Thomas Piketty must have struck a nerve to have so many people falling over themselves to contradict him. Now we have Inequality Deniers, too. Of course, criminals would be stupid to admit to their crimes. That’s for a jury to decide.

Capital in the Twenty-first Century (2014) By Thomas Piketty

Product details

- Publisher : Belknap Press: An Imprint of Harvard University Press (January 1, 2014)

- Language : English

- Hardcover : 704 pages

- ISBN-10 : 067443000X

- ISBN-13 : 978-0674430006

- Item Weight : 1.88 pounds

- Dimensions : 6.6 x 1.86 x 9.59 inches

- Best Sellers Rank: #42,429 in Books (See Top 100 in Books)

- Customer Reviews: 4.5 out of 5 stars 3,996 ratings

About The Author:

Professor of Economics Thomas Piketty currently holds positions at the School for Advanced Studies in the Social Sciences, the Paris School of Economics, and the International Inequalities Institute (London School of Economics). He established the World Inequality Lab and the World Inequality Database, in order to track the historical evolution of wealth and income distribution “both within countries and between countries.”

In philosophy, Piketty is closer to John Maynard Keynes (post WWII economic policy) than Karl Marx (who penned the original book on ‘Capital’). Keynes saw capitalism as unstable, with “self-destructive tendencies” that could only be made right through tax and transfer mechanisms (aka redistribution). In contrast, Milton Friedman (1980s through present) declared that the free market was just fine, and government should stay out of it, which went over quite well with the people who owned the market. Slowly, the band-aid fixes of Keynesian economics were scrapped for a full-on hostile takeover of the Darwinian kind.

Piketty is working to get us back to where we were under Keynes: large transfers of wealth through redistribution. Economist Sir Paul Collier attacks the evolution of inequality from a less scientific angle: in his view, there have always been ’thugs’, and thugs have always asserted control over the many in order to service their singular needs. Capitalism is only the latest version of this; it turns what should be fairly simple mathematics into ridiculously complex convoluted equations. It must be completely frustrating for economists like Piketty to mathematically legitimize the quantum level machinations of thugs. Likely, his r>g equation (meaning that the ‘rate of return on wealth’ is often greater than the rate of ‘growth’ in the economy) was an attempt to simplify the discussion, so that all of us could get involved.

Piketty is currently attempting to turn strong words into concrete actions, with his Manifesto for the democratization of Europe; it proposes an assembly of European countries that would meet outside the purview of old established traditional treaties, and solve inequality with redistribution payments based on individual wealth and income, corporate profit, and carbon emission taxation. It is an admirable attempt to get the wealthy to financially contribute to the infrastructure upon which many have built their fortunes, and to also incur some of the financial cost that this ‘cheaper is better’ philosophy (aka economic ‘efficiency’) has wrought upon our planet.

Still off the table is any solution to the damage capitalism inflicts upon the average citizen, but in order to fix this, Capitalism would need to change. Perhaps this is still a bridge too far – something to be crossed once the chasm of inequality narrows a bit more. Piketty does envision a kind of ‘participatory socialism’ at some point, where a ‘progressive’ tax on both income and inherited wealth could finance an initial “capital endowment” plus a continuous “basic income” for each citizen. Any fairness doled out to citizens early in their lives would certainly foster greater hope – and thus greater ‘mental’ health – but will need to be backed up with a share of the wealth they helped produce throughout their lives, in the form of some retirement security (meaning something beyond extracting money from a paycheck and giving it back later).

