Ellen Brown’s compendium of public banking history shows how it consistently outperforms the private version which often replaces it, to the detriment of people and their democracies.

The Public Bank Solution (2013)By Ellen Hodgson Brown

Product Details

- Publisher : Third Millennium Press; Illustrated edition (June 11, 2013)

- Language : English

- Paperback : 486 pages

- ISBN-10 : 0983330867

- ISBN-13 : 978-0983330868

- Item Weight : 1.42 pounds

- Dimensions : 6 x 0.98 x 9 inches

- Customer Reviews: 4.7 out of 5 stars 125 ratings

About The Author:

Ellen Hodgson Brown founded the Public Banking Institute in 2011, in conjunction with her book Web of Debt, where her research led her to discover how well public banks have performed throughout history, and how well this fact has been covered up. Since that time, she has continued to spread the word about the value of public banking. Between articles and public appearances, she can be found spreading her message at EllenBrown.com, and on her podcast “It’s Our Money”. She is also a fellow at the Democracy Collaborative, who advocate for a ‘bottom-up” approach to economic development, in order to strengthen communities and promote a more democratic society.

Here are her comments from a 2013 New York Times Op-Ed piece:

“Public banking is not a radical idea but has been practiced in the U.S. with excellent results for decades, and around the world for centuries…To ask whether public banks would interfere with free markets assumes that we have free markets, which we don’t…Banking, money and credit are not market goods [anyway] but are economic infrastructure, just as roads and bridges are physical infrastructure.”

About the Book:

“Money today is simply credit; and credit must come first, before services can be rendered or the products can be made that will generate the profits to pay back the loans…when the bank is owned by the community, and when the profits return to the community, the result can be a functional and efficient system of finance.”

The Public Bank Solution highlights the many instances where public banks have been utilized throughout history. The First Bank of the United States was a National Public Bank, for instance, founded by economist and first Treasury Secretary Alexander Hamilton. Not coincidentally, he was shot and killed by the founder of U.S. private banking, Aaron Burr. Initially, Burr had gone to Hamilton and asked for his support in building a water company, to provide a safe water system for the people of Manhattan. Once Burr gained Hamilton’s approval, Burr secretly altered the application form to give his Manhattan Company financial investment power. His Manhattan Company never did an ounce of water business, but did manage to become Chase Manhattan Bank, which today operates under the name JP Morgan Chase and Company, the largest bank in the United States, seventh largest in the world. Burr’s underhanded move infuriated Hamilton, and from that moment on Hamilton challenged Burr’s character at every opportunity, until they famously dueled, where Burr killed him. With Hamilton’s death, National Public Banking died as well, though in the spirit of Hamilton, many Americans continue to challenge the character of the private banking industry.

Public banking did manage to stay alive in the United States, however; in 1919, farmers in the state of North Dakota, who were fed up with private banking’s high interest rates, voted for their own state public bank (now BND). Because of the BND, North Dakota had no financial dip during the 2007-2008 financial crisis, and still remains lowest in unemployment and foreclosures, and highest in return on equity of any U.S. state. As Brown puts it, “having its own bank allows North Dakota to fund projects without either raising taxes or incurring debt.”

Brazil, Russia, China, India, Australia, Germany, New Zealand, Japan, Canada – many countries have benefitted from the government owning the banks instead of the other way around. In this book, Brown has compiled a comprehensive guide to public banking, in the hope that new generations will not be ignorant of – and thus subservient to – the oppressive power wielded by private money.

Third Option Takeaways

The Third Option believes that the founding fathers intended to create a democracy, not a financial oligarchy – strong sustainable communities, not wealth inequality. People oppressing other people is as natural as our drive to consume and replicate, and this ‘will to power’ has naturally driven modern-day oppressive types toward money and politics; unless the rest of us have better control of these two mechanisms, human history is doomed to repeat itself ad nauseam. Since America’s founding, private interests have attempted to denounce public banking as ‘unconstitutional’ in order to eliminate it, but (in McCulloch v Maryland) the Supreme Court shut them down. That law is still in place, waiting for whatever generation is strong enough to reclaim their constitutional right to it, and with it, our ‘intellectual property right’ to democracy, money creation – even the concept of ‘property rights’ themselves.

