Joseph Stiglitz believes that economics should serve people, not divide and conquer them; we believe that 99% of people, once they read his books, would agree.

Rewriting the Rules of the American Economy (2015) By Joseph E. Stiglitz

Product details

- Publisher : W. W. Norton & Company; 1st edition (November 2, 2015)

- Language : English

- Hardcover : 256 pages

- ISBN-10 : 0393254054

- ISBN-13 : 978-0393254051

- Item Weight : 1.3 pounds

- Dimensions : 5.9 x 1.1 x 8.6 inches

- Best Sellers Rank: #2,149,881 in Books (See Top 100 in Books)

- #922 in Business Structural Adjustment

- #1,074 in Organizational Change (Books)

- #2,731 in Sociology of Class

- Customer Reviews: 4.3 out of 5 stars 59 ratings

About The Author:

American economist Joseph Eugene Stiglitz is currently a professor at Columbia University, but he has taught, lectured, or studied at nearly every prestigious university on the planet. Countries have decorated him, schools have bestowed honorary degrees upon him, and he is generally seen as one of the most influential people in the world. He has attempted to guide the World Bank, the International Monetary Fund, the United Nations, and world leaders (including several U.S. presidents) toward more control over free markets and a vision of shared prosperity for all citizens. He continues to advocate for income distribution based upon the Georgist view that natural resources are a shared value among a society, for which economic rent can be assessed, collected, then redistributed equally.

Stiglitz founded the Initiative for Policy Dialogue in 2000, in order to share knowledge and economic ‘best practices’ with policymakers around the globe, in the hope that global development could become more equitable. The New York Times, where Stiglitz often contributes articles and opinions, dubs him “An Economist Who Believes Only Government Can Save Capitalism”. In the preface to his latest book, People, Power and Profits, Stiglitz makes it clear that “this is a time for major changes…minor tweaks to our political and economic system…are inadequate to the tasks at hand.”

About the Book:

“Wages for most Americans are stagnant, but worker productivity continues to grow; the disparity between the two is unprecedented…eighty percent of the job growth we do see is in low-wage service and retail employment [only]. This combination of growth for the very wealth and economic stasis and anxiety for the rest of Americans is politically volatile.”

Unlike most economists, who peddle the quiet redistribution of wealth through tax and transfer mechanisms – after it has already been taken – Stiglitz chooses to shout into the democratic void that perhaps someone should “fight inequality at the source.” Back in the early days, when Stiglitz stood alone in his vision, the paid minions of corporate economics would attempt to discredit him, imposing the same bully-like ‘economies of scale’ bigness they’ve used to push many a small business off the financial cliff.

But Stiglitz (and his ideas) did not simply disappear, and in Rewriting the Rules of the American Economy, he strikes straight for the root of modern inequality, advocating for more affordable and accessible education, a new universal healthcare, a living wage, expanded childcare and financial services, guaranteed retirement, and much more. His firm belief in shared prosperity – and a government that has better control of the so-called “free market” – has never wavered. He quite reasonably demands that democratic values be more clearly reflected within the economics that democracies practice.

Third Option Takeaways:

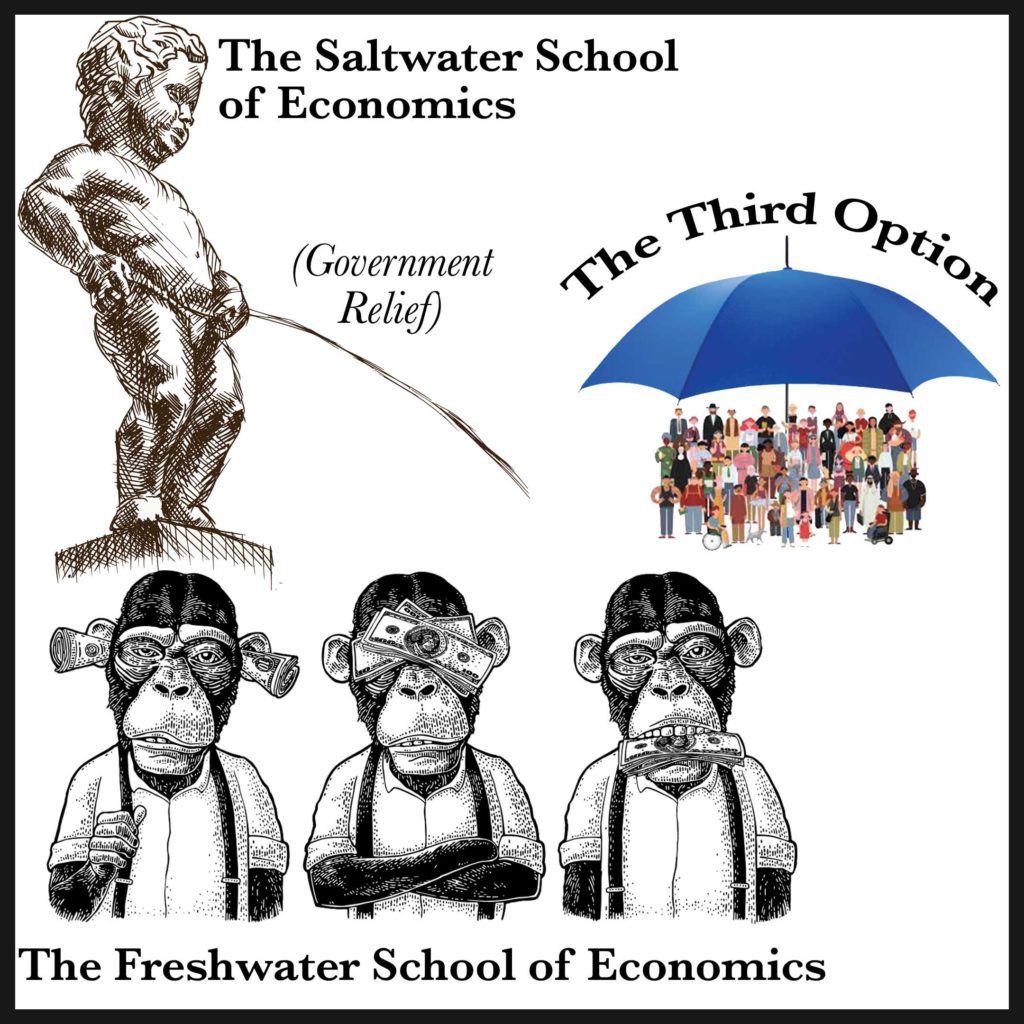

Joseph Stiglitz believes there should be some “third way” to run economics, where government takes on an important – though somehow limited – ‘management’ role. The Third Option has that ‘third way,’ through what Stiglitz would call a Public Infrastructure Bank, that can be utilized to serve in a more expanded capacity, in order to deliver, through ‘infrastructure’, all human needs deemed ‘essential’, per our current economic arrangement.

Infrastructure could be any ‘platform’ where an economic lifeline can be constructed. All communities need schools, healthcare facilities, clean and safe transportation, water and sewer lines, communication platforms, agriculture platforms (indoor and outdoor), green energy / electricity, affordable housing, etc. Through a National Public Bank, jobs are created within each community, in order to build – then implement- these needs. Meanwhile, the loans used to build the infrastructure automatically get repaid through the (more affordable) rent / mortgage, utility, food, and healthcare bills we already are trained to pay anyway – though usually to someone else. A lifetime of working – in order to ‘pay the bills’ – ought to be constructed as an ‘investment in ourselves and in the real economy all of us produce.

Charging interest on these loans would bring a Return on Investment for everyone, in the form of Retirement Dividends. In this way, all of us would get to be investors and shareholders, something only afforded the wealthy at this time.

The earth moves in sustainable ways – it ‘recycles’ itself continually; our economics needs to do the same. If you do not understand why, it might be that you are letting someone do your thinking for you.

Once you begin thinking for yourself, here are a couple other items to reflect upon. First, Money, as a representation of the value of all ‘things’, has – by association – achieved a value all its own. Money can detach itself from labor (effort) and products (resources), then reattach itself wherever it likes. This makes it as parasitic as the ‘capitalizer’ who wields it. When economics turns competitive, that stockpile of Money can become a weapon of mass destruction to those caught in the crossfire.

As weapon owners too-often quip, ‘guns (and money) don’t kill people, people kill people’. In order to understand the damage that money does, it seems we will need to better understand the people who are hoarding the money. Economics is ‘personal’; it is time to take it more personally. Detaching economics from the people it serves – in order to serve the cold hard math that Money affords – has regrettably put control of the world back into the very hands from which Democracy was trying to wrest it.

Reattaching people to their economics is the crucial first step. Just as engineering utilizes the science of the planet, economics needs to be constructed according to a better understanding of people. Attaching the ‘sub-discipline’ of current economic study to all the other social sciences (psychology, sociology, anthropology, ethics, human geography, law and politics) would create a much more useful interdisciplinary degree, which is bound to improve ‘big picture’ decision-making for future generations.

Secondly, as the rich are allowed to gamble with all their excess money, detached from the real economy, a disturbing development has predictably begun to transpire, where the rich make money as the real economy is either stagnant or tanking. If this were to continue, at some point, the winning gambler may be able to buy the entire planet for pennies on the dollar. Labor – or effort – is the only thing that produces goods and services; when excess money is allowed to accumulate in one person’s hands, this now represents money gained through no effort, and idle hands with money stuffed into them will invariably do the devil’s work.

One thing the wealthy possess – that the 99% do not – is the opportunity to invest in something larger than themselves. Forget about making money off of money; the 99% would be fine simply to invest in themselves as a whole – the human ‘assets’ that, through labor (effort) produce all the tangible goods and services in the real economy. Again, the answer to controlling the money supply, in order to avoid a hostile takeover of the earth’s physical resources, is a National Public Bank.

The ultimate goal of a National Public Bank should be to control the creation of all the Money stock available; only then could We the People charge economic ‘rent’ on the complete money supply (through ‘interest’) and in a Georgist kind of way, reap the shared value of this ‘unnatural’ resource. Coupled with a Land / Mineral / Resource Value Tax – another idea Stiglitz endorses, all people could then own a modest ‘share’ in the overall resources – both natural and unnatural – to which our government has claimed a sovereign right. Really, what’s the point of having a government – or a nation – if it does not serve the interests of all people under its jurisdiction? One only needs to read the second paragraph of our very own Declaration of Independence in order to know what we should do next.

Other Works By Joseph E. Stiglitz

Books:

- People, Power, and Profits

- The Price of Inequality

- Economics of the Public Sector

- FreeFall

- ReWriting the Rules of the European Economy

- Globalization and Its Discontents

- The Great Divide

- Creating a Learning Society

- Measuring What Counts

Articles:

- “A Chance to Repair the Cracks in Our Democracy”

- “Don’t Feel Like a Recession? You Should be Paying More in Taxes”

- “Republicans, not Biden, are About to Raise Your Taxes”

Interviews:

- “The Rolling Stone Interview”

- “Interview with Federal Reserve”

- “Repairing the Future”

- “Nobel Prize Interview“

- “People, Power, and Profits”

- “What’s Next for the Economy?”

Videos:

Social Media:

Twitter: @JosephEStiglitz

The Future of Capitalism by Sir Paul Collier – a Book Review

The Future of Capitalism by Sir Paul Collier – a Book Review