About the Book:

“What’s really new about ‘Capital’ is the way it demolishes that most cherished of conservative myths, the insistence that we’re living in a meritocracy in which great wealth is earned and deserved…[Piketty] offers what amounts to a unified field theory of inequality, one that integrates economic growth, the distribution of income between capital and labor, and the distribution of wealth and income among individuals into a single frame.” –Paul Krugman, Arguing With Zombies

“Piketty has returned economics to the classical roots where it seeks to understand the ‘laws of motion’ of capitalism. He has re-emphasized the distinction between ‘unearned’ and ‘earned’ income that had been tucked away for so long under misleading terminologies of ‘human capital,’ ‘economic agents,’ and ‘factors of production.’ Labor and capital—those who have to work for a living and those who live from property—people in flesh—are squarely back in economics via this great book.”—Branko Milanovic, The Haves and Have Nots

“An extraordinary sweep of history backed by remarkably detailed data and analysis… Piketty’s economic analysis and historical proofs are breathtaking.”—Robert B. Reich, Saving Capitalism

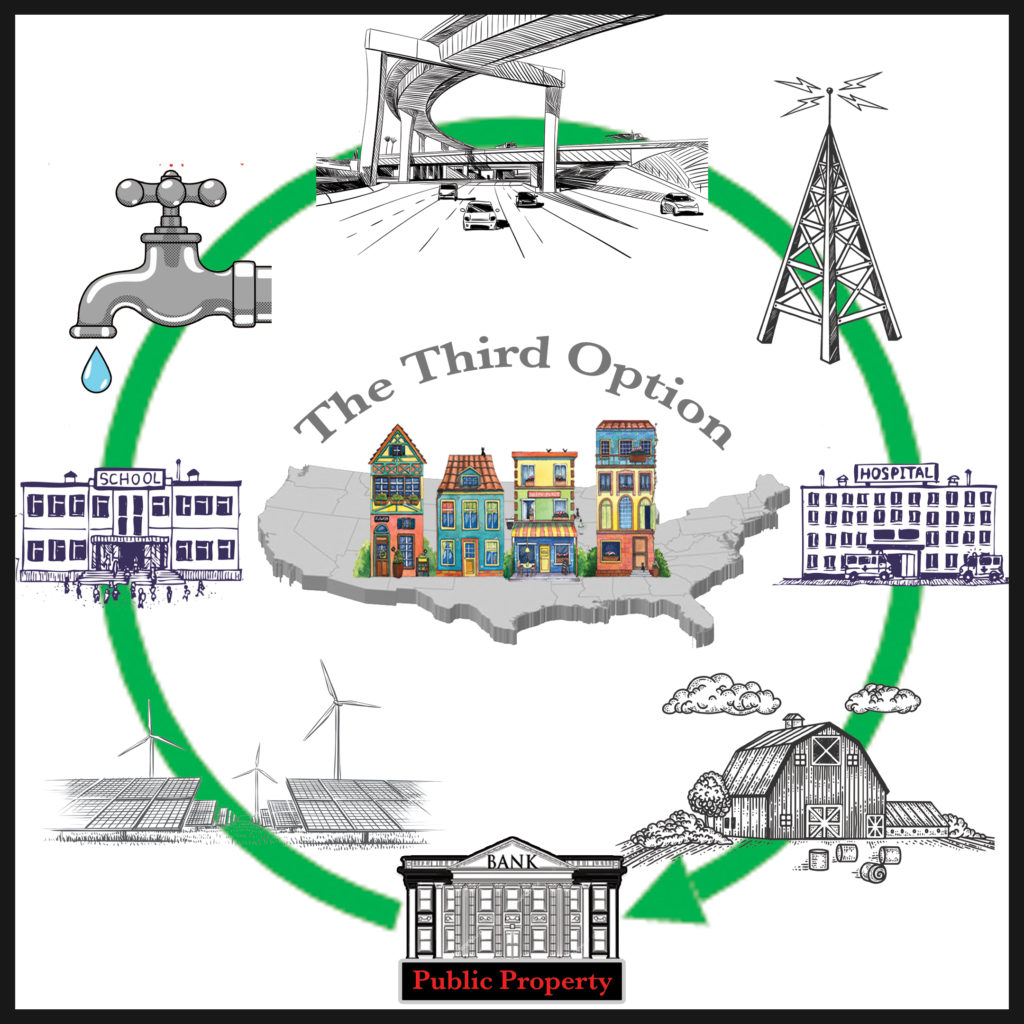

French economist Thomas Piketty represents the new prototype of economic thinkers, willing to wander outside their designated ‘lane’, and hold their profession accountable for all the poorly designed infrastructure it continues to peddle. Similar to motor vehicle infrastructure – which kills 1.3 million people a year – we have come to accept the ‘collateral damage’ caused by our flawed economic framework. Meanwhile, this framework has directly and negatively impacted our other infrastructure choices as well, like energy, agriculture, housing, education, legislation, health care, water / sewer, and communication. None of these essential needs are designed to serve people as much as they are designed to serve the wealthy who are allowed to run them for a profit at our expense.

