Irwin thoroughly laid out the steps the Fed took to save Wall Street, because Wall Street, in the current system, was “too big to fail.”

By Neil Irwin

About The Author:

Since receiving his M.B.A. from Columbia University, Neil Irwin has worked for the Washington Post, the New York Times, and is currently the chief economic correspondent at Axios, where he continues to report on the decisions of the Federal Reserve.

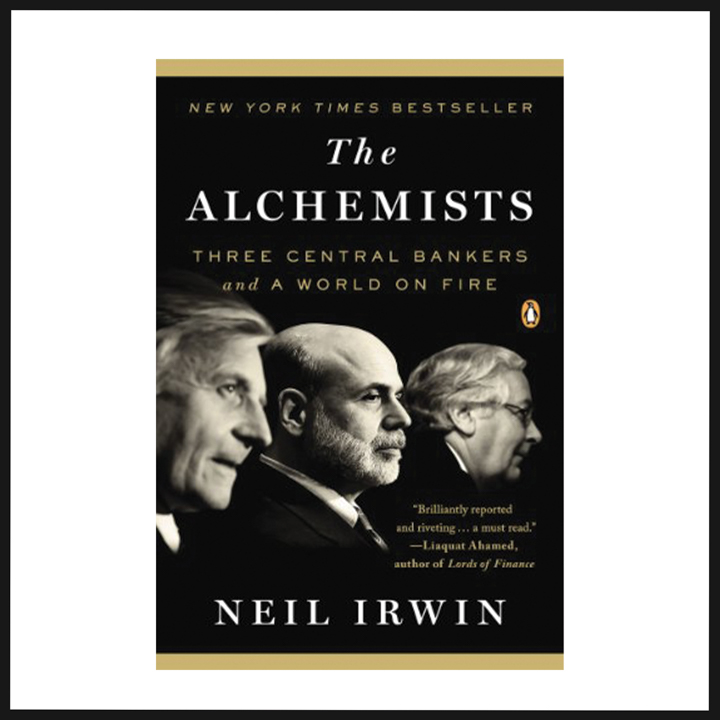

About the Book:

The title of the book refers to the ancient practice of alchemy, “an art based partly upon experimentation and partly upon magic”, which aptly describes the pseudo-science of private central banking, as it attempts to conjure up more and more liquid gold for the wizards of Wall Street.

Irwin supplies the backstory of how money came to exist, how banks became the conjurers of money, and how central banks were created to maintain the illusion that money was real, banks were solvent, and everyone’s deposits were safely waiting inside them, should they ever come back for it.

Since the founding of the nation, private bankers sought to wrest control of the U.S. money supply from the government. Unfortunately, once Andrew Jackson vetoed the National Public Bank out of existence in 1832, financial panics became routine in every decade thereafter. Something had to be done to get private banking under control, but private banking did not want to be under government scrutiny, so in the early twentieth century, private bankers conspired to form our current Central Bank, that operated independently from government to “promote the dual objectives of maximum employment and price stability.”

In the beginning, everyone naturally wanted control over this new Central Bank. According to Irwin, “there needed to be a central bank to backstop the banking system. It would consist of decentralized regional banks, and its governance would be shared—among politicians, bankers, agricultural and commercial interests.” When Congress passed the Federal Reserve Act of 1913, the Baltimore Sun declared that “if, as most experts agree, the new measure will prevent future ‘money panics’ in this country, the new law will prove to be the best Christmas gift in a century.” In reality, it did not appear capable of preventing any of the problems created by capital. Luckily for the new Central Bank, the federal reserve system charter was renewed in 1928, a year before the Great Depression. As Neil suggests, the Federal Reserve would probably have been disbanded if the charter ran out in say, 1931, once the public discovered how ineffective the Fed was at its job, although the National Public Bank was disbanded while the majority of the population favored it; some people get what they want regardless of what other people want: that is the very definition of a Capitalist Democracy.

Democracies grant these secretive technocrats control over their nations’ economies; in exchange, they ask only for a stable currency and sustained prosperity (something that is easier said than achieved).

Neil Irwin, The Alchemists

This background proved helpful in understanding the role of the Federal Reserve—and how it vastly overstepped its role—when the financial crisis of 2007 struck.

Third Option Takeaways:

Irwin thoroughly laid out the steps the Fed took to save Wall Street, because Wall Street, in the current system, was “too big to fail.” Because it was also, in reality, too big to save, taxpayers suffered ($498 billion) and homeowners suffered (ten million of them lost their homes). Overall, there was another $2 trillion in bailout money injected straight into the veins of the Wall Street sector, some of which was used to buy up several hundred thousand of these foreclosed homes, then start rental companies utilizing the assets they helped dislodge from average citizens.

Each of the major central banks had taken steps beyond any it would have considered possible…The Federal Reserve had rescued investment banks and insurance companies, maintained zero interest rates for four years and counting [ultimately seven years total], and bought $2 trillion in bonds through quantitative easing…And all for what? The economies of the major Western powers were a shambles, with the United States, Britain, and all but the strongest European nations producing well below their potential. In the summer of 2012, there were thirteen million more people jobless in the European Union and the United States than there would have been if pre-2007 trends had continued. A generation of young people faced poor career prospects; a generation of retirees saw its life’s savings damaged by the crisis. In some European countries, extremists were on the march.

Neil Irwin, The Alchemists

With the help of Neil Irwin’s thorough research, The Third Option has outlined how a National Public Bank would successfully solve the problems that capital and private banking creates, and the Federal Reserve cannot effectively stop. You can find the article here, Redefining the Role of the Central Bank.

Other Works:

Books:

Articles:

- The Housing Market is About to Get More Dysfunctional

- The Future of the World Economy is Deglobalization

- Powell’s Message: Inflation is Coming Down One Way or Another

- Why Soaring Mortgage Rates May Not Cool the Housing Market

- The Virtues of Slow and Steady Economic Growth

Videos:

- Axios’s Neil Irwin breaks down surging inflation and the post-Covid economy

- It will be a ‘rocky transition’ to full employment: The NYT’s Neil Irwin

- A conversation on impacts of the rising cost of living

- Axios’s Neil Irwin breaks down surging inflation and the post-Covid economy

Social Media:

- Twitter: @Neil_Irwin

MTM Earth Lab Climate Action Park

MTM Earth Lab Climate Action Park