Extra thanks to Neil Irwin (now with Axios) for his comprehensive look into the role of Central Banking in the modern economy—The Alchemists—upon which this article draws several of its examples, Ellen Brown, for her continuing crusade to reinstate public banking, and Otto Scharmer at MIT, whose observations concerning the current societal disconnects serve here as a litmus test for our proposed economic solutions.

By Robert Simmons

Preface

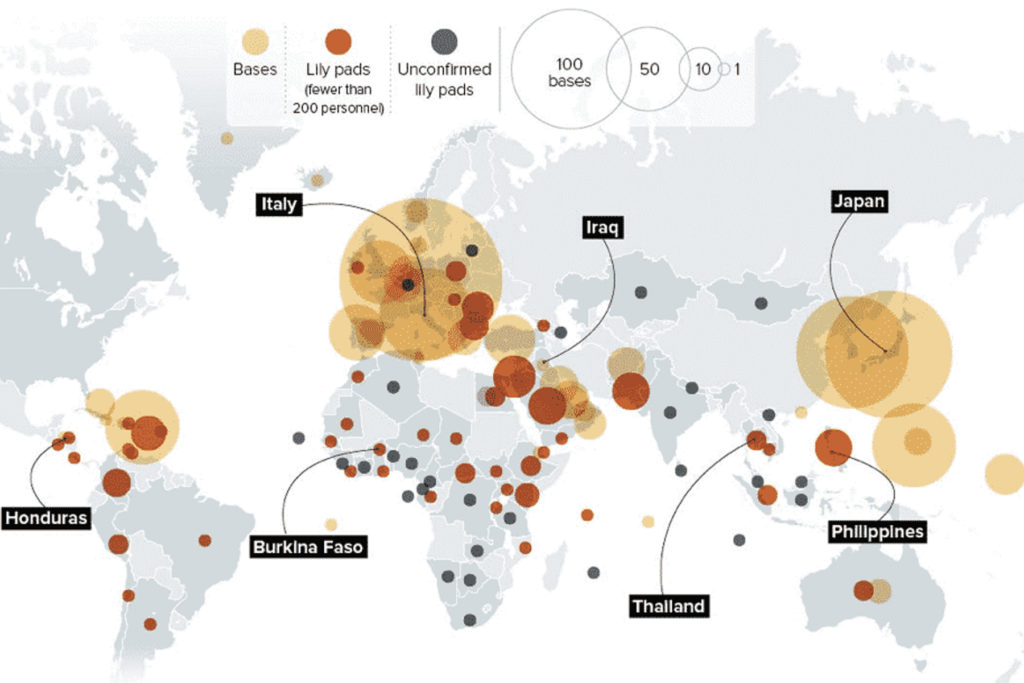

Our current U.S. economic system has suffered financial panics in every decade of America’s existence. It is the reason we currently spend $1.25 trillion on all things war (the price tag is scheduled to rise as high as $1.75 trillion by 2030). It is the reason our healthcare system ranks #1 in cost but #11 in quality, and why we rank #1 in GDP, but #91 in basic education and #28 in quality of life. We score high for violence, traffic fatalities and National Debt, and low in life expectancy, sanitation and access to healthcare. We have yet to solve any form of pollution, or any of the problems caused by wealth disparity, such as poverty, poor mental and physical health outcomes, incarceration, environmental racism, blockbusting, credit rationing, racial ‘steering’, redlining, food deserts, eminent domain, and gentrification. As Democracies go, we currently rank #26.

Table of Contents[Hide][Show]

Statistics, Statistics.

To be fair, U.S. government is currently set up more like a dummy corporation—in order to protect the financial services sector—than any legitimate version of Democracy, so getting ranked #26 is really pretty generous. Perhaps the research group gave us partial credit; we are, at least, a government by some people, for some people.

Here’s a few interesting statistics: somewhere between 80 and 100 million eligible Americans do not even vote (which is roughly half the potential voters). Apparently, only two out of five Americans can name one of their many government representatives; only one-third of us know who our state governor is. In a true Democracy, by the way, people would only have to represent themselves; if someone asked “who represents you?” in an actual Democracy, you would, at least, know the answer.

In a representative Democracy—which is what we have now—you simply wait until an election year rolls around, scroll down a list of people you don’t really know, and confidently check the box next to everyone who belongs to the same political party as you. If it’s a ‘primary’, you will likely vote for the person whose name sounds the most familiar. It sounds the most familiar because that particular candidate spent more money than anyone else on campaign advertising, meaning that someone gave them this extra money; this, of course, is all perfectly legal in any ‘flawed’ version of Democracy. In the end, the American people get a choice between Coke or Pepsi; there is no third option. Thankfully, economic growth is a winner no matter which soft drink the people choose; freedom of choice has never been so safe.

Statistics do show that eventually all of us will end up being a statistic. On paper, statistics don’t hurt that much, but they are a bitch when you have to live through being one. When trying to make sense of some tragedy, individuals often seek comfort in being around others who have been similarly victimized. Perhaps they’ll form a coalition, and take a number behind the many other coalitions, each formed around a different flaw in the same system. In this way, citizens will be pitted against each other, all vying for the same small allocation of scarce government funding. Each of them will waste hours of their remaining lives. attempting to get some measure of justice, until it dawns on at least some of them that there really is no such thing as justice, or liberty, or equality; someone just made all of that up, then bundled it together into a mortgage-backed Democracy, and sold it to the world, in order to hedge their bet in case corporatocracy failed.

Statistics aside for a moment, there are some things we can all agree upon, without having to consult a spreadsheet:

- We’ve got problems, and they’re piling up as high as our National Debt and as wide as our Great Pacific Garbage Patch, because we apparently can’t solve any of them, and

- Even though a majority of the population would like to see these problems solved, down on the floor of Congress, we somehow remain in perpetual political gridlock. Two facts should be noted, however:

- even when both sides took turns garnering enough support to grab sufficient political control (one in 2016, and the other in 2020), nothing significant changed anyway, and

- when nothing changes, there is one small subset of the population that does still benefit.

Statistics are often misleading. For example, we are not a flawed Democracy, we are only flawed in thinking we are a Democracy. Real Democracy is not the Control of the Many, it is the Power of the One. Control is the strategy of the powerless, who roll themselves into a large comforting ball in order to assuage their fears, which ironically, only serves to magnify them, and more easily manipulate them; the tyranny of majorities has been well documented.

Thankfully, Democracy is much easier than whatever we are trying to institute presently. The first step in establishing actual Democracy is for you to stop passing the buck and start representing yourself. The Third Option wants to give you a chance to practice this.

In the following article, The Third Option has a complete plan to fix every flaw in our current economics, simply by fixing Democracy, and thankfully, we do not have to convince some lobotomized majority about it, we only need to convince you. We don’t care about anyone else, because you don’t represent anyone else, and no one else represents you, so it appears we are talking to the right person. Now that you represent yourself, we only have to convince you. See, Democracy is easy.

Thomas Jefferson once said that “wherever the people are well informed they can be trusted with their own government.” Unfortunately, Tom did not predict modern media, and the weaponization of white noise, constantly jamming the signal into our brains; it is decidedly difficult to dive deep into any subject armed with only an eight-second attention span. In order to practice Democracy, you will need to have decent reading comprehension. You can do this. All that time you spent learning to read in your number 91-ranked public school system was for this moment. Time to start representing yourself.

This article is divided into two parts:

- Identify the flaws in the current economic operating system.

- Explain how The Third Option plan would effectively eliminate every one of them.

