating effects of wealth accumulation. Just like distributive justice, economics itself represents those ‘lovely parting gifts’ one receives after losing at the game of Belonging.

Democratic equality is a way to guarantee each of us as many ‘capabilities’ as we can cram into our lifetimes, in order to function as a “free and equal citizen”, and to avoid in-egalitarian Oppression. However, “Egalitarians must face up to the need to uphold personal responsibility, if only to avoid bankrupting the state.” Anderson sums up this point by noting that “being a poor card player does not make one oppressed,” and would surely advocate for gambler’s to cover their own losses, even if they do their gambling on Wall Street. This speaks to taxation as a pragmatic necessity, not utilized to compensate people for ‘bad luck’, but to financially cover their poor choices. The Third Option’s model for Universal Healthcare, for example, procures most of its funding from ‘Health Taxes’ that utilize this basic concept. Guns, for instance, should carry a tax to cover the amount of financial health damage they cause; the same for alcohol, tobacco, beef, junk food, cars (six million accidents per year), gasoline – every purchase with clear health consequences should have a small ‘risk insurance fee’ placed on it – the truest kind of ‘health insurance’ – in order to cover the predicable health cost associated with it. Pragmatism is not paternalism. People would still be free to kill themselves in a slow and inefficient manner; with this form of taxation, however, the rest of us would also be free from any financial obligation associated with their choice to do this.

The ECONOMIC JUSTICE LEAGUE Game Plan

The vehicle of Economics rolls on, but We the People are not inside of it. We are the ones out in front – the working animals that tow our Economics forward – while the elite sip tea in the carriage. How much longer will humanity allow themselves to be ruled by the things they create? In the current socio-economic arrangement, those on the bottom are forced to continually battle the elite for every financial inch of ground they can secure, toward some relative – but never true – equality. During the changing of the generational guard, whatever compensatory ground the previous era may have captured gets walked back. This is inevitable within the upside-down Economic paradigm we have created, where inequality is the actual goal. Look at how it has divided us. Witness our children, as they voluntarily commodify themselves in the social media marketplace. Soon we will all struggle to separate our true selves from our economic avatars, and then, resistance will truly be futile.

Step one must be for us to ‘level up’ intellectually. Recombine all the social sciences into one interdisciplinary study, then make ‘economics’ the equivalent of ‘engineering’ – the field that utilizes this new interdisciplinary knowledge, in order to build the economic ‘structures’ that best serve people. Unless we restructure our educational process in this way, economics will remain the toxic tool of those at the top of our inegalitarian pyramid scheme.

Let the natural sciences study what they will; as ‘social scientists’, we must begin to do our research introspectively: to dig down to the root of ourselves. The mistake social science makes is to leave the only person they actually know out of their research, which automatically makes it incomplete and uselessly shallow. Once we use the tools that social science provides, and dig down to the root of ourselves, we will find that each of us is connected to that same root. This is our true ‘original position’. With this perspective, we will be able to better see how each of us has quite logically grown in different directions, which will 1) enhance our empathy, that 2) leads us to proactively alter our socioeconomics, in order to promote the healthy growth of all people.

Step two is to form a unified theory of Economics, where Economists, like those above, must set forth complete theories, subject to scrutiny by the entire economics community, to weed out all the nonsense. All conjectures that, through the data, clearly show correlation to known negative externalities, can no longer be accepted within an ultimate economic ‘theory of everything’, and must be shelved. This is where economics can join with the other union of concerned scientists, and grow their collective voice further, as our social selves must start making economic choices that utilize the science now at our disposal. Science must chart our future path forward, not Economic Growth. Someday soon, A.I. will likely allow us to feed all data into an ‘Interdisciplinary Supercomputer’ and spit out the answers we seek, but for now, we have to network our own heads together. Belongingness has always been the solution to clear every new hurdle in this human race so far. We must continue to play to our strengths if we hope to remain in the contest. Whatever awaits us down the road is assuredly beyond our current capacity to manage. We must continue to ‘level up’ to have a puncher’s chance of surviving it.

Step three is to turn Economists into leaders, not simply mentors, advisors, researchers, and the like. Already, political candidates from A.O.C. to Andrew Yang are attempting to lead us, but they need to step back for a moment, and wait for this ‘New Economics’ to get its shit together, so they can be the spokespeople for this newer better path forward, that the mass of people will buy into, because science, through leading by example, is going to teach all of us how to ‘get along’. At that point, many more economists need to jump into the political arena, vowing to also work together. Many of the economists mentioned above have already been mentoring us to get political about our economics, but they need to step down from this comfortable perch and get in the actual fight, where they really belong, and can do the most good. Any economist passionate about economics has surely picked up a history book and knows that politics and economics must integrate: ‘separate but equal’ is the strategy of Oppression.

If we are trying to run a human circus, it makes sense to put clowns in charge, but this is not what any of us truly wants – it is only what we have settled for. Einstein most understandably regretted his scientific contribution winding up as an atomic bomb dropped on innocent civilians. Science can no longer be passive, and thus ultimately wind up the tool of Oppressors. It must step out from the safety of its silo and lead us toward the truths it has painstakingly tasked itself to uncover.