What made Piketty’s book popular was that it tried to prove that inequality was inherent to Capitalism – it wasn’t Keynes ‘wickedest people’ or Friedman’s ‘government intervention’ that caused it, but simply that Capitalism tends to produce inequality by its very nature (the fact that inequality exists proves one thing most certainly: that our current system is either useless in its capacity to control it, or highly effective in its capacity to perpetuate it, depending on one’s financial perspective).

What makes Piketty’s book important is its attempt to utilize as much historical data as possible to refute the claim that wealth is earned, and thus ‘deserved’, rather than continue to breathlessly explain the inequality in mathematical, philosophical, sociological, anthropological or constitutional terms. It is disappointing but not surprising that the minions of capitalism have even attempted to refute, discredit, dismiss, deflect and deny the data; it is by now long established that facts and truth are ineffective weapons against pure thuggery, yet we still persist in ‘reasoning’ with those holding this gun to our heads.

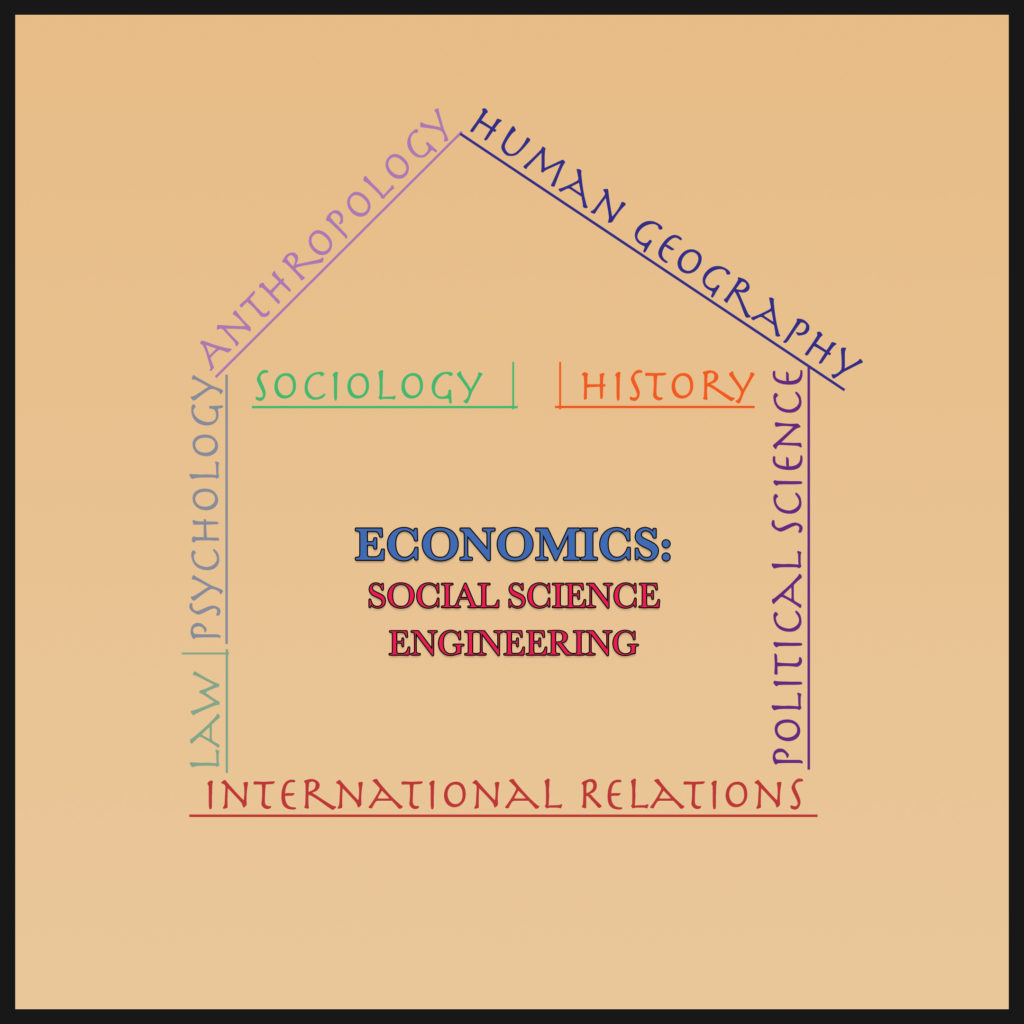

What makes Piketty’s book disappointing to some is its solutions to wealth inequality. To be fair, this can be said of nearly every economics book ever written on the subject; this may be because economics, attempting to be a ‘science’, is forced to simply describe the ‘economy’ rather than engineer it in any way, even though economists would be the most knowledgeable among us to at least participate in re-engineering it.

In truth, economics should always have been in the same relative category as engineering. Both utilize scientific principles in order to build infrastructure that improves human existence. Engineering utilizes the physical sciences to build physical infrastructures; economics utilizes social science to build social infrastructures.

In applauding Piketty’s work, sociologist Mike Savage of the London School of Economics called Piketty a ‘social science engineer’, which he definitely has the potential to be someday, as do many of his colleagues (Paul Collier, Joseph Stiglitz, Robert Reich, James Heckman, David Harvey et al), but they will need to think outside the narrow mathematical box into which they have been forced. Thankfully, many institutions, like Piketty’s School for Advanced Studies in the Social Sciences, are beginning to train the next generation of economists using more interdisciplinary methods; hopefully, this will slowly turn economists into the social science engineers of an ‘emerging future’.

