Peter Barnes wants to upgrade our 18th century economic operating system to serve 21st century people, but over 300 years after Democratic Equality was established, people still fear it.

With Liberty and Dividends For All (2014) By Peter Barnes

Product details

- Publisher : Berrett-Koehler Publishers; 1st edition (August 4, 2014)

- Language : English

- Paperback : 192 pages

- ISBN-10 : 1626562148

- ISBN-13 : 978-1626562141

- Item Weight : 0.035 ounces

- Dimensions : 5.56 x 0.56 x 8.5 inches

- Best Sellers Rank: #1,708,373 in Books (See Top 100 in Books)

- #790 in Income Inequality

- #1,746 in Government Social Policy

- #2,593 in Economic Policy

- Customer Reviews: 4.6 out of 5 stars 22 ratings

About The Author:

Peter Barnes has been the most socially responsible entrepreneur he can be, but knows that a handful of fair-minded caring capitalists will not be enough to steer our economic system straight, and so he also continues to write, which is how he first made a buck back in the 70’s, for Newsweek and the New Republic.

The subject is always about how to improve Capitalism – an 18th century reaction to the problems of 17th century mercantilism and imperialism – which has somehow managed to survive intact until the 21st century, without anyone attempting to seriously ‘upgrade’ it. Peter Barnes has many suggestions for how to do this, and most of them involve either curbing the negative externalities Capitalism creates (through its attempt to maximize profits) or how to better recycle the wealth of nations, which continue to accumulate inordinately at the top. In his 2014 book, With Liberty and Dividends For All, Barnes addresses both of these issues simultaneously.