I. Identifying the Flaws

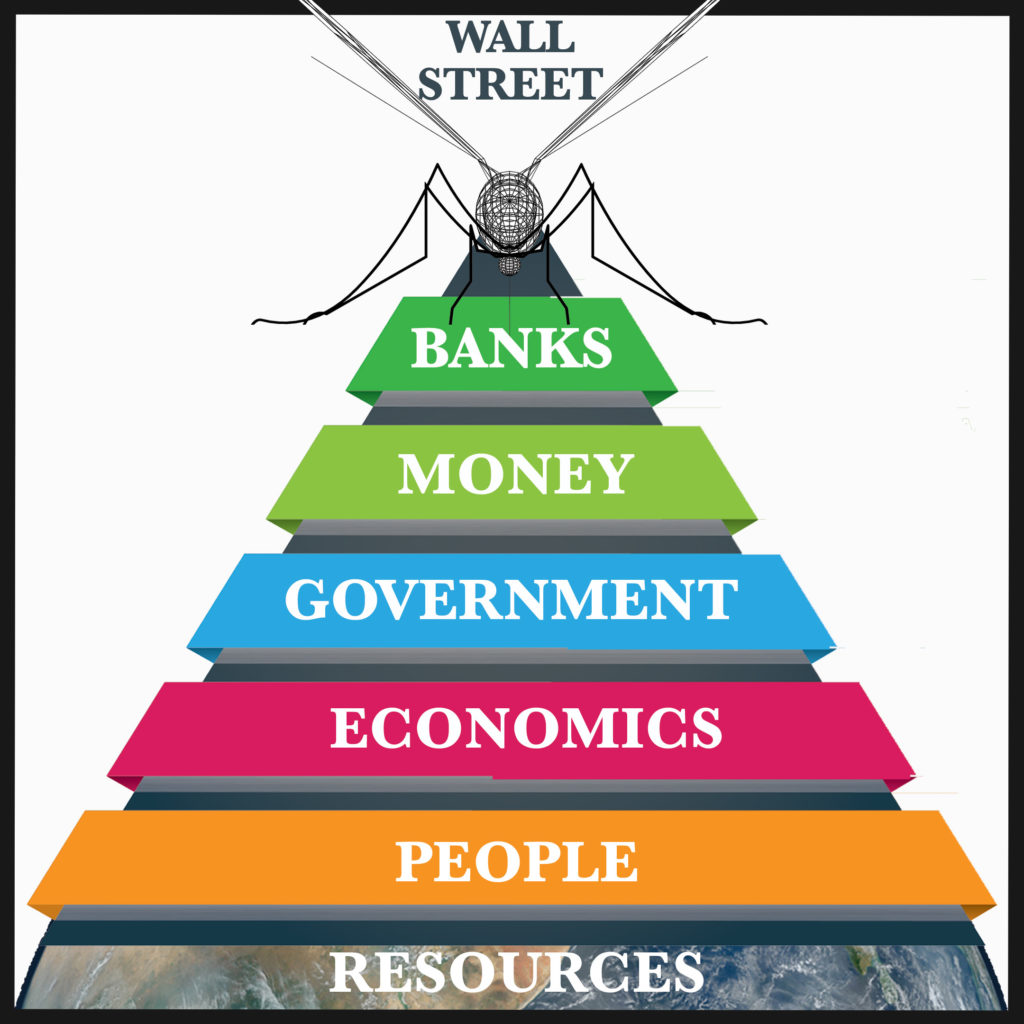

If we wish to understand the economy, we would look at it from the bottom up. When we wish to control the economy, we would look at it from the top down.

Robert Simmons

Economies are the necessary survival strategy of all living organisms; given a fertile foundation, a natural hierarchy begins to form; each new tier is dependent on the tier below it, to provide the ‘resources’ necessary for its continuation.

If a tree falls in the forest, and there are not ants to inhabit it, or bark beetles to chew on it, or beavers to build with it, it doesn’t really qualify as a ‘resource’ [tier one]. When people [tier two] laid claim to the foundation and began utilizing its many resources (as both worker and consumer), a process formed; the methods people utilized to extract these resources, convert them into usable products, then distribute them to each other came to be known as economics [tier three].

In areas of abundant resources, crowds would start to form. Claims of ownership became tenuous, as well as the available supply of resources (scarcity)—another hierarchal tier was needed, in order to manage the issues caused by the agglomeration of people—thus began the role of government in economics [tier four].

What Goes Around Comes Around

In humans, symbiotic relationships often tend toward the predatory and the parasitic; predictably, a management trend began occurring where ‘thuggish’ types (devoid of any emotional connection with their fellow man), used the guise of governance to gain control of the land (and thus its resources), forming what might best be described as a ‘protection racket’. Sir Paul Collier reasoned that these “thugs” exist naturally because they are born physically imposing, but inadequately skilled in farming, construction or artisanship. In an economy where one must fend for themselves, these types naturally gravitated toward survival by extortion. Among this group, a leader would invariably emerge, and with the rest serving as his ‘army’, management slowly evolved into the job of thugs.

Hierarchal relationships are the survival strategy of parasites. A biological economist would reason that parasites must form more commensal relationships with their hosts per ‘rational self-interest’, meaning that those on the tier above must learn to extract from the tier below without driving them both into extinction (which would be ‘irrational’), but that this act would not imply any measure of empathy; parasites would only manage their resources intelligently through pure self-interest. The attachment of a rationally self-interested government tier was how ‘the few’ were able to turn ‘the many’ into their most valuable ‘resource’; in this way, oppression was born.

Takeaways: Because people are, by necessity, attached to the resources, and resources are attached to the land, thuggish types found they could control people simply by controlling the land underneath them, thus war and the concept of property rights—secured through the threat of violence—became the two main jobs of governments. Issues: how can governments be arranged to facilitate economies (empower them from the ‘bottom up’)—or even manage them—but have no avenue to form parasitic or extractive relationships with the people they are charged to represent? Further, how can the concept of property rights be re-framed, in order to minimize the conflict that naturally forms around them?

While governments attach themselves for both logical and dubious reasons, economics continued to evolve, in order to handle ever-growing numbers of people. To facilitate the efficient exchange of dissimilar goods and services in the economic marketplace, the enigmatic concept of money was added, as a medium that both represented and indefinitely stored an agreed-upon measure of ‘value’ between each transaction. Understandably, people wanted something more tangible than a ‘concept’, so ‘currency’ was created to represent the money (both coins and then paper); unfortunately, this incited people’s desire to covet the money as a tangible good, the way they first coveted shiny objects like gold and silver, upon which the early forms of money were standardized.

Takeaway: Our desire to covet the things we see is a huge factor in the process that leads toward wealth inequality, resource depletion, resource wars, and continued oppression. It is important to differentiate between money as a physical commodity, where it has no value, and money as a medium of exchange, where all its value is stored. Inadvertently, by giving money an exchange value, it has become a fifth hierarchal tier [tier five], allowing anyone who controls the money to control both the economy and the government underneath it. Issue: how can money continue to serve as a medium of exchange to empower economies, without retaining the ability to control them? Further, how can we continue to progress as a society without having to market the idea that covetousness is a virtue, when in fact it is the source of our continual suffering?

A sixth component necessarily developed—banks [tier six]—which became a private industry granted the sole right to manufacture and regulate money (central banks were later added to manage this industry). The original premise behind banks was that people needed a safe place to store their ‘valuables’, so no one robbed them of it, and once these shiny objects were sitting idle in a bank, it seemed a waste to not let others ‘borrow’ its value for a little while, toward some economic venture. The congregation of people around a naturally expanding marketplace needed a medium of exchange to facilitate the production of marketable goods. Even when banks lent their ‘full reserve’ of money, it was not enough to facilitate a rapidly expanding economy, so the idea of ‘fractional

reserve’ banking came along, where only a fraction of the deposits needed to remain in the bank (in case of sudden withdrawals by depositors), meanwhile, ‘credit’ was extended to entrepreneurs, often well beyond the actual amount of ‘full reserve’ deposits.

This was achieved by a system of double-entry bookkeeping, where a ‘debit’ was recorded on one side of the accounting ledger, to offset the ‘credit’ established on the other side of the ledger; the debit—or debt—was wiped out when customers finally paid this ‘credit’ back (with interest). This is how banks came to create new money, well beyond what was actually within their possession, every time they overextended their ‘credit’ limit.

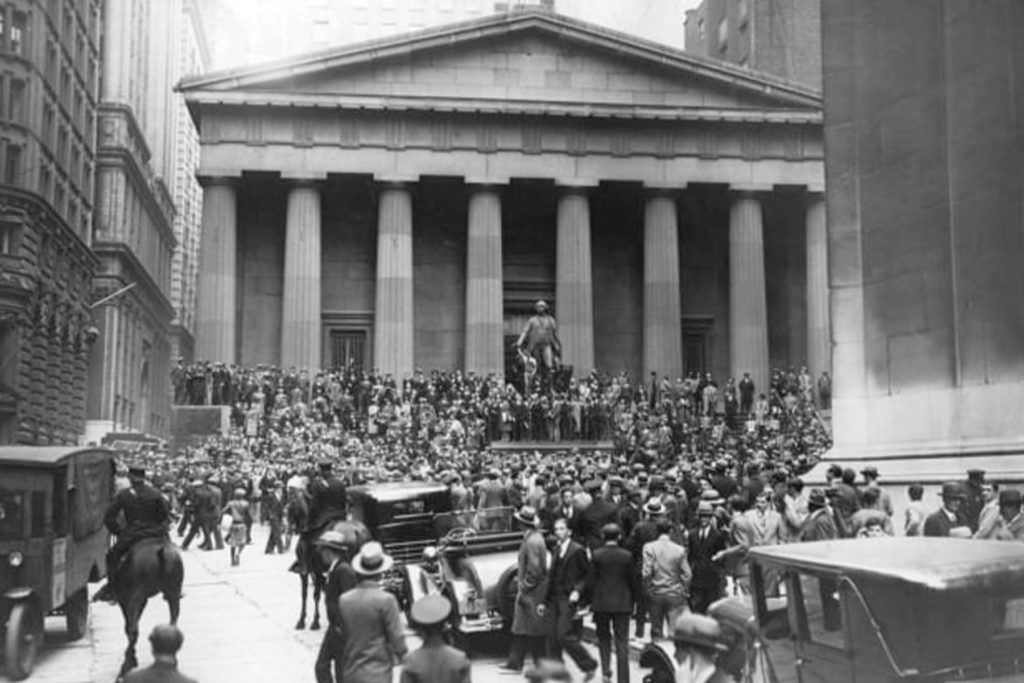

What made this work was the easy expansion of economic growth at the time. New territories were being usurped (imperialism, colonialism, ‘westward expansion’ etc.), human resources were being procured (aka slaves, ‘wage slavery’, and labor exploitation), and new goods were being produced and exchanged. Production outpaced money creation. Unfortunately, whenever the economy slowed down, money ‘borrowers’ were unable to pay back their bank loans at the same time money ‘depositors’ needed their deposits back, in order to weather the ‘economic downturn’.