Justin Fox of the Harvard Business Review quipped whether Piketty’s views about inequality would change once he got rich from sales of his book (they have not). Like all things funny because they have some surface truth, the humor is actually born of tragedy that lies just below the surface; we quickly chuckle and move on, because if we ponder it too long, we would feel something between anger and hopelessness.

The truth is that if we ever tried to stand up to capitalism, we would wind up prostituting ourselves with a book deal in order to get our idea heard, and ultimately still become the slave of the very thing we despise. Piketty has had to expose himself to scrutiny as a new-found celebrity, raising his ‘utility’ as a human commodity; his celebrity is likely being consumed at a higher rate than his actual ideas. In obscurity or celebrity, we are all made prostitutes by capitalism in the end. Even more maddening must be the reality that your ideas are now the property of someone capable of extracting ‘rent’ from them, when your message is basically how rent is what destroys society in the first place.

Third Option Takeaways:

Piketty has been criticized for how much redistribution would be necessary to offset the inequality caused by our current economic arrangement (a wealth tax could reach as high as 90%). The massive level of ‘offsetting’ necessary only makes it more clear how poorly our system is designed. In the Social Darwinism of the so-called ‘free’ market, as firms rise and fall, based on their economic ‘fitness’, a natural ‘balance’ should be reached somewhere – in the market, in the general population, or in the planet – but there is no balance anywhere. Monopolies in any one of these arenas would mean the destruction of the whole.

The genetic traits that helped us get this far (fighting, fleeing, consuming, replicating, etc.) are also the traits that will destroy us in the end, if not tempered. We shoot first and ask questions later. We too-easily submit to authoritative control. We uncontrollably and addictively consume. We seek to perpetuate the oppression we secure, passing it on rather than letting each life unfold how it will. Capitalism is a way of encapsulating, maximizing, and even glorifying these things, not tempering them. Without government defending us, however poorly, we would all be crammed together like cattle, continuously bred then used up in order to fulfill our ‘economic purpose’. Some would argue that we are already there.