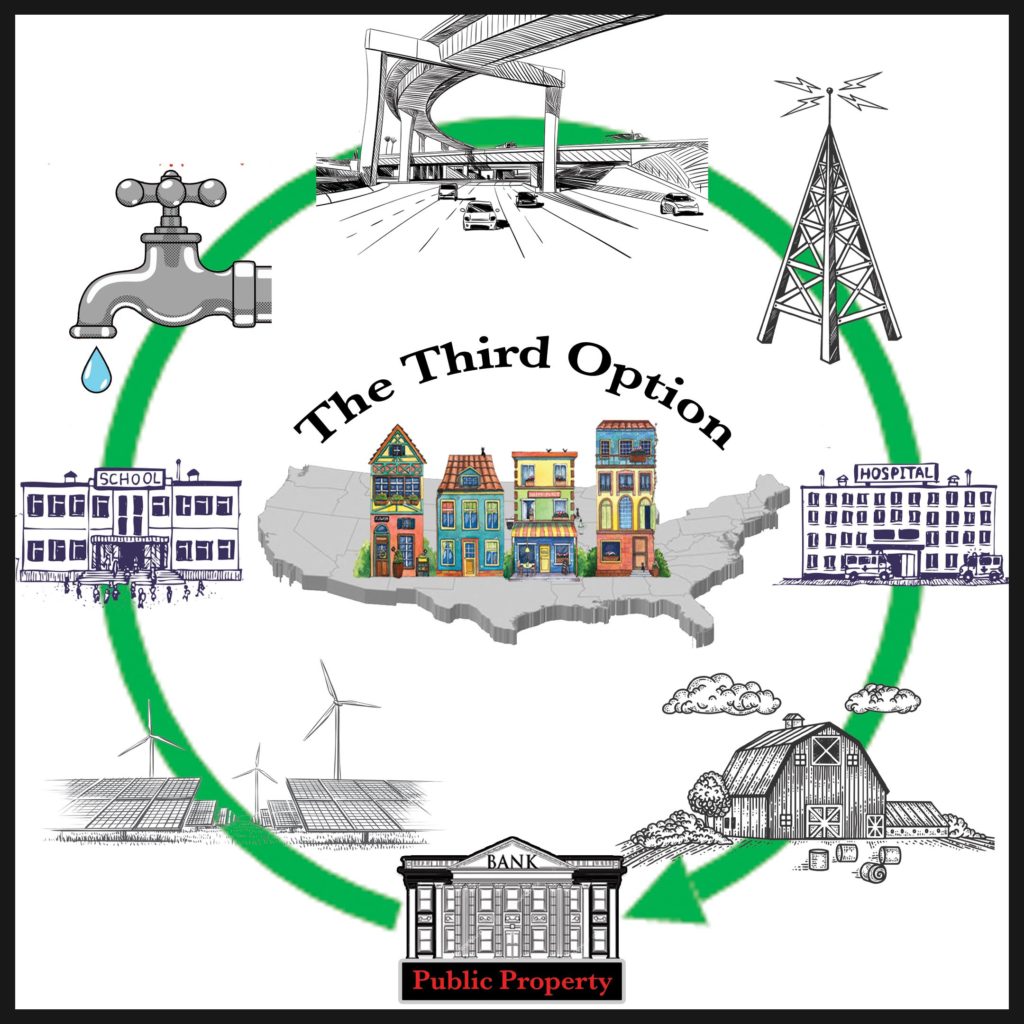

Barnes has always been a fan of economist E.F. Schumacher, whose book Small is Beautiful entreats us to arrange our economics to serve communities instead of corporate entities. Barnes currently sits on the advisory board for the Schumacher Center for New Economics, whose mission is “to envision a just and regenerative economy; apply the concepts locally; then share the results for broad replication.” This places Barnes in the large camp of organizers who are planting seeds at the grassroots level, in order to grow this new community-driven economy. It is imperative that we do not stifle that growth at the macro level. This is why The Third Option exists; to help fashion the environment where communities can lead ‘economic growth’ from the ground up.

About the Book:

“As studies have shown, highly unequal societies have more homicides, obesity, heart disease, mental illness, drug abuse, infant mortality, and teenage pregnancies than do more egalitarian societies…when I was growing up, middle-class families with one breadwinner could send their children to college without incurring huge debts…those days are gone now.”

From Thomas Paine to Henry George, the idea of a ‘commons’ – made up of all “the wealth we own together” – has been logically, eloquently, and passionately presented; meanwhile, creeping privatization continues its quest to infest every possible public space. Nevertheless, each generation of socially responsible economists, writers, and politicians take up the mantle for this idea of ‘co-owned wealth’; Peter Barnes is one of ‘those people’.

The basic gist is that if We the People claimed co-ownership of everything our government either creates or protects – physical and intellectual property, the air and the ‘air waves’ (including the internet), the physical and financial infrastructure, the natural and unnatural resources, publicly-funded innovation, etc. – we could, in effect, charge ourselves rent on the use (or misuse) of them, then give this money back to ourselves – equally redistributed – as dividends. This would not interrupt the general flow of Capitalism, yet more fairly compensate all citizen laborers / consumers, for their part in the economic process.

Right now, for instance, We the Taxpayers collectively pay for freeways, yet apparently do not own them. The internet, like the ‘free market’ itself, is a collectively empowered public utility by any measure of common sense. Meanwhile, Amazon drives 50 to 100 thousand vehicles around on the roads we’ve built, delivering 1.6 million packages a day, purchased through the internet we provide. If we charged rent for the use our economic infrastructure, it would help ensure those who use it more often wind up paying a bigger share of this ‘rent’.

On Wall Street, many investors come together to fund all sorts of business endeavors. If We the People start playing the game of Capitalism the way it was designed, we would collect ‘shareholder dividends’ for all the things we have collectively invested in – our collective ‘commons’. It’s just good ‘business’. If Capitalists are the only ones who get to play the game of Capitalism, leaving We the People to always ‘get played’, perhaps We the People should take our economic ball and go home; leave Wall Street to gamble on the weather, death and other natural phenomenon without the rest of us present. Unfortunately, the money would only be valuable as toilet paper, with no ‘real economy’ goods and services attached to them.

People are much more likely to protect something in which they actually have a stake. Claiming ‘air’ as part of the ‘commons’, for example, would make us the stewards of it, in order to ensure we have breathable air in the future. This would turn pollution, that damages the air supply, into a finable offense. If the fine was greater than the profit derived from cutting corners and allowing pollution to exist, the Capitalist would allegedly be ‘nudged’ into solving the pollution issue.