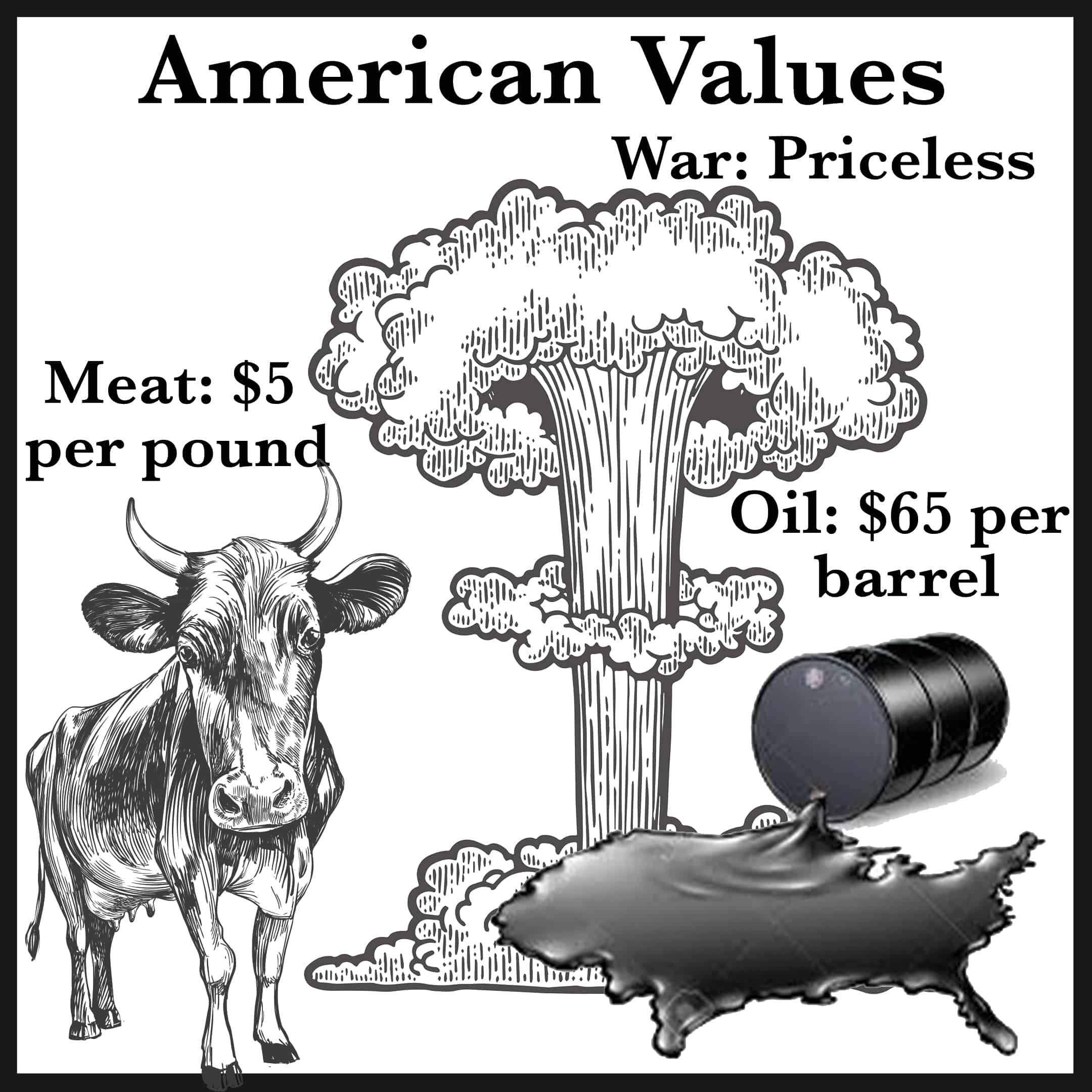

Originally, money was only meant as a conversion tool – a common denominator to measure the relative value of otherwise unrelated tangible goods. Unintentionally (but logically), money became something of value all by itself, and through its over-accumulation, eventually was able to buy ‘up’ everything that could be bought (aka the ‘means of production’). Thus, capitalism was born – the modern version of Oppression – a financial form of extortion achieved through controlling the entire means of a population’s survival. Money was even used to buy up government legislation and regulation, so that wealth would remain at the top, through control of money creation and property rights.

What inequality teaches us is that our fates have always been tied together – the wealth of some inevitably leads to the poverty of others. When we pause long enough to re-establish on what authority money creation and property rights exist, we will begin the mental journey back toward the idea that having our fates tied together – through government – can be a fortuitous arrangement, and that, in reality, government is only hazardous to the health of people when the private sector has control of it.

For this reason The Third Option supports a third National Public Bank as the source of all money creation, as well as the source of all government funding – through self-liquidating loans – in order to supply the basic needs that would keep life more certain for all citizens. By making the National Public Bank the heart of the nation, with all our money circulating through it (in order to sustain the entire economic distribution channel), ‘Economic Growth’ will truly be a collective financial achievement, the benefits of which we all can share.

Other Work By Ellen Brown

Books:

Articles:

- “Will 2021 Be Public Banking’s Watershed Moment?”

- “Another Bank Bailout Under Cover Of A Virus”

- “Regulation Is Killing Community Banks – Public Banks Can Revive Them”

- “Trump’s $1 Trillion Infrastructure Plan: Lincoln Had A Bolder Solution”

- “How To Wipe Out Puerto Rico’s Debt Without Hurting Bondholders”

Interviews:

- “An Interview with Ellen Brown”

- “Ending Unemployment with State Bank Money”

- “Banks vs. The Real Economy”

- “Interview with Katie Teague”

- “Ellen Brown on Public Banking TV”

Videos:

- “Why We Should Own the Banks”

- “From Scarcity to Abundance–Re-imagining Money (TEDxNewWallStreet)”

- “Funding the Green Transition with Public Banks”

- “Real Wealth – A Future We Can Bank On”

Social Media:

- Twitter: @ellenhbrown

- YouTube: Public Banking Institute

The Process of Our Polarization

The Process of Our Polarization