Ouch. Go to any articles about “tax payer funded stadiums” and the reviews are pretty one-sided: giving public money to privately owned sports franchises is a losing proposition.

No argument here, but the fact remains: people like their sports teams. There is a public good there, outside of any economic considerations.

That being said, the stadiums and arenas themselves are a financial hot potato that no profit-seeking business person, in their right (profit-seeking) mind, would want to touch.

The obvious problem is that football teams might only play 8 or 9 games in the stadium all year (basketball or hockey teams a more significant 41 games). Regardless of how wealthy these private owners are (and they are loaded), you can’t blame them for not wanting to pay full price for infrastructure they only need a handful of times a year. Meanwhile, the way stadiums are currently constructed makes them difficult to utilize for much else.

As usual, The Third Option is not interested in talking much about how things don’t work, but how they could work. There is very little to salvage from the current pro sports model, if you are a “public” investor, but we will take a look at arguably the best case scenario out there, in order to glean some insight into the sports franchise business.

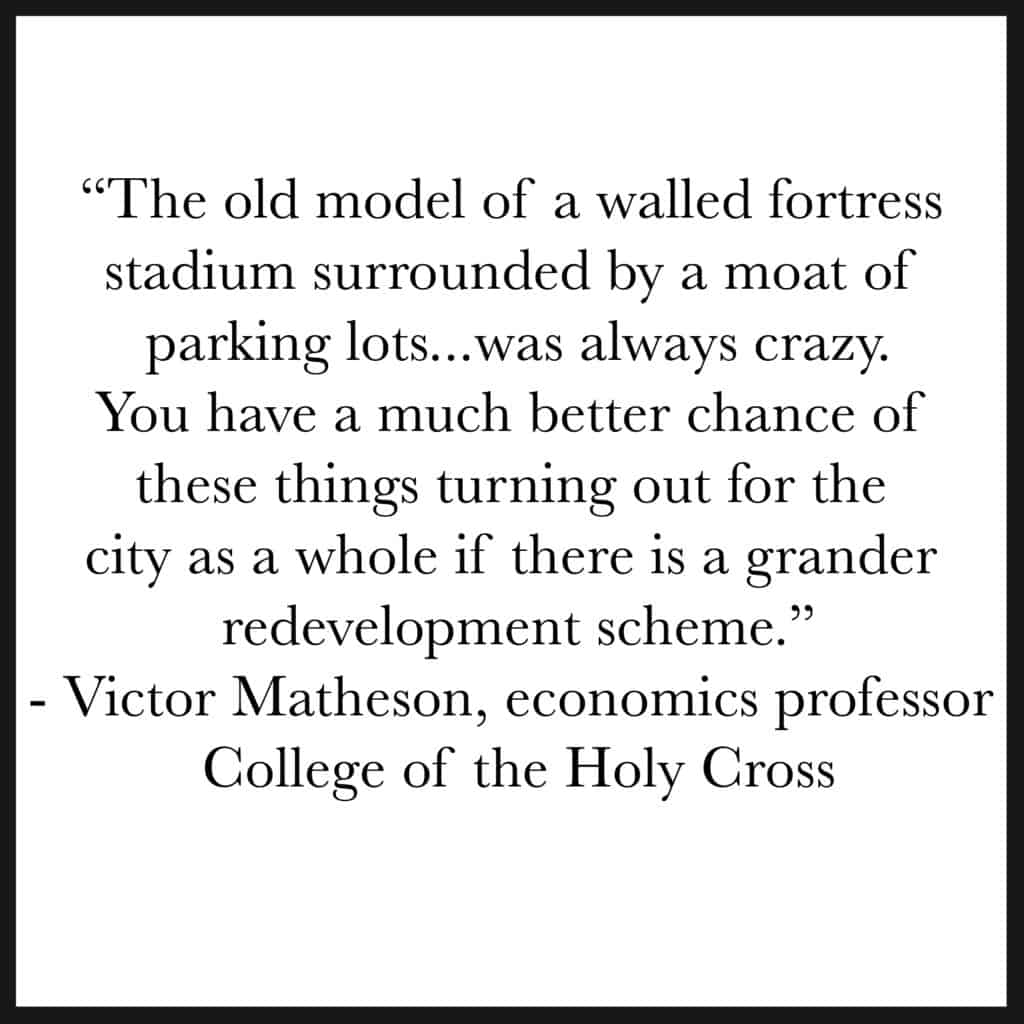

The Staples center cost $375 Million to build (which is on the high end for basketball arenas), but has been the quintessential win / win for every one involved in its creation and operation. Logistically, it hosts both the Clippers and the Lakers, so is able to take in revenue for an entire 82 game season (41 regular season “home games” each, plus many playoff games). It also hosts the Los Angeles Kings hockey games; they use the venue another 41 times. They also manage to squeeze in other events along the way, including the Grammys, and 8 different concert tour events. The real success is that, financially, it was one of the first projects to also develop the area around the venue. The development deal required that a hotel, movie theater, ice skating rink, plaza, (and eventually much more) would also be built, in order to revitalize the entire neighborhood. In the end, both the developer and the city were able to profit.

In most cases, stadiums are disincentivized to help the area situated around them because they would much rather have fans come in and eat their crappy $6 hotdogs, than dine outside the venue before entering to watch a game. It is admirable that cities try to Frankenstein a better deal for themselves, as citizens clamor for a sports team, and owners try to blackmail them with that information, threatening to leave town if public money is not invested. The general understanding is that stadiums are so expensive now, only governments can afford to buy them, through our tax dollars.

A new “public” business plan needs to include:

- a venue that can have multi-use potential (during off-seasons)

- a guarantee that the area around it also thrives and benefits financially