Takeaway: new money creation comes with the risk that it will not be paid back. Even with a central bank in place, depositors who panicked and came for their money when the stock market crashed in 1929 still brought the economy down (#GreatDepression). Issue: how can the attachment of ‘old’ money (deposits) be permanently severed from the creation of ‘new’ money (through loans).

It was apparently decided that the best way to prevent economic catastrophe was to adopt a policy of constant expansion. For consistent economic growth to occur, new goods and services must continually be produced and consumed at ever-higher levels; new money must be created in order to facilitate investment, increase employment, expand production—distribute, purchase, consume, repeat—to avoid any prolonged periods of ‘recession’, that would expose the realization that the money supply was, in fact, not of any real value, but used merely to coax expanded production and consumption.

Takeaway: our push for economic growth illustrates the underlying human drive to create certainty for ourselves, in order to avoid, as much as possible, the corrosive effects of uncertainty, that lead toward individual maladies such as stagnation, depression, submission, addiction, suicide, etc. Simply put, uncertainty is always chasing us, and nearly all human behavior is built on our attempt to escape its grasp. Economically speaking, we have allowed the captains of industry to lead us toward certainty—mostly for themselves—while the rest of us are told to remain busy, in order not to think about it too much. In more developed countries, we have been able to slowly add more comforting illusions such as the pursuit of happiness, freedom of choice, and ‘upward mobility’, which have helped block the crippling fear of uncertainty, at least for some of us. Issue: how can we better manage ‘certainty’ and uncertainty; to ensure every citizen’s mental and physical well-being in a more sustainable way?

When banks create new money, it is readily made available to wealthier investors at the ‘prime interest rate’, which represents the lowest possible fee to purchase this credit. Less wealthy types are given a ‘subprime rate’, meaning they are charged more for the same amount of money; this is because U.S. banks are private business investors, too, so logically seek to ‘hedge their bets’, by securing a higher ‘return on investment’ for riskier (less ‘certain’) loans, that tend to default more often. Citizens deemed too risky to secure a bank loan must ironically still retain a bank account, if they hope to qualify for short-term ‘payday loans’, where they may be charged an annual interest rate equivalent to four times the amount actually borrowed.

Key fact: because banks are private profit-seeking entities, like any other business (not simply the suppliers of money as a medium of exchange) they cannot help but favor the wealthy in any lending scenario; this establishes a process by which the wealthy—minus some form of intervention (such as heavy taxation, for example)—will ultimately control the entire money supply.

Because this economic growth model train constantly gets derailed, runs out of steam, and even crashes, Central Banks were put in place, to be “responsible for policies that affect a country’s supply of money and credit.”

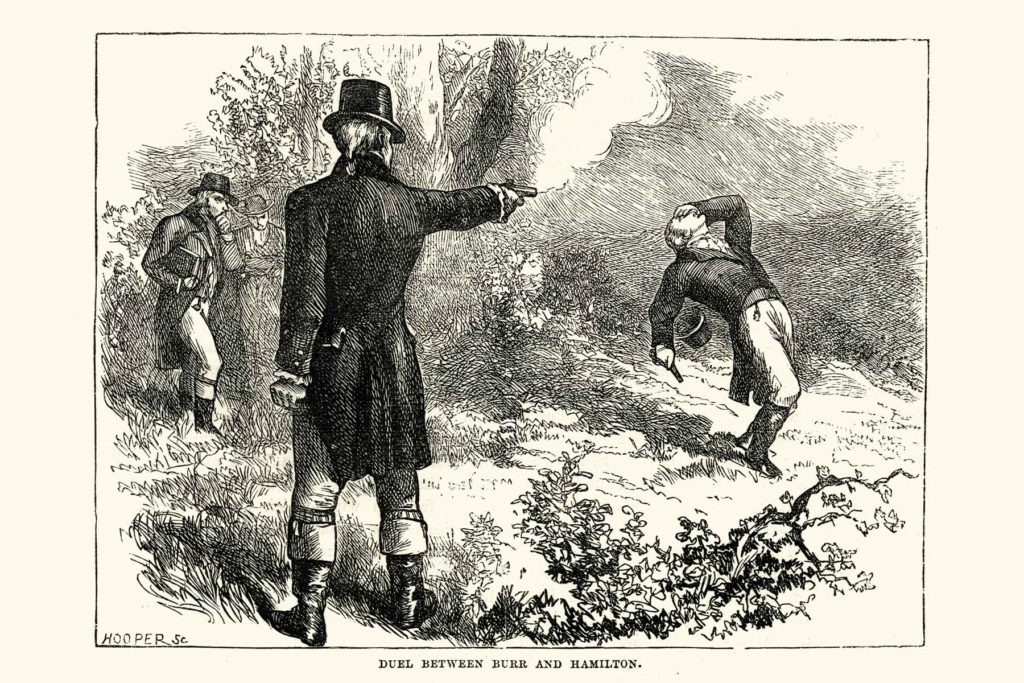

Central Banks go back to the 17th century. When America was founded, Alexander Hamilton believed the U.S. should have a National Public Bank as its Central Bank, and his wish was granted. The First Bank of the U.S. had a charter of 20 years and helped stabilize the nation during its wobbly beginnings. The charter was renewed two more times; the Second Bank of the U.S. ran until 1832. When the bank was re-chartered for the third time, then-president Andrew Jackson vetoed the recharter, charging that the bank constituted the “prostration of our Government to the advancement of the few at the expense of the many.”

Sadly, the “prostration of our government to the advancement of the few at the expanse of the many” also accurately describes the financial crisis of 2007-2008, so Jackson’s solution back then clearly was not the answer to halt the problem of wealth inequality today (The Third Option contends that this mistake was precisely what accelerated it). Jackson himself, as it turns out, was a staunch supporter of inequality; he effectively eliminated the Native American from the south and expanded the institution of slavery as far west as it could go. Every move Jackson made helped lead us to War with ourselves, which is where oppressors always lead us (erroneously—and conspicuously—most historians give Jackson a pass on all of it). To understand Jackson, it is instructive to know that he was orphaned by the age of 14, and blamed the death of his mother and two brothers on the British military. Jackson himself was taken prisoner, where he was struck, starved, and nearly died of smallpox. Psychologically, this could explain his path toward joining the military (to kill the British) and his reckless behavior, getting into several duels (where he killed at least one man and was shot twice himself). He had a personal grudge against many, but especially hated banks (he lost a lot of money in a land deal where the buyers paid him with paper money that became worthless when they went bankrupt—this led him to despise paper money or borrowed money [bank ‘credit’]). Oppressors are fearless because their fear has been sublimated—often brutally— such that they can no longer feel anything, but this does not make them wise decision-makers. Ironically, Jackson’s face now appears on the paper money he tried so hard to eradicate.

Because of Jackson, the United States went into the Civil War without a National (Central) Bank. Lincoln worked around this, creating money called ‘greenbacks’ to help finance the war, rather than borrow the money from the British. Lincoln was smart about money, and the greenbacks were really just receipts for goods and services rendered—the actual money was exchanged later; in other words, work was done first to create the product, then the supply of money was created to cover that labor (or effort). In our current system, the money supply is created first—by individual private banks—with the Federal Reserve charged to manage the ensuing inflation and deflation of the dollar.

Takeaway: The arc of wealth inequality may or may not be long, but it definitely bends toward the wealthy. The duality of money creates a double-edged sword, however: with money as a thing to be valued, the covetous are inherently drawn to possess it, but once possessed, the reality becomes that money truly is worth nothing until it is exchanged.

Therefore, the wealthy must either spend it (though people can only consume so much by themselves), give it away (charity, binge spending, tax-exempt gifts), hoard it (bury it in the back yard, where inflation or rodents will eat away at its value), or invest it. With money, it’s ‘use it or lose it’; thus, the system is designed to force at least some measure of economic growth out of the wealthy. Issue: how can we eliminate the inflationary tactics of rational self-interest, so our money supply simply reflects the intrinsic value of what society has labored to produce?

This brings us to the seventh and final component of the U.S. economy [tier seven]: the financial services industry we call Wall Street, where the arc of wealth inequality just got a lot shorter.

Wall Street

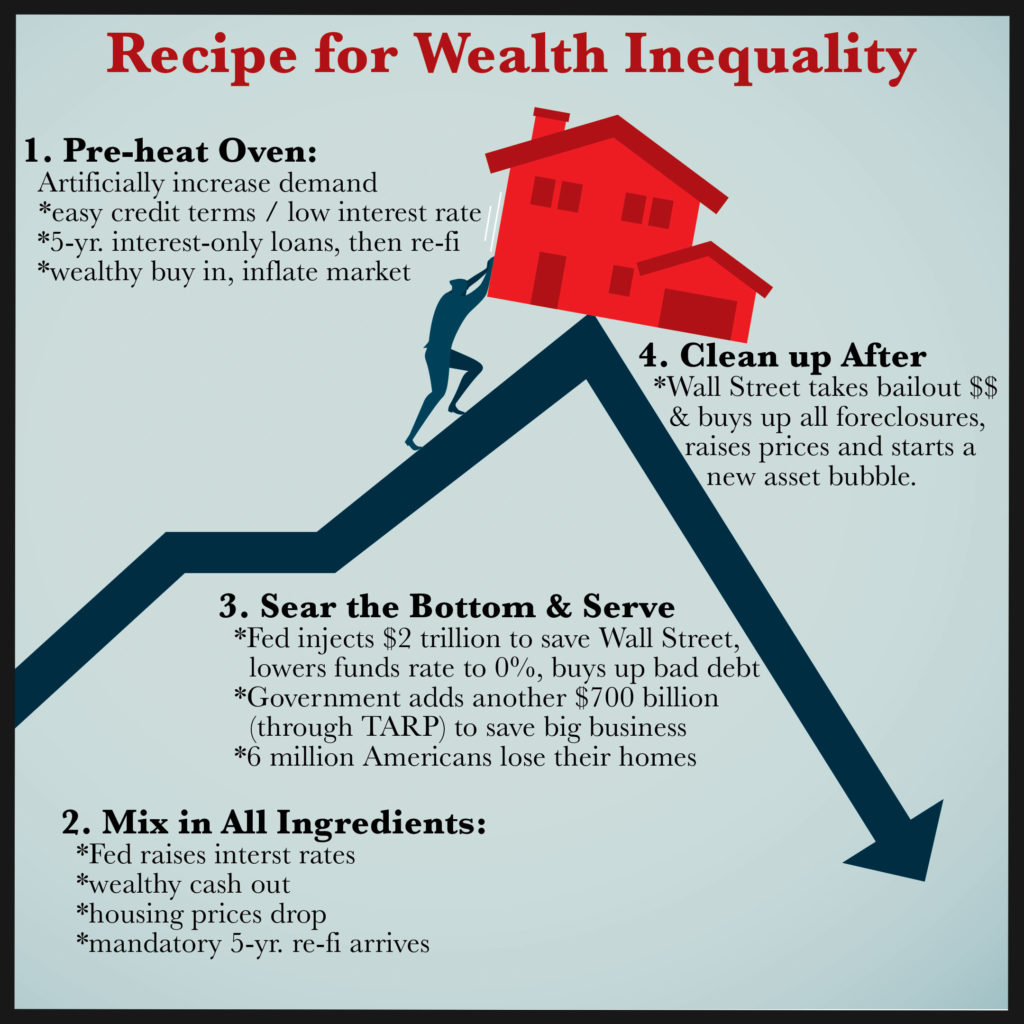

According to Steve Denning over at Forbes, the IMF calculates that the private sector had issued credit equal to 184% of GDP during the period directly after the housing crisis (where reaching 80% is considered excessive). When there is too much money floating around in the economy, it actually drags economic growth down a couple percentage points, from a healthy 3-4%, to a “dismal 1% to 2%”, as recorded during that 2011-2014 period; so why was Wall Street issuing so much credit directly after the housing fiasco they helped create?

They were just doing what they always do: buy low and sell high; curiously, they seem to especially buy big when the blood in the streets is their own. During the period directly after the 2007 crisis, Wall Street investors swooped in and bought up 200,000 foreclosures, then turned those houses into Wall Street rentals, effectively making them 21st century feudal landlords.

Wall Street is a gambling establishment; with no-limit to the betting, the wealthiest really are not gambling at all. When a gambler has the most money, he simply bids everyone up beyond their price range, until they are forced to fold, but the Wall Street gambler knows that money isn’t really worth anything until it is exchanged for real assets, and that the value of real assets can go up and down, making the value of money go down and up. It does beg the question whether the wealthy are greedy stupid, or greedy smart. Are they causing the creative destruction of the market on purpose, or just so wealthy that they cannot help—per their ‘rational self-interest’—but snatch up the remains of every fire sale in which they were the ones caught playing with matches? If they were greedy smart, they would, of course, intentionally lure fish (and their assets) into the game, simply by offering them ‘credit’ with which to gamble, as long as it comes attached, of course, to some form of ‘collateral’.

The Art of the Hedge

Thinking of owning your own home? It’s barely 2003, and interest rates are lower than ever before; banks don’t care about your credit or income, so you can put zero money down on a house and secure an interest only payment for up to five years. In a sluggish economy, no one is going to stop you; realtors need a sale, the bank needs a sale, and besides, Wall Street is going to bundle it all up into AAA mortgage-backed securities and sell it off to the world. After the dot-com wave crashed, investors were ready to hop onto a new wave. Collateralized Debt Obligations. Mortgage-Backed Securities. Why not? Just to be safe, though, better make the bet, then hedge the bet (bet against yourself with a credit-default swap in the derivatives market), and insure your bet (with someone trusty, like AIG insurance). If all else fails, the Fed will fix it, and if it gets really bad, the American taxpayer will pick up the tab. They’ll have no choice; with so much extra money and nowhere to spend it, Wall Street logically invested it in the ultimate hedge fund: the financial safety net known as Congressional representatives, bought and paid for legally (#CorporateWelfareSystem).

When the music stopped, Lehman Bros. was left standing alone. Bear Stearns and Washington Mutual were absorbed by JP Morgan, with an assist from the Federal Reserve (who bought up most of the bad debt to sweeten the deal). The Fed bailed out the Bank of America in exchange for them absorbing Merrill Lynch and Countrywide Financial. In the end, AIG had to be bailed out, or it would have taken the entire global economy down with it; at that point, people would start to talk, and capitalism would most assuredly have to be reevaluated. (When you are wealthy, you can even control evolution).

Meanwhile, bailing out AIG also saved the average citizen, who lives in a country where basic certainty is out of their price range. It seems safety nets and hedging bets are inherent to the species: ‘insurance’ is yet another way for investment companies to siphon money from those who already don’t have enough—who live in constant uncertainty—so naturally would pay tithes to the Financial Church of the Sacred Dollar, in order to ‘hedge their bet’ in the afterlife (aka ‘life’ insurance), or at the very least buy themselves a financial safety net in 360 easy monthly installments, for that one time when they become a ‘statistic’ and get knocked off the financial tightrope our country has built for them. Six million Americans had to walk away from their homes. Taxpayers got stuck with a $498 billion bill. Like a parasite, Wall Street has latched onto the real economy, and is slowly draining it of its liquid capital. Will they get too fat and explode, or eventually grow large enough to swallow the whole world?

Wall Street funds 72% of our U.S. economy, yet only adds about only 8% to our GDP; they don’t create economic growth, they just fund it. Similarly, they don’t own the businesses, they just own the infrastructure where the businesses operate. A real estate investment trust (REIT) “is a company that owns, operates, or finances income-generating real estate” according to Investopedia, and they are financed by a pool of investors who generate a portfolio of real “apartment buildings, cell towers, data centers, hotels, medical facilities, offices, retail centers, and warehouses.” This, of course, is the latest chapter in How to Be a Billionaire: to own the platforms, the infrastructure—the ‘marketplace’ itself—where the economy does all its business (Amazon, Facebook, Google, Banks, and Commercial Real Estate). Now, thanks to buying up all those foreclosures (with extra cash they just had sitting around), Wall Street investors have started a new housing bubble, except this time they’re confident it’s not going to burst, because now they own the bubble. If those Wall Street types blow rent prices up too high, though, the people may be forced into bursting their bubble.

The Federal Reserve to The Rescue: The Subprime Housing Crisis (2007)

When Wall Street climbed to the top of the food chain, it built itself a financial vehicle the size of a monster truck, capable of rolling all over the real economy. If Wall Street is the vehicle for wealth inequality, the Federal Reserve is their financial accelerator pedal.

Ben Bernanke, Chairman of the Federal Reserve at the time of the 2007-2009 financial crisis, labeled the phenomenon of cascading economic uncertainty the “Financial accelerator”: “Bank failures fueled economic weakness, which fueled even more bank failures, which in turn fueled further economic weakness.” (Neil Irwin, The Alchemists) During the 2007-2009 financial crisis, the Federal Reserve was tasked to step in and hand money to the very entities who drove everyone off the road of financial certainty in the first place. Here are a few of the Fed’s strategic responses, some legally part of their job description, others not so much:

- Lowering the Fed funds Rate (2007-): during the financial crisis, the Fed gradually lowered the rate at which banks can lend and borrow money from each other; starting at a high of 5.25% in the summer of 2007, the Fed dropped the interest rate all the way to 0% by 2008, where it stayed for over seven years. The Fed further broke with convention and extended these free money loans to large Wall Street firms like Lehman Bros., Morgan Stanley, Goldman Sachs, etc., who were not legally the Federal Reserve’s responsibility at the time.

- Currency Swaps (2007-2014): the Fed traded dollars for Euros and other currencies, allowing the dollar to continue circulating overseas. Later, it auctioned off money, trying to push it out to the highest bidder –often overseas affiliates—because lending was essentially frozen in the U.S. during the financial crisis. The Fed essentially “laundered” our money overseas, as well as sold off our mortgage and credit card debt to other countries; by trading these “poisonous” mortgage-backed securities to everyone, Wall Street and the Fed exposed the entire world to our risky business schemes.

- Quantitative Easing (2008-2014): The Fed bought up the ‘bad’ debt and mortgage-backed securities of Wall Street, taking them off the market in exchange for injections of ‘clean’ money – over $2 trillion in all—to save the financial sector, on the theory that this would allow regular people to be able to save themselves. Dealers from JP Morgan and Citibank were the ones buying up these bonds, and thus retained control of the economy, which did not bounce back until mid-2014, six years after this program was initiated (new evidence suggests that Wall Street purposely prolonged the crisis further in order to profit from it). The difference between Wall Street and the real economy was even more dramatically illustrated during the recent pandemic, when the Fed injected QE money into Wall Street such that the markets reached an all-time high at the same time the real economy hit an all-time low.

- Commercial Paper Funding Facility (2008-2010): the Fed, utilizing an “unusual and exigent circumstances” clause, lent money to 82 businesses, in order to help them finance loans to customers wishing to purchase their products. $738 billion in commercial paper was purchased from affiliates of eighty-two different companies, some of them big domestic and foreign banks: the Royal Bank of Scotland ($85 billion), Switzerland’s UBS ($77 billion), Deutsche Bank ($66 billion), the UK’s Barclays ($65 billion), Belgium’s Dexia ($59 billion), and Japan’s Norinchukin ($22 billion)—as well as U.S. corporations like Verizon ($1.5 billion), Harley-Davidson ($2.3 billion), Ford Credit, GMAC, Chrysler Financial Services, General Electric, Golden Funding Corp. (McDonald’s franchises), etc. Finally, the Treasury had to take this over; it was not within Fed monetary policy to hand money over to insolvent businesses; this fell under the category of fiscal policy. $700 billion was allocated from TARP (troubled asset relief program) that continued targeting insolvent U.S. businesses. Some of this money went toward executive bonuses; much of it went to simply keep these banks from insolvency. According to Better Markets, “the inspector general for the bailout found that lending among the nine biggest TARP recipients ‘did not, in fact, increase’”. The banks held onto the money they received, so not even government bailout money ever trickled down to people in the real economy.

- Operation Twist (2011): to not appear as though it was ‘printing more money’ (aka Quantitative Easing), the Fed exchanged some of its short-term Treasury securities for long-term Treasuries ($400 billion worth), which pressured the long-term bond yields downward. (It also purchased new mortgage-backed securities to help pay off the ones that were maturing, in order to avoid taking on more debt). The Fed found other ways to skirt the rules: they gave money to the banks, in order for them to buy up the bad debt sitting in our nation’s mutual funds. By pledging this purchased debt back to the Fed, the banks became an “intermediary” that did not have to incur any risk.

Each of the major central banks had taken steps beyond any it would have considered possible…The Federal Reserve had rescued investment banks and insurance companies, maintained zero interest rates for four years and counting, and bought $2 trillion in bonds through quantitative easing…And all for what? The economies of the major Western powers were a shambles, with the United States, Britain, and all but the strongest European nations producing well below their potential. In the summer of 2012, there were thirteen million more people jobless in the European Union and the United States than there would have been if pre-2007 trends had continued. A generation of young people faced poor career prospects; a generation of retirees saw its life’s savings damaged by the crisis. In some European countries, extremists were on the march.

Neil Irwin, The Alchemists

Why did the Federal Reserve’s “wall of money” (as Neil Irwin put it) not stop the recession from happening? The Federal Reserve sent out its helicopter to dump liquid money on Wall Street, but apparently something about walls or helicopters full of money doesn’t solve the underlying problem. Perhaps we need a different analogy to understand what is really happening.

The Problem with Too Much Money

From the point of view of the people down on the bottom—in the real economy—our current economic system seems absolutely lousy at managing certainty and uncertainty. The big picture view from the top makes it all much simpler to see; for those who spend their entire careers only peddling one product, there is only certainty and uncertainty, and nothing else. It seems economically fitting that the Gods of finance should hold the fate of humanity’s certainty and uncertainty in their manipulative (yet allegedly invisible) hands.

The Secondary Market: Our Manmade Wave Pool

In the ‘primary markets’, Wall Street puts businesses who wish to ‘go public’ next to investors who have excess money and wish to make even more of it (these can include individuals, other companies, institutions, or even foreign governments). The new company gets ‘equity’—or cold hard cash—in exchange for giving investors an ownership stake in the business, in the form of ‘shares’. The Secondary Market is for public trading of the stocks initially sold to investors. The stocks now have a life of their own. Let the certainty and uncertainty begin.

In a market where one store of value (money) is used to secure another store of value (stocks or ‘shares’), the public ‘stock’ market essentially becomes a giant wave pool of rising and falling value, or more precisely, rising and falling Certainty.

The medium used to fill the pool (liquid capital) forms individual waves of certainty that reach a ‘peak’ then ultimately break into ‘troughs’ of uncertainty, and when more liquidity is added, the waves rise even higher. The professional financial ‘surfer’ hops on and easily rides these waves of certainty, quite ‘certain’ himself that he possesses the skill to peel off before the wave peaks and bottoms out.

Any professional gambler loves when there are fresh ‘fish’ in the game; it just puts more money in the pot for him to win. The amateur investor, who finally comes into a little extra cash, cannot seem to help jumping straight into this wave pool and swimming with the sharks. In a manmade wave pool, however, it is important to remember that something artificial moves along underneath the water, helping to push it up.

For example, let’s say that a professional gambler is sitting on vast shares of Haliburton, and a pandemic strikes. Suddenly, no one is using oil. In the real economy, the price of oil did drop quite radically, from $60 a barrel to -$30 a barrel at one point in April, 2020, but oddly, it didn’t do this until well after the stock market dipped first. In February 2020, Haliburton stock stood at $22 a share. If, for example, someone (or several someone’s) sold off enough shares of Haliburton, it would surely send amateurs into a panic. By March of 2020 (still a month before oil actually took a dump), Haliburton was down to $5 a share. The professional gambler, who sold his shares for $22, could now buy the dip he helped create, scoring over four times the number of shares he had originally owned (think 200,000 foreclosed houses), using the money he had parked over to the side for a couple of months, perhaps financing some other sketchy deal.

When the price rises again to $22, the professional gambler nets 440%, without the value of Haliburton shares rising at all, only falling, which is much easier to manipulate. Meanwhile, during the same stretch of time, “the Fed bought corporate bonds from at least 95 companies that issued dividends to shareholders while also laying off workers.”

Just imagine how many dirty deals are going down in Gotham City, while the rest of the people wait for a superhero to rescue them, who turns out to be a rich dude as well. It’s a game where companies are legally allowed to buy back their own stock, in order to artificially drive up the price; Pete Rose bet on his own baseball games, and they banned him for life, but to be fair, Wall Street is not really about competition, it’s about Control, and by slowly financializing everything in the economy, Wall Street can now make waves big enough to drown the whole world.

Asset Bubbles: The Waves of The Future

Some economists will explain that ‘asset bubbles’ bursting preceded every economic collapse we have ever had. Some will claim there are no such things as asset bubbles. Perhaps they can say this because these bubbles are simply caused by there being too much money and too few places to put it. George Soros devalued the English pound one time, sending England into a recession that crashed their entire housing market; all he ended up with is even more money. When the ‘average citizen’ has too much money, it suddenly takes a wheelbarrow full of it to buy a loaf of bread; when the wealthy have it, though, it usually goes into stocks (tech stocks in 2000), real estate (housing in 2007), commodities (2008, 2011), and bonds (2021). Oil has always been a good ‘go to’ in a pinch (2008, 2014, and 2020), and recently, investors have even stooped to driving up cryptocurrencies like bitcoin (2021).

Many have likened asset bubbles to Ponzi or a pyramid scams, where the ones who start the pyramid get paid by the next tier entering, cashing out before the bottom tier finds out there is no one left to scam. The real scam is the money itself, good for nothing except hoarding more and more assets, which will only drain one’s money further, unless they are turned into investments. Ironically, the people who purchase more and more stuff only end up giving it away for someone else to enjoy, while all they get in exchange is more money. This constant wave of financialization sweeps through the economy, slowly dragging loose whatever isn’t securely tied down. In the geology of finance, the erosion of the real economy is merely a product of time, and the pressure exerted by money; in the double-edged sword of wealth accumulation, those who utilize time and money literally wind up with nothing in the end but time and money.

The Devil Makes Work for Idle Money

A. Tax Breaks for the Top

Part of President Ronald Reagan’s ‘voodoo’ economic policy, the tax rate for those at the top was first dropped from 70% to 50% (1981), and then again to 28% (1986), in order for the wealthy to invest more, whereupon the money would allegedly ‘trickle down’ to the rest of us. In reality, the money trickles upward, as citizens are forced—through leases, mortgages, or rent—to give up whatever small amount of money they do acquire through their labor.

B. Deregulation

According to Christopher Witko at the Washington Post, President Bill Clinton’s Financial Services Modernization Act of 1999 was not only when the regulatory chains were cut off the financial sector, but was also the moment when Democrats turned away from the unions and their fight for livable wages, and joined with the Republicans to support the banking industry and white collar professional.

C. Money as Free Speech

‘Playing both sides against the middle’: to gain an advantage by setting opposing parties or interests against one another.

In Citizens United v the Federal Election Committee (2010), the Supreme Court ruled that government had no authority to restrict the “independent expenditures” of corporations and other associations who wished to further or hinder any candidate’s political campaign, and thus the ever-fluid medium of money could now flow freely into the area of ‘free speech’. Money talks, the Supreme Court listened, and while speech is still free, the price of listeners has gone up significantly.

D. Union Busting and Wage Stagnation

Since President Franklin Roosevelt signed The National Labor Relations Act in 1935, corporate America has been steadily chipping away at it. Right to Work laws, which in 1944 began a campaign to bust up unionization, got stronger legs with the Taft-Hartley Act of 1947, and has continued its campaign to the present day, with wealthy donors like the Koch Brothers, the U.S. Chamber of Commerce, the Tea Party, and other corporate-leaning interests.

II. Eliminating the Flaws: The Big Re-Think

As stated before, economies are built, like EVERYTHING, from the ground up. For this reason, we will start with The Third Option’s economic foundation: a National Public Bank.

- The Third Option would replace the Federal Reserve with a National Public Bank, that will have branches in every community of 100,000 people. The National Bank would have sole power of money creation in the U.S.; new money would be divided equally among the approximately 3,300 branches. If any private banking would still wish to exist, it must borrow the money at the set National Bank funds rate of 4%, and like any bank loan, it would need to be paid back in full. In this way, if any private bank is forced to default on their loans, the National Bank would simply absorb them, much like JP Morgan Chase has done from within the private sector.

- It is important to note that in the current model, private banks are the foundation, and the Federal Reserve is tasked to herd these financial cats along, making sure they do not go too far astray and make a mess of the overall economy. The National Bank is a true Central Bank; all the money goes out of it, and all the money comes back into it; the ‘branches’ are only there to facilitate lending within each community.

- The National Bank would represent everything that Americans co-own: the money supply, the land, the infrastructure, and the natural resources (the ‘platforms’). It would begin with an eight-year plan to rebuild all community infrastructure: housing and commercial buildings (built, because of massive economies of scale, at $100 per square foot, and either rented for a cost of $1.20 per square foot per month, or sold ‘at cost’ and financed through a loan from the National Bank), a new fiber-optic communication grid, a new green energy grid, a new community center, new public school restructuring, new universal health care facilities, new regenerative and vertical farming infrastructure, new water and waste management systems, and a new clean energy transportation grid.

- The money used for these essential needs loans would not be ‘created out of thin air’, but would come from a new 10% income investment, which would replace the current income tax system. Taxation, more than anything else, is lazy. There is no such thing as a ‘sunk cost’; whether it’s research and development, infrastructure, or equipment and supplies, if it is essential to even one member of society, then it is a sound investment, and therefore the money needed to produce it can be easily recouped. The average citizen does not have money to waste, and apparently, the wealthy don’t either, judging by how far they will go to not pay any taxes. 10% of all American incomes would be ‘borrowed’, deposited into the National Bank, and invested directly into communities, which would immediately create employment opportunities in essential needs fields (as well as local small businesses). Employment would allow everyone to pay their monthly bills (housing, electricity, communication, etc.), which the National Bank would collect, in order to pay back the community infrastructure loans (at 4% interest). Because the money originally came from the people, who lent it to themselves (through their National Public Bank), they would get it all back later as ‘retirement dividends’ (a more equitable and sustainable version of our current social security). 10% means one-tenth of everyone’s gross revenue for that year; there would be few—if any—deductions (and remember, corporations are now people, too). With no money being created, no money would be destroyed; both principal and interest would accumulate in the National Bank and represent the collective effort of all U.S. residents. This, in essence, would become the new measure of economic growth.

- Although this money represents the ‘deposits’ of all residents, it cannot be withdrawn directly for any reason, therefore ‘bank runs’ would effectively be eliminated.

- By setting the prices on all essential needs (‘at cost’ plus 4% interest on the loan) prices would remain stable for these items, which would allow the wages paid in order to produce them to remain stable as well. The ‘cost of living’ would now be lowered, so that someone making $15 an hour / 30 hours a week could pay for all their needs, add to their retirement, and still have over $600 a month to spend on ‘growing the economy’.

- Businesses would also benefit, because they would no longer have to offer any health or retirement benefits—neither would they have to raise wages past a minimum of $15 an hour, or minimum salaries past $31,200 for full-time equivalent employees; meanwhile, with social security being covered by the new retirement dividend, ‘payroll taxes’ would soon be phased out as well.

Before going further, it is important to explain that a National Public Bank is not only Constitutional but is, in fact, the only money-creating source that is Constitutional. In America’s colonial days, hyperinflation was rampant, as each colony ‘privately’ issued its own paper money, devaluing the goods and services throughout the territory. For this reason, The Constitution established that no state would be allowed to issue ‘fiat money’ (paper currency); only the federal government had the “power to coin money, establish currency and determine its value.” In the ‘Legal Tender Cases’ of 1871 (Knox v. Lee and Parker v. Davis), the Supreme Court “affirmed the constitutionality of paper money.” In Juilliard v. Greenman, the Supreme Court declared federal government the only power allowed“to provide a national currency.”

When the First Bank of the United States was rechartered, and became The Second Bank of the United States, it was challenged by private bankers who believed it would interfere with their business. In McCulloch v. Maryland (1819), the Supreme Court affirmed the constitutionality of National Banks once again.

Private Banking, on the other hand, had absolutely no Constitutional backing, but did have the help of two patron saints:

- Eventual U.S. traitor Aaron Burr, who killed National Bank founder Alexander Hamilton, and illegally smuggled private banking into existence, through a Manhattan Water Company (that eventually became Chase Manhattan, before it was absorbed by JP Morgan Chase & Co.), and

- Andrew Jackson, who vetoed a constitutionally approved National Bank, and essentially handed the power of money creation over to private interests.

Now, the private banking tail wags the federal government dog by forcing the issuance of more and more currency (by the Fed) to match the amount of ‘credit’ that private banks create whenever they lend money. With the National Bank gone, and the country marred by constant economic instability, it became apparent that a Central Bank was needed after all; the private sector managed to create one of those out of thin air, too; unfortunately, the private Central Bank is only there to cover for the private banking industry, with the strategy that protecting the wealthy, no matter what collateral damage results among the general population, will keep American financial interests intact (ironically ‘preserving the Union’ by severing it). It should also be noted that government managing its own money supply, through a National Public Bank, in no way infringes on the ‘liberty’ of the wealthy, though they might reasonably ‘feel that way’, considering 1% of us do hold a majority share of the money supply at this time.

A huge component of The Third Option Plan is Sustainability, and this also means financial sustainability: to create an infinitely recyclable economy and turn debt into credit, then into dividends, meanwhile turning our usual sunk costs into benefits. We refer to The Third Option plan as Democracy’s version of Capitalism, because we intend to utilize all the tenets of sound economics, and only leave out the parts that were added to ensure one group would continue to profit at the expense of another.

The Third Option has a plan to minimize every so-called ‘sunk cost’:

- We will drop the price of U.S. healthcare from $4.1 trillion to less than $1 trillion.

- Eliminate profit-seeking (by declaring healthcare an essential need),

- Use economies of scale for all infrastructure, equipment and supplies, plus drive big pharma completely out of business if they do not lower their drug prices to our liking (we do not care if we build our own pharmaceutical plants (through the National Bank), we do not care if we invoke our fifth amendment right to ‘eminent domain’ over patents, as they are considered property that is legally protected by our government anyway, so can be ‘unprotected’ if we deem it ‘necessary and proper’),

- Employ individual health care taxes for the use of products, services, activities, etc., that are proven to have direct negative health effects (tax rates would be calculated to cover the financial cost of all healthcare needed to treat these effects),

- Fund cures for Cancer, Alzheimer’s, MS, PTSD, etc.

- We will pay for the entire infrastructure of every community through the National Public Bank, and by people paying cheaper versions of their regular monthly bills (house, car, electricity, communication, water / sewer, food, etc.), pay it all back with interest, whereupon the people will get all their money back—via ‘retirement dividends’—that will become the new, more sustainable version of social security.

- We will drop the cost of our U.S. military from $1.2 trillion to $210 Billion. War is all about property rights protection; by assessing a 1% Land Value Tax, at least $210 billion could be collected for the military (China, our next highest-spending competitor, only has a $196 billion budget, for example, though some claim it is as high as $260 billion). If the people who own property wish to vote for it, the land value tax could be raised as high as 5%, in order to reach the current $1 trillion we spend on war. (To deter the likelihood of war against us, we will not only begin a Global Peace Project, but will also forbid our military industrial complex from selling weapons to anyone else, either, under threat of treason; at least we will not be killed by our own weapons.)

- We will have our children payback their entire public education by helping us with essential needs work like recycling, childcare, tutoring, vertical farming, healthcare, elderly care, computer coding, construction, plus any entrepreneurial endeavors they wish to pursue.

- We will change the prison rehabilitation program to reflect a ‘do-over’ for American citizens caught within that system, because they ironically were victims of the system first, and acted out, in many ways, to communicate how the system had treated them. For this reason, we will give them each a two-year ‘timeout’ to get healthcare treatment (addictions, mental health) while they work on a two-year associate degree in some essential needs field. Then, they will be given employment. The cost of their rehabilitation will be taken straight out of their National Bank account, so no taxpayer money need be utilized, while economies of scale would reduce their cost to only $12,000 overall.

- In order to turn our National Debt into retirement dividends, continuous chunks of it will be dropped into our National Public Bank, to pay it down during periods where no essential needs infrastructure is on the federal, state, or local dockets,

- The cost of Federal Government will drop from $6.82 trillion (2021 was a bad year) to $400 billion (which is minus the National Debt, as this will be paid off through the National Public Bank). Overall, we have eliminated military costs ($1.2 trillion) [now covered by 1% Land Value Tax], social security costs ($1 trillion) [now covered by National Bank Retirement Dividend], healthcare costs ($1.1 trillion) [now covered by Universal Healthcare System], rehabilitation costs ($84.6 billion) [now covered through the National Public Bank], and welfare costs ($361 billion) [now covered by Universal Healthcare System and National Public Bank infrastructure]. Meanwhile, the bulk of the remaining $400 billion cost will go to employee salaries, but their job description will change: they will work in their districts most of the year, helping ensure their communities are fully implementing the National Bank mandate.

- Part of the Federal responsibility is the protection of our lands. We will set it up so our National Parks receive a $24 billion loan from the National Bank to fix them up, plus provide amenities—that when utilized by tourists—will effectively pay back this loan, and perhaps provide a further Return on Investment through time.

Does it Solve the Obvious Issues?

Issues that a National Public Bank helps solve:

- Agglomeration as a Reward and Not a Penalty: businesses utilize agglomeration to increase their economic efficiency and effectiveness, meanwhile, people—as consumers—are penalized for it. By turning taxes into investments, A National Public Bank rewards people for the efficiency they create together. In the area of essential needs infrastructure, especially the larger platforms, the Bank will utilize economies of scale to deliver an affordable life for everyone. For instance, in laying down a communication grid in a densely populated area, the cost for 100,000 people would be $3.78 per month per person, while in a sparsely populated rural area, the cost would go up to $10.23 per month per person. Currently, customers might pay $62.77 per month for internet coverage in the city, while in rural areas, if one gets internet at all, it might cost around $45 per month. The cost to build a house in California is $240 per square foot; in Oklahoma, it’s $111 per square foot. Fiber optic cable and wood do not cost more in densely populated areas; this is simply an example of economic rent being extracted, under the guise that demand somehow drives up the price of supply. Supply and Demand, rational self-interest, inflation and talk of ‘scarcity’ are all natural laws in an economics of oppression, which legitimize, more than anything, the flaws in our human character, and thus encourages them. Democracy is about fairness, so if anything were to be both essential and truly ‘scarce’, our business model would need to change, in order to deliver it more sustainably.

- The Elimination of Economic Rent: through the National Public Bank, Main Street would now be owned by the people, who create a real ‘market’ economy when they collectively congregate to do business; this is the original meaning of a ‘free market’. If people still prefer large franchises to exist in their community, those businesses would at least be charged rent by the community for infrastructure (buildings, roads, electricity, communication, etc.), as well as the land they occupy.

- Replacing Scarcity with Sustainability: Through a National Bank, all the energy, transportation, and agriculture could be made clean and sustainable. Similarly, materials like timber, concrete, steel and plastic could be made cleanly and sustainably, and even infinitely recyclable. The planet is a finite space, and until we learn to manipulate the atomic structure of some elements in order to create others, we will have to perfect recycling strategies, and learn to want what we already have.

- The Problem of Value: Regardless of their immense value, when it comes to our essential needs, prices must remain stable. We would continue to remove the problem of scarcity, through renewable resources, infinitely recyclable materials, smart design, etc. If we give Americans an affordable option for basic needs and remove the strategy of flooding the economy with too much money (which allows the owners of the money to artificially inflate prices), the damaging effects of fluctuating value would not ‘trickle down’ to the average American.

- Renewing Trust in Government: In truth, people actually distrust the financial services sector, and therefore are extremely disappointed and frustrated with their government, for allowing Wall Street to take precedence over the rest of us. In every instance, centralization of power has only made it easier to corrupt or manipulate it. The National Bank, by empowering 3300 communities with their own funding, makes it impossible for anyone to gain a significant foothold in our government, and would hopefully empower even more diversity and nonconformity among us. Decentralization of Power—by giving it equally to every American—is the antidote to eliminating Control.

- Meanwhile, the wealthy continue to fuel this distrust through its private media corporations, its private political party, and every politician it has helped place in positions of power; still, this does not fully explain how it receives support from average Americans. Gerrymandering aside, research shows that eight out of the top ten (and 17 out of the top 20) states receiving the most welfare are republican states (red states get an average of $1.35 from the federal government for every dollar they spend themselves). Republicans, who talk a good game when it comes to abolishing government welfare, are quietly propping up their voters with government handouts just the same.

- What the wealthy really seek to gain, through their anti-government rhetoric, is access to the taxpayer’s money, which currently goes toward government programs such as social security, education, prisons, postal services, transportation, and healthcare, etc. What the average citizen may not comprehend is that when the private sector calls for the ‘privatization’ of these public services, they only seek to manage these businesses, then send taxpayers the bill. Private charter schools receiving tax funding are a source of constant fraud and mismanagement issues. Private Prisons make profits from cutting corners and overcharging government for basic services. Pharmaceutical companies overcharge Medicare and Medicaid for prescription drugs simply because government cannot say ‘no’. We have to get the private sector out of our pockets; with the National Bank, we can eliminate private sector extortion of our tax money by eliminating the concept of income tax altogether, meanwhile investing in our own affordable versions of these crucial goods and services.

- Maximizing Rational Self-Interest: in the beginning, there was dependence on others in order to survive, which made it easier for hierarchal forms of oppression to establish themselves on top. Independence—to get everyone to stand on their own—is preferred. By establishing a National Bank, it not only creates an environment where independence is easier to achieve, it ties our fates together, so we are collectively rewarded for it; this, in essence, is how eventual interdependence can be reached. The current system is designed to exploit dependence for the benefit of a few; the new system would be designed to exploit independence, for the benefit of everyone. Maximizing the rational self-interest of all would turbocharge economic growth much more effectively than only facilitating the rational self-interest of a few.

- Managing Certainty and Uncertainty: economic downturns occur when people feel uncertain about their future. By the National Bank allowing everyone an affordable life, and paid retirement, people would have extra money to spend; if they support local business with it, that money would come back to them as well, because of our collective investment in local business through the National Bank. In the current model, small businesses and homeowners fail because the current economy gives them no real chance to succeed; they immediately must compete with big businesses and wealthy landlords. The success of the National Bank (aka economic democracy) would depend on every citizen investing in themselves, and communities clearing a path for them to succeed. This would facilitate unprecedented economic growth, to the benefit of every stakeholder. The object of competition would no longer be to destroy the other competition, but instead to push each other to the limit of our collective skill level, efficiency, ingenuity, and perseverance; in this way, everyone benefits. The true believers of capitalism, deep down, want this same result, but the economics is flawed, and drives us toward a more corrosive (and less efficient) arrangement.

- Eliminating Inflation: even a capitalist economist would concur that monopoly control causes inflation, because there is no ‘competition’ to keep prices in check. Currently, however, the private sector has a monopoly on economics itself. Because of this, areas such as private healthcare have learned that if they all raise prices together, they can collectively monopolize the healthcare industry to their individual benefit, proving that even competition may not work anymore as a method to stabilize prices. When Wall Street raises housing prices, it even influences individual landlords to hop on the asset bubble. Meanwhile, witness the rise of cryptocurrencies, as people seek alternative ways to operate outside an economy that does not serve them. The National Bank is already Supreme Court certified. It utilizes the government of the people to legally collect income, extend credit, and offer services ‘necessary and proper’ toward the general welfare of its stakeholders. The private sector would have to match prices, or offer much greater quality, in order to compete, or else slowly be absorbed into this new economic engine; either way, it would be a win / win for people.

- Align Democracy with Capitalism: in essence, the National Public Bank turns the United States itself into a giant conglomerate, which is managed by the ‘parent company’ (government), which currently has 330 million stakeholders, each with an equivalent amount of shares (one). In this way, all property falls under United States ownership, not to control it, but to protect it further, from any kind of hostile takeover. In order to decentralize authority within the conglomerate, the National Bank, and not some individual CEO, would delegate power, through ‘capital’, to each subsidiary district. Under this management system, a senator could be seen as a ‘regional manager’, and a representative would be considered a ‘district manager’. Again, competition among districts or communities would only further overall economic growth, which would lead to Gross National Happiness (GNH), because internal drive (passion) is much healthier than being externally driven.

- Reframe Property Rights: The National Bank / U.S. Treasury (through its constitutional mandate “to lay and collect taxes”) would connect all stakeholders to the nation’s resources (water, air, land, money, infrastructure, mineral resources, etc.); resources essentially become part of a ‘trust fund’ or holding company, representing the total shared wealth of the nation. Initially, individuals would still retain ownership of the surface property. Mineral rights would be separated out, and eventually become the property of the people’s ‘trust’ (there may have to be compensation given in some cases where mineral rights have already been sold off separately from the land). Next, residents and business owners would start paying ‘land rent’ to the holding company, in the form of an annual Land Value percentage; in other words, we would disconnect the land from the house, business, or other fixed ‘improvements’ upon it, which the ‘owner’ would retain. They would no longer own the land, however; it would become the property of the United States Trust, and what we now call property tax would instead become ‘land rent’, paid to the Trust, for the right to occupy that piece of land. The improvement would legally tie them to the land, so selling the improvements to someone else would also legally tie the next owner to the land. Through this, the intrinsic value of land could be more accurately measured and assessed, housing and other improvement prices would become more a matter of square footage, and the value of the land, whatever its designated cost, would become a shared asset; the rent would most likely used to protect and maintain the land (as mentioned previously), versus generating some actual monetary dividend for U.S. stakeholders.

- Align Money creation with GDP: it is difficult to know what people will value; the private economy can continue to take its chances on non-essential goods and services, but the National Bank strategy would be to deliver only essential needs, where production could easily precede finance; this would keep the money supply in perfect alignment with consumption for this part of the economy. Small or local business, through the National Bank, would be designed to scale up slowly and grow in accordance with its popularity, so entrepreneurs would do little to expand the money supply in any significant way, either. Replacing the Federal Reserve with a National Bank would make the most significant impact, as any injection of liquid capital would have to go straight to the root; it could no longer be helicoptered down from above.

- Minimize the Effect of Money in Politics: in order to facilitate civic engagement, the new communication grid—built through the Bank—would provide information on every candidate—local to national—and give each one equal time online to present their plan for improving the community, district, or region. Each Community would also utilize the communication grid to solve problems locally, vote on important issues, and maintain an informed citizenry. The role of politicians would now be to facilitate the hands-on management of their community’s development, rather than their current purpose, which is unclear.

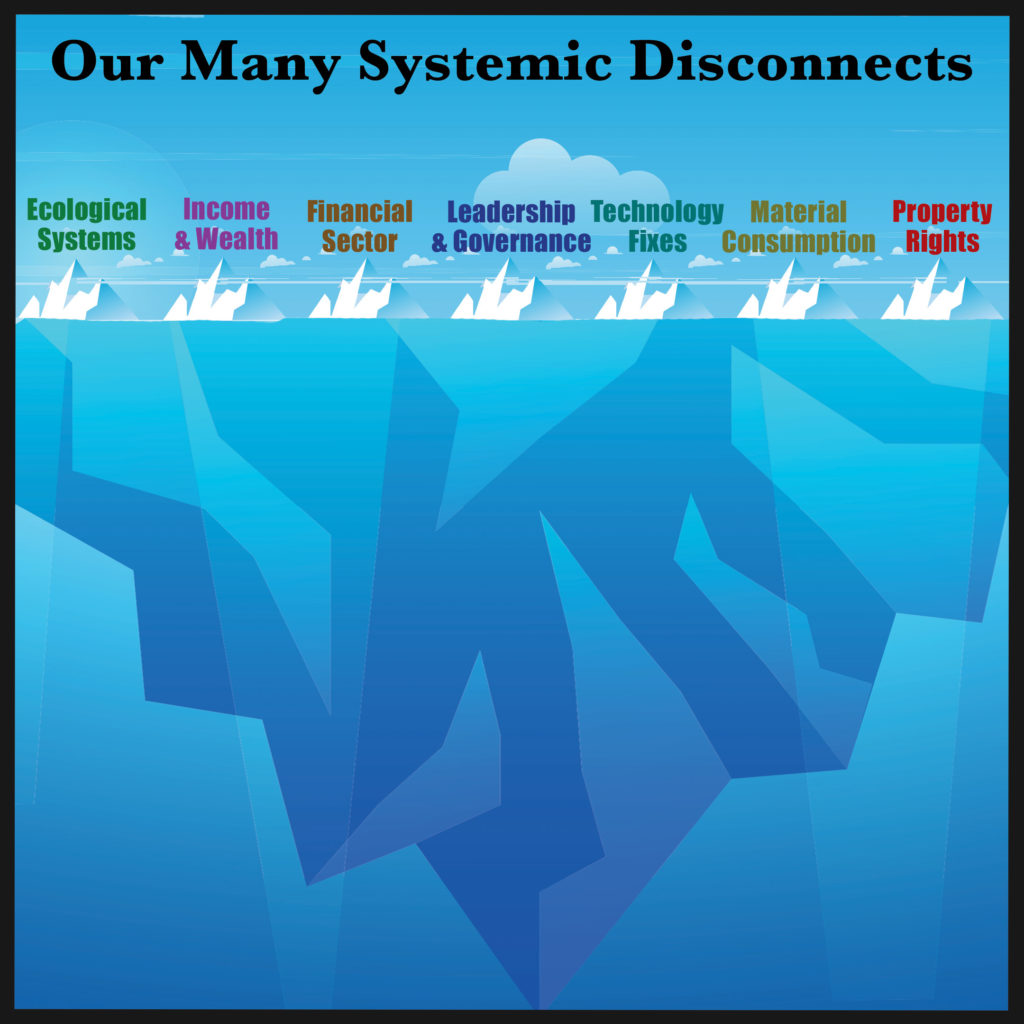

Our Litmus Test: Comparing Notes with Otto Scharmer

In his book Leading from the Emerging Future, Otto defined eight systemic disconnects that prevent us moving forward as a society. They are:

The ecological disconnect:

We consume resources at 1.5 times the regeneration capacity of Planet Earth.

- Doing things more sustainably is costlier, and thus ‘less profitable’—which is a deterrent in the current model. A National Bank would empower the sustainable consumption of resources, because cost has been turned into investment, thus expense no longer becomes an issue (the more expensive sustainability is, the more our eventual ‘return on investment’). In this way, financial payoffs are now connected to environmental payoffs.

The income and wealth disconnect:

The top 1 percent of the world’s population owns more wealth than the bottom 90 percent, resulting in… unmet basic needs…

- People do not need financial wealth, they need resource wealth, in the form of the essential needs that drive feelings of safety and security, and lead to belongingness, esteem, and self-actualization. The National Bank will provide this ‘Certainty’, by connecting everyone to these much-needed resources.

The financial disconnect:

Foreign exchange transactions of US$1.5 quadrillion dwarf international trade of US$20 trillion…this disconnect is manifest in the decoupling of the financial economy from the real economy.

- The National Bank is a financial tool that can only be wielded by individuals at the Community level (aka the ‘real economy’). While the financial sector has attached itself to the real economy parasitically—in order to drain it of its power (aka assets)—the National Bank is a true financial power source. Communities would plug into that power source, and ‘pull the plug’ on the current financial sector, in order to sever this parasitic connection.

The technology disconnect:

We are hitting the limits to symptom-focused fixes—that is, limits to solutions that respond to problems with more technological gadgets rather than by addressing the problems’ root causes.

- The National Bank is specifically designed to strike at the root of every problem. By becoming the financial root of a new economic model, everything connected to it will grow forward, free of parasitic attachments from above. If any National Bank endeavors prove to be cancerous to society at any time, we would have the power to ‘pull the plug’ on financing it, with a two-thirds vote from Congress.

The leadership disconnect:

Decision-makers are increasingly disconnected from the people affected by their decisions. As a consequence, we are hitting the limits…to traditional top-down leadership that works through the mechanisms of institutional silos.

- The National Bank turns government representatives into managers tasked with problem finding and solving at the grassroots level. This would directly connect representatives to their constituents, in order to lead from the bottom up, not the top down; their effectiveness would now be based on how positively they impact the community of stakeholders who hired them.

The consumerism disconnect:

Greater material consumption does not lead to increased health and well-being…a problem that calls for reconnecting the economic process with the deep sources of happiness and well-being.

- The National Bank does not deal in what people want, only what they need; the current economy has generated a society of addicts, but through connection to education, opportunity and universal healthcare, The Third Option hopes to get the entire nation on the road to recovery.

The governance disconnect:

Markets are good for private goods, but are unable to fix the current tragedy of the commons…we are increasingly hitting the limits to competition.

- The National Bank is designed to create a healthy form of competition; it shares all information and resources, and basically challenges each Community to improve upon every model. With beta-testing at the local level, coupled with the connection provided by the Bank, the new communication grid, and our shared mandate to provide essential needs to every Community, the potential exists to scale up any system update in real time (which could come in handy during a pandemic, for instance).

The ownership disconnect:

[Because of] massive overuse of scarce resources…we are increasingly hitting the limits to traditional property rights.

- The National Bank connects all stakeholders to the nation’s resources (water, air, land, money, infrastructure, mineral resources, etc.), by placing all property within a collective stakeholder ‘Trust’; in this way, our nation’s assets can be more efficiently and effectively managed, so when problems require immediate attention (sustainability, climate change, pandemics, mass extinction of ecosystems, etc.) action could be taken in real time if necessary.

What You Can Do

In the upside down, backwards world we have created for ourselves, value is measured by how many people value it, whereupon ‘demand’ is formed, and supply allegedly follows. The more people hear about something, the more they will talk about it, and the more value it will begin to possess. (In reality, of course, each of us is valuable, regardless of whether anyone knows it or not, but I digress.) If you feel that reinstating the National Bank would be helpful to people in any way, perhaps you would do us the honor of spreading the word about that. Also, you could sign our National Bank Petition, and get our proposal heard by Congress, should the number of signees reach 100,000. Either way, you can go forward armed with a little more knowledge, which will make you better equipped to represent yourself. Someday, hopefully, we may all get the chance to do that.

News We Can Use: Top Takeaways from Andrew Yang

News We Can Use: Top Takeaways from Andrew Yang