A land value tax (We the People’s rent on land prior to any improvement to it) avoids charging anyone for the value produced through application of labor upon said land, and thus would not cut into ‘earned income’. An Intellectual property tax could likewise be imposed, as compensation to our government, which upholds these rights. Minerals, like Alaska’s oil, could draw a ‘dividend’ for its extraction, which can be shared by the entire population. Many of our federal lands are utilized for their timber, coal, iron ore, aggregate, solar and hydro power, cattle grazing, and more. We have even allowed the private sector to run their businesses around our national parks, making money that does not go to the upkeep of these parks; these businesses would not prosper without the attraction of the parks We the Taxpayers own.

Bottom line: The idea of co-owned wealth can more fairly redistribute money to citizens for the parts we share as a sovereign nation, and meanwhile address many of the issues – like pollution, poverty or resource scarcity – that Capitalism creates.

Third Option Takeaways:

Property ownership, and the Capital that measures its value on the ‘market’, are the two great enigmas of economics; they are difficult to define, and difficult to justify, yet they are the two most important tenets of Capitalism. Like good science fiction, Capitalism makes perfect sense once we take the initial leap of faith and agree on something that is otherwise beyond comprehension.

There are resources, and these resources can be combined to make some product that people may wish to possess. If resources were colors, those of us who were inspired to do so would combine various colors in order to paint our masterpiece – our vision. Should someone be able to own the property rights to the color red? What if our masterpiece was a musical creation; would we have to pay to use middle C? Of course, many resources are scarce (though we have found ways around this already), which creates potential value, especially once people find some popular use for them. At this moment, those with the most ‘Capital’ will get ‘first dibs’ on this scarce and valuable resource. These ‘Capitalists’ are not the ones who paint the masterpieces, though; it is either the people who own the ‘market’ – the platform where the exchange of goods occurs – or the people who have retained ownership of the resources – the paints – that enable artists to create their masterpieces.

Allowing someone to own property generates Capital, through ‘renting’ out the resources connected to this property. Allowing someone to own the marketplace (or selling ‘platform’) – in order to charge rent for brokering the exchange of goods between buyer and seller – is even more lucrative. Amazon doesn’t even have to own any of the infrastructure, products or resources; billions can be made from simply brokering the deals between buyer and seller. At least there are real products involved. Investment firms are brokering deals comprised solely of excess Capital – making money off of money. Spill a coke on the cement, especially on a hot summer day, and very quickly ants will swarm to it; you have just created a market. You own the product, you designated the space, you might even own the property where the slab of cement sits. If only ants had something of value to exchange. Perhaps you could create a fictitious form of Capital which allows ants to pay you for a taste of your coke. Of course, none of this is possible if you did not already own the property, and the coke.

Capitalism evolved as a way to escape mercantilism and imperialism, which evolved as a way to escape feudalism, which evolved as a way to escape the slave-based economy of the Roman Empire; unfortunately, we have never been able to outrun Oppression. Meanwhile, in other parts of the world, economics and politics evolved around a tribal arrangement – ‘communities’ – that shared whatever they acquired in a more egalitarian manner. No matter how you slice it, the foundation of Capitalism – property rights – is a throwback to those early days of conquest, where property was simply taken, often from tribal territories. Capitalism is built on this delusion of property rights, where property must first be usurped, making a foundation for the creation of Capital, which attempts to legitimize the property rights that were obtained illegitimately. The delusion is then perpetuated by the passing on of this ‘stolen wealth’ to chosen ‘heirs’, with the further self-deception that the passing of time increases legitimacy. In this way, Property (and the Capital it continues to generate) creates an economic ‘ruling class’ and a ‘wage’ slave-based class, which only feels natural because we have never known anything else.

Yes, there must be a marketplace infrastructure, and there must be raw resources in order that our labor and ingenuity create something of value for other people. In order to create a sustainable economy, this process must be an infinitely recyclable one, with no one ‘skimming off the top’.