Capitalism is incapable of managing the planet. Capitalism would argue that it is not designed to manage the planet, only to make a profit, but we need some system to do it, and capitalism, in its attempt to dismantle government, either has to take over this management role, or finally admit that it is simply a national pastime for the rich and shameless, and nothing more.

The most honest and informative list espousing the ‘pros’ of Capitalism cites the ‘trickle-down effect’ – the fictional narrative that wealth will magically filter down into the poorer communities – as the third best thing about Capitalism. Fourth on the list is “there are no better alternatives”. If a list of ‘pros’ cannot yield more than two positive benefits, it may be time to look for that ‘better alternative’.

Whatever this ‘better alternative’ might be would do well to retain the two positive benefits capitalism does afford: the pressure on businesses to remain efficient and innovative (if they wish to remain viable). Developing better and better products that people wish to use (demand) at the most efficient cost to produce them is essential to continued economic progress. For example, our transportation is dangerous and dirty, our energy is not green or clean, our health care is overly expensive and – in the case of hospital care – the leading cause of accidental death, from mistakes we still make. Not everyone has the benefit of healthy food (see ‘food deserts’), clean water, internet, education, or affordable housing. In other words, there are many innovations remaining for us to tackle, in order to create a sustainable society, and capitalism is incapable of delivering on any of them, simply because it is not in their ‘best (self) interest’ to do so.

The private sector prefers innovations like repackaging the same drug in order to extend the patent on it, or such essentials as disposable e-cigarettes, birth control patches, augmented reality games, bitcoin, Siri, human gene editing and online streaming. True innovation would be to make our transportation and healthcare safe, our energy and agriculture green and clean, our housing affordable, and the like. We the People are the only ones funding these kinds of crucial innovations, through our government. The public sector brought us electric cars, green energy solutions, the internet – through our funding – but of course gave it over to the private sector. Bezos, Zuckerberg, Gates, Musk have all made their fortunes from public funding. The government, blindly believing that propping up the private sector will ultimately help people, have subsidized oil and coal for our energy, factory farming for our agriculture, internet neutrality, bankrupt car companies, failing private banks, unaffordable health care; What is next? Should we hand over our education, prisons, traffic control, retirement security?

Private schools will not be offering opportunity to those who cannot pay. Private prisons will not lower our incarceration rates because this would not be profitable. Pollution will not be solved in transportation, energy, or agriculture, because oil is more cost-effective than cleaner energy. Meat will continue to create an antibiotic-resistant bacterial threat because we must crowd sick animals together in order to make meat profitable.

We will continue with non-regenerative farming practices in order to feed all this livestock we plan to eat, which will continue to pollute our groundwater with their feces, and our air with their methane. Neighborhoods devoid of economic ‘value’ will continue to be abandoned, followed by using them as a dumpsite for toxic industry, until gentrification comes along to displace the non-essential people previously left there.

The list of offenses is endless. We are too overwhelmed, overworked, and overanxious to fight back. The Third Option believes that a bunch of data, math, philosophy or law, is not going to be enough to change any of this. People do not fight back out of intellect; they fight back out of emotion. This fight has to be personal. We need to change all this because it is the right things to do on ethical and personal grounds. Listing statistics just puts people to sleep. People need someone to offer them a complete and clearly better choice, backed by names they can trust, in order to ante up and vote for this ‘better alternative’.

Economists – more than any single group right now – have the economic (and social science) knowledge, political clout, and name recognition to think outside this mathematical box of tax and transfer rhetoric and create a third way forward. Rather than rule in hell, as the superstars of capitalism, it is time for economists to serve, as the superheroes of Democracy.

Other Works:

Books:

Articles:

Interviews:

Videos:

- “Why Capitalism Must Be Reformed”

- “New Thoughts on Capital in the Twenty-first Century”

- Social Media: Twitter: @PikettyLeMonde, @Capital21stCent

The One Percent Solution by Gordon Lafer – a Book Review

The One Percent Solution by Gordon Lafer – a Book Review