THE THIRD OPTION on Step Two: Our Submission for a New Working Unified Theory of Economics

As stated previously, Economics is upside down. By simply placing People ahead of Profits in our Economic paradigm, we would eradicate many of the negative externalities of the current model, while losing none of the positive benefits it creates. The biggest obstacle is how to remove Oppression from the equation, then permanently lock that door.

Economic Growth, as it stands now, is a measure of how much we consume the Earth annually – in many ways, a measure of our parasitic relationship to it. Debt is the measure of how much MORE we consume than we are able to pay back, although this number is misleading. In order for us to go into Debt, there must have been something ‘consumed’. This shows that Effort, or work, had already been exerted, though (apparently) not adequately compensated. In an egalitarian sense, Debt mirrors Profit, and thus measures the amount Capitalists skim off the top of our Effort. Seen this way, Profit does not allow the worker adequate purchasing power, thus sending many laborers into Debt.

In Capitalist-speak, of course, there is no word to describe the inability of workers to reap as much as they sow – this would tip off the overall ‘grift’. The term ‘purchasing power’ or ‘buying power’ would have been the logical term for what a laborer could afford – instead, the term ‘purchasing power’ refers to how much the ‘value’ of the money mysteriously diminishes due to ‘inflation’, which adversely affects how much we (the consumer) are able to purchase.

This, of course, is yet another grift, as ‘inflation’ is simply a euphemism for some (or several) greedy so-and-so’s perched along the distribution channel, jacking up their prices (thus lowering consumer ‘purchasing power’), in an attempt to garner more Profit.

What is their rationalization? ‘Demand’, which simply means that because someone wants it, they have a right to charge more for it. Demand and Scarcity being allowed to drive Value is why convenience stores mark up water prices 125% in a hurricane. The takeaway is that when some economic rationalization, like ‘Demand’, only works when good times are rolling, but breaks down under stress, it proves that the theory behind it is flawed. The Earth, it appears, is not flat after all. Economists must dig deeper, and get the right answer, because lives are at stake.

If consumers stopped buying things, in order for ‘lack of Demand’ to bring prices down, businesses would likely fold, many of us would be out of work, and without government intervention, those on the economic ‘bottom’ would likely starve. Perhaps this would finally elicit a serious conversation about ‘positive freedom’ and ‘justice as fairness’, but alas, ‘no’, it would not. In reality, government would simply pull out the National Debt ‘Credit Card’ while the wealthy among us ride out the storm, using their big stash of previously accumulated cash as a floatation device.

Annoyingly, Debt allows Banks (and other loan sharks) to kick consumers while they are already down – a chance to grift consumers further, by grabbing even more Profit from the inevitable discrepancy between Effort and consumer purchasing power. The sucking sound we often hear is Profit vacuuming up our government tax money, leaving National Debt for our children, that worryingly, other countries are buying up more and more. National Debt is very real, if only because we are paying hundreds of billions in interest payments on it, through our tax dollars, that could have gone toward some positive use.

For a moment, let us reason with our Forebrain and not our Hindbrain, or as Richard Thaler puts it: our Reflective System and not our Automatic System.

There are two main ‘constants’ in the real economic equation: first is People, who, as they conceivably grow in population, also simultaneously grow in their capacity to produce Value. The other constant is the Earth, with its finite resources, which conceivably may shrink at some point, leaving us to figure out how to eventually feed 5,000 people with 5 loaves and 2 fish. The next thing needed is a Government, in order to set the method of resource allocation – i.e., the economics.

Then, of course, there’s Money, which also needs to be redefined. Money is a measuring tool, only made real, or legitimate, because every one has agreed to its function. Through it, we can measure all the ‘resources’ on the planet, whose value will (unfortunately) always be arbitrary, because ‘value’ is in the eye of the beholder. For instance, aggregate might appear worthless to some, but the concrete it makes allows cities to be built. How are they built? Through Effort. Effort, in fact, is the constant in all our economics. There are few things the Earth possesses that have ready-made value – air, water, some random fruit, etc. – and not coincidentally, we charge little to nothing for them, because it takes no human Effort to turn them into something of value. Therefore, Money is more correctly defined as the measure of human Effort, not some arbitrary measure of ‘use value’, based on what we would be willing to pay.

This is how ‘Economic Rent’ has come to exist – where someone buys up the ‘commons’, then holds it hostage until we pay a ransom for some small piece of it.

In the new Economics, ‘Economic Growth’ becomes the yearly measure of human Effort, measured in Money. Who gives Money its numerical value? All of us. Government (aka We the People) has been ‘instituted’ to do many things, one of which is to officially legitimize money; because Government and Money represent our collective will, neither can be left in the hands of any single person or group.

Currently, a Bank is the place where money is created, kept, disbursed (or loaned), then returned – with interest. Money already has a transaction fee attached to it, but for whatever reason, We the People currently have no claim to it, even though we invented the money, legitimized it, and collectively agreed on its value relative to Effort (which turns rock and dirt into consumable goods).