- a way for the city to not only avoid debt, but profit financially in the deal (for the citizen “investor”)

The Third Option, if brokering this deal, would advise the People to outright own the infrastructure, not just hand over money for nothing. With the infrastructure, the People would now be able to rent out the Stadium.

Our disclaimer: NFL Stadiums are big behemoths that are good for football and little else. Even the Multi-Use type stadiums (that tried to house both baseball and football) did not seem to fare well in the end. Golf courses can host big events, and the public can use them the rest of the year, as we do with our Torrey Pines Golf Course, home to several U.S. Open events, and the yearly Farmer’s Insurance tournament. Even Arenas have more potential for multiple uses, from concerts to basketball to hockey, and each play a lot more times during a year (arenas can also host high school and college games, or even NCAA games).

Football Stadiums cost the most of any sports venue, and the current two, Allegiant Stadium in Las Vegas, and SoFi Stadium in Inglewood, CA, have cost $2.4 Billion and $5 Billion, respectively, though the Inglewood deal is building up the area around the stadium as well. Note to the People: make sure, when building up the area around a stadium, that it actually benefits the people already living there (#Gentrification).

Here at The Third Option, we are all about our National Public Bank, and if the People build this stadium, and become the owners, there would be no sense in gouging ourselves; we will not only do this for $2 Billion, we will build up the neighborhood around it as well. Our San Diego Petco Park was built with $474 Million; San Francisco’s Bart Transportation (to get fans to and from games) only cost $106 Million to build. A five-Star hotel costs $60 Million; Apartment buildings run $22 Million for 200 units. Entire malls can cost $350 Million. We can do this.

Because this $2 Billion is not a tax, but an investment, the People only need to come up with $125 Million a year, the cost of the mortgage payment, which includes another $10+ Million to cover maintenance and staff cost (which could cost as little as $6 Million). If we can make this payment, 30 years down the road, the People will clear $3.44 Billion, just from the original Bank loan. This money, if split among a city of 500,000 citizens, for example, would eventually net each of them a $6,874 dividend from their “share” of the project (a share of the Green Bay Packers only gets you -$249.97).

Ok. So how do we bring in $125 Million, to pay back this loan?

To understand the NFL business model, we will need to look at the only publicly-owned NFL team, the Green Bay Packers, mainly because it is the only team forced to open its books to public scrutiny. There are two streams of revenue coming into the NFL franchises: national (TV) revenue, and local revenue (ticket sales, concessions, merchandise, and corporate sponsors).