This is easily done. If every person has equal control of the ‘free’ market, then no single person can have too much control of it. To do this, we must retain some equal share in the creation of Capital, that together we legitimize, through our government (We the People), and we must retain some equal share of the property – our physical and intellectual resources – that we also legitimize, through our government. This, by necessity, names our government as the broker between We the People and those who wish to ‘capitalize’ on their ideas. By utilizing the mechanism of ‘rent’, we could collectively receive a constant ‘piece of the action’, while still allowing Capital and Property to go where they will.

A land value tax is a clever mechanism, because it basically charges rent on the resources prior to being utilized; therefore, it does not attempt to extract from anyone’s labor or artistry ‘after the fact’. It also applies a little pressure on the owner of the property, who is losing ‘rent’ sitting on the property and not putting it to some economic ‘use’.

A tax on Capital could work in the same way, but only if all Money starts out by being loaned, thus incurring interest – or rent – on its usage (by the way, this is the only way Money is currently created, whether through private banks or through ‘quantitative easing’ by our ‘Central Bank’, the Federal Reserve). Again, it would be a waste to let loaned Money sit idle. Meanwhile, whatever extra money (profit) can be gained through labor or artistry would be outside the purview of this tax.

The Third Option advocates for a National Public Bank as our new Central Bank; that way, all money creation would run through something co-owned by every living citizen. The Bank would also be charged with supplying the ‘necessary and proper’ infrastructure needed to secure life, liberty and happiness; doing it this way would allow us to benefit financially from all the infrastructure that We the Taxpayers build.

Income tax could become a flat percentage – back-end ‘rent’ on the prosperity of the nation as a whole – that would be turned into an ‘investment’, used to build this essential infrastructure, including housing, health care, education, communication, transportation, water / sewer, agriculture, energy, etc. – everything that communities need. Again, charging ‘rent’ to use these, through utility bills and other payments, would pay back the bank loans used to build the infrastructure, and begin to create a substantial ‘retirement dividend’ – an accumulation of shareholder dividends that is the sum of ‘collective economic growth’.

Turning certain essential needs into ‘human rights’ is not a way to get them for free, but an opportunity to broker a deal between buyer and seller, creating a market of universal basic needs for every individual.

By making health care universal, for instance, we can legitimately collect taxes on all the things that harm our health individually and collectively, in order to pay for all the ‘excess’ health care we receive every year (somehow Liberty has turned into the right to kill ourselves any way we choose). Pollution is a health issue; this is why we must tax it. Gun violence is a health issue; this is why we must tax gun owners (as a form of ‘insurance’). Motor vehicles, with their accidents, pollution, theft, and infrastructure maintenance costs are over the top; this is why we need to completely change our transportation infrastructure; the health cost alone is impractical. Tobacco, alcohol, even food known to cause health issues needs to be taxed, simply to collect money up front for people who will inevitably wind up in the health care system because of excessively using these unhealthy products.

Nobody is going to get anything for free in this deal. Liberty also dictates that we stop allowing one group to be forced to pay for something another group receives. Do the math: rich people are what create poor people, not the other way around. Once the load is collectively carried, it will be light enough for each person to do their share. People will still get wealthy, but only because they deserve it, through creating something people overwhelming appreciate.

To know what a Capitalist is plotting, it is best to ‘follow the money.’ It is the ace of spades that trumps all wealth because, in a ‘free’ market, everything is for sale. One can buy votes to quash worker rights, or elect pre-paid politicians, who vote for privatizing the internet or prisons or creating a permanent tax holiday – the list is endless what money can buy, when one has the money. But money is made sacrosanct by the powers invested in all of us, through our government mandate; it is here that the buck needs to stop – at least long enough for us to attach some rent to it.

Other Works By Peter Barnes:

Books:

- Pawns: The Plight of the Citizen-Soldier, The People’s Land, Who Owns the Sky? and Capitalism 3.0.

- Articles:

- “A Simple Market Mechanism to Clean Up our Economy”

- “Climate Solutions – a Citizen’s Guide”

- “Alaska Bolstered Its Economy and Curbed Inequality—By Paying Everyone Thousands in Oil Dividends Every Year”

Interviews:

Videos:

Social Media:

Twitter: @PeterBarn

Giving Kids a Fair Chance by James J. Heckman – a Book Review

Giving Kids a Fair Chance by James J. Heckman – a Book Review