The Packers made $507 Million in 2020; $296 Million from TV revenue (meaning all 32 teams made $296 Million, because they split $9.5 Billion equally), and $211 from ticket sales, food, merchandise, and sponsors.

Currently, the going rent that NFL teams pay to use their stadiums runs from $0 to $10 million.

The only interesting deal is the one the Baltimore Ravens have: they agreed to pay all utility and maintenance costs, plus the salaries of all stadium personnel, which comes out to nearly $10 Million. The average team pays only $2 Million. That is how much these privately-owned teams are gouging everyone else involved. Quite the audacity, considering stadiums do not grow on trees, and seem to depreciate rapidly after being built.

The current NFL salary cap is $192 Million a year, meaning this is all owners can spend on their players. Ticket prices range from $93 to $501 per game; the average number of seats in a stadium is 69,444, and teams average just 2,000 seats shy of “selling out” every game. Teams only earn about $3-5 million in profits off of concessions.

Given these numbers, the People’s business deal should be:

- NFL teams can keep all their National Revenue – that would get them an automatic $100 million a year in profit (a 35% profit margin). They need to learn to be happy with that, because

- We get ticket sales, concessions, and a percentage of any merchandise we sell for them at our stadium

Now, they aren’t going to like that deal, so we will go back and forth, then concede that because of their fine team, they do bring fans into the stadium. We would point out, however, that the worst attended NFL teams will still put 25,000 people in a stadium meant for 70,000, showing that even a poor product draws at least a few die-hard fans. Meanwhile, that sorry-ass team still retains a 35% profit margin because of their fairly Communistic “share the TV wealth” economics (Communism is still bad, right?).

Bottom Line: they are running a business, and now, so are we. Good for them. They made a lot of money for their product, but to get their boys on TV, they need a stadium to play the game; and we need that $125 Million. In the final deal, we will probably need to settle for:

- 100% of the first 25,000 tickets sold, and if they make their team better, we will split the rest of the tickets with them 60/40. Meanwhile, we will get all the concessions, and 10% of any merchandise we sell for them. They do not need to put any private money up front.

25,000 tickets at $120 per ticket (we won’t gouge our own investors!) makes us $3 Million a game, or $24 Million for the minimum 8 games. If they fill our 70,000-seat stadium, we would get an extra $3.24 Million a game, or $26 Million. Concessions and sales may only be around $5 Million, so for our 8 NFL games, we would only bring in around $55 Million.

But take heart, sports fans, there are many ways to squeeze more money out of this venture. Anyone who rents out this venue can have an equivalent deal: come in and make 40% of whatever they sell in tickets. Concerts, local college games, bowl games, or additional sports teams like baseball or soccer.

Meanwhile, the real money is in our renovated neighborhood, lest you forget our original deal. We spent $2 Billion, only half of which went into our stadium; the other half developed housing, restaurants, retail businesses, transportation, maybe a hotel for the “away” team and their fans, etc. If we built 2,000 new apartments, and charged a reasonable $850 a month (currently considered the lowest median rate for a one bedroom in the U.S.), we would bring in another $20 Million a year. Similarly, the rent paid by all restaurants, retail and commercial businesses would also go toward paying back our original Bank Loan, and since the people are paying this money to themselves, with later dividends, hopefully they will make sure to support these local businesses, and help them succeed.

The Third Option is about U.S. citizens, who normally fund everything through their taxes, turning these sunk costs into investments instead, by borrowing the money from their own National Bank. In this way, the citizens can actually own the things they’ve always had to pay for anyway. All investments must have a built in income stream attached to them, like rent or usage fees, so NFL stadiums are a bit of a stretch, but people do like their sports teams, and clearly, the model used right now puts cities in debt, and robs the citizens of basic needs like good schools and good roads.

By the way, when private sports franchises get the public to pay for infrastructure that allows their business to thrive, this is not an isolated incident; this is how the private sector runs all its big business models. Agriculture, airlines, retail malls, transportation, healthcare, education, electricity, delivery services; the list is long. Let us begin to rethink how we pay for all our shared platforms and infrastructure.

SPORTS LESSON #1: You Suck Less When You Think More (Eventually)

SPORTS LESSON #1: You Suck Less When You Think More (